- Croatia

- /

- Construction

- /

- ZGSE:IGH

Institut IGH d.d.'s (ZGSE:IGH) Shares Climb 33% But Its Business Is Yet to Catch Up

Institut IGH d.d. (ZGSE:IGH) shares have continued their recent momentum with a 33% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 6.2% isn't as attractive.

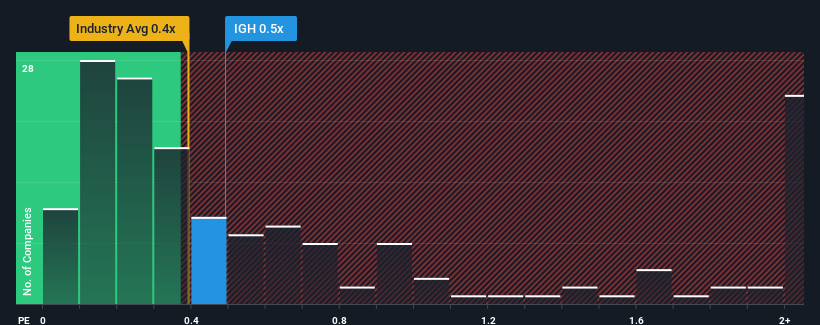

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Institut IGH d.d's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Croatia is also close to 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Institut IGH d.d

What Does Institut IGH d.d's P/S Mean For Shareholders?

For instance, Institut IGH d.d's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Institut IGH d.d, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Institut IGH d.d would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. As a result, revenue from three years ago have also fallen 28% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 6.8% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Institut IGH d.d's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Bottom Line On Institut IGH d.d's P/S

Institut IGH d.d appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Institut IGH d.d currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 5 warning signs for Institut IGH d.d (4 can't be ignored!) that you should be aware of.

If you're unsure about the strength of Institut IGH d.d's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Institut IGH d.d, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:IGH

Institut IGH d.d

A consulting company, engages in the design and engineering activities in the civil engineering sector in Croatia and internationally.

Medium-low with imperfect balance sheet.