As global markets navigate the complexities of trade tensions and fluctuating economic data, investors are increasingly seeking stability amid uncertainty. With U.S. job growth cooling and tariff discussions influencing market sentiment, dividend stocks offer a potential avenue for steady income and resilience in turbulent times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.35% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.79% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.46% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.11% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1969 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Tianjin Development Holdings (SEHK:882)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tianjin Development Holdings Limited, with a market cap of HK$2.16 billion, operates through its subsidiaries to supply water, heat, thermal power, and electricity to industrial, commercial, and residential customers in the Tianjin Economic and Technological Development Area in China.

Operations: Tianjin Development Holdings Limited generates revenue from several segments, including Utilities (HK$1.51 billion), Pharmaceutical (HK$1.50 billion), Electrical and Mechanical (HK$176.09 million), and Hotel (HK$136.51 million).

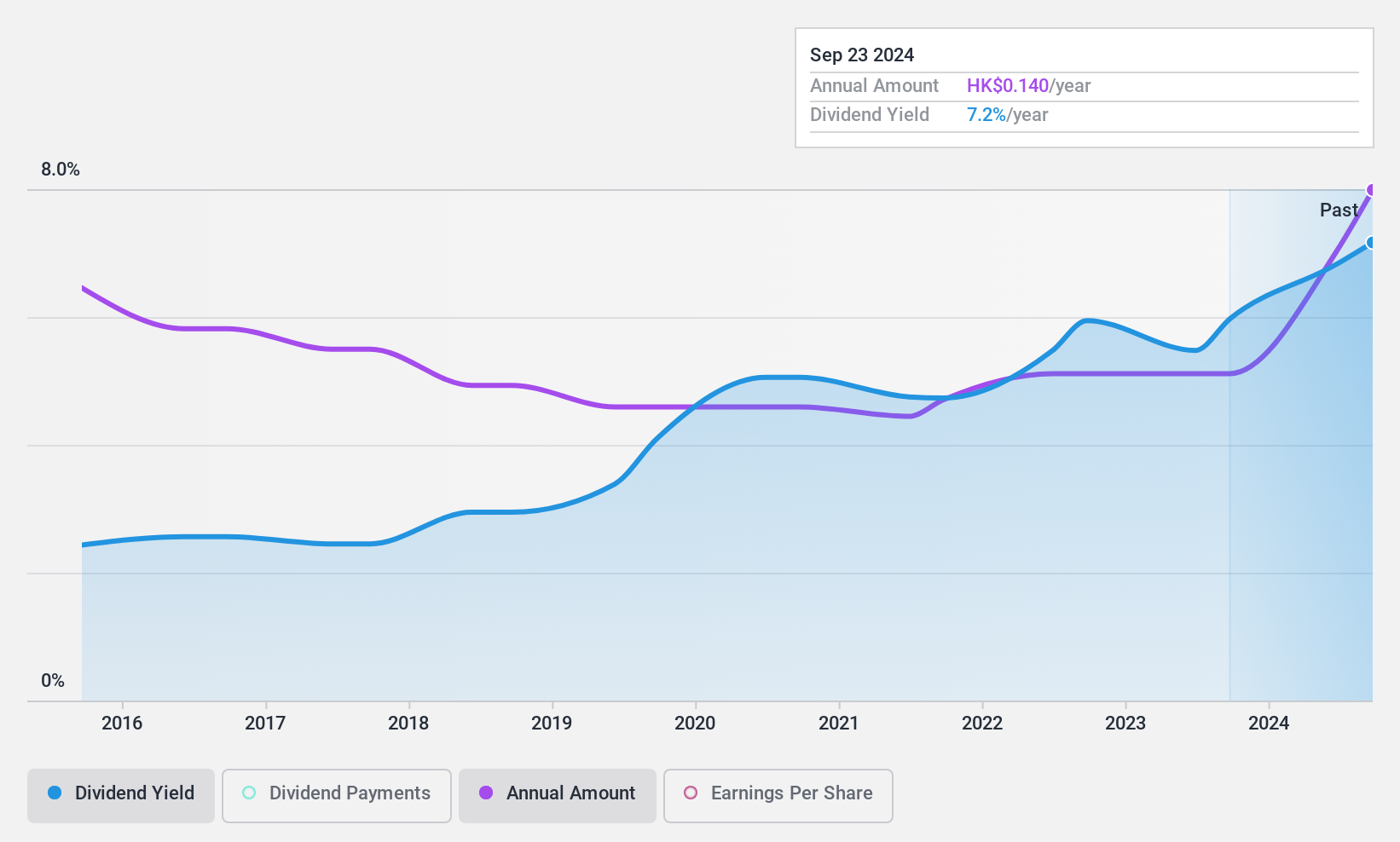

Dividend Yield: 7.0%

Tianjin Development Holdings offers a stable dividend, with a 6.96% yield supported by a low payout ratio of 27.2%, indicating strong earnings coverage. Dividends have been reliable and growing over the past decade, although they are below the top tier in Hong Kong's market. Recent executive board changes and debt financing activities highlight ongoing strategic management adjustments, potentially affecting future dividend stability but maintaining control under Tsinlien Group Company Limited's oversight.

- Take a closer look at Tianjin Development Holdings' potential here in our dividend report.

- The analysis detailed in our Tianjin Development Holdings valuation report hints at an deflated share price compared to its estimated value.

Dainichiseika Color & Chemicals Mfg (TSE:4116)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dainichiseika Color & Chemicals Mfg. Co., Ltd. operates in the chemical industry, focusing on the production of pigments and related products, with a market cap of ¥49.89 billion.

Operations: Dainichiseika Color & Chemicals Mfg. Co., Ltd.'s revenue is primarily derived from its Color & Functional Products segment at ¥66.79 billion, followed by the Graphic & Printing Materials segment at ¥31.31 billion, and the Polymer & Coating Materials segment at ¥25.04 billion.

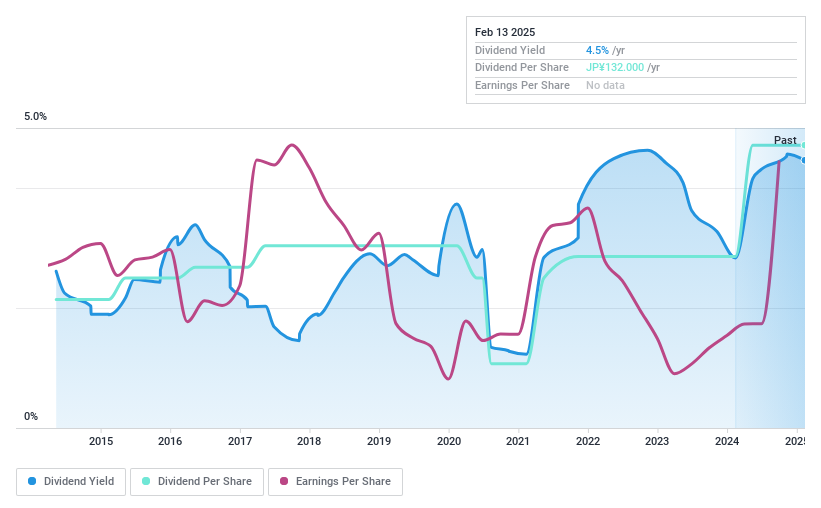

Dividend Yield: 4.5%

Dainichiseika Color & Chemicals Mfg.'s dividend yield of 4.54% ranks in the top 25% of Japan's market, supported by a low payout ratio of 17.1%, indicating strong earnings coverage. However, dividends have been volatile over the past decade despite recent increases, including a special dividend announced for December 2024. Current cash flow coverage is adequate but less robust at an 88.5% cash payout ratio, and recent guidance revisions suggest cautious optimism about future stability.

- Delve into the full analysis dividend report here for a deeper understanding of Dainichiseika Color & Chemicals Mfg.

- Our expertly prepared valuation report Dainichiseika Color & Chemicals Mfg implies its share price may be lower than expected.

Enshu TruckLtd (TSE:9057)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Enshu Truck Co., Ltd. offers logistics services in Japan and has a market capitalization of ¥20.25 billion.

Operations: Enshu Truck Co., Ltd. generates revenue primarily from its Logistics Business segment, which accounts for ¥48.15 billion.

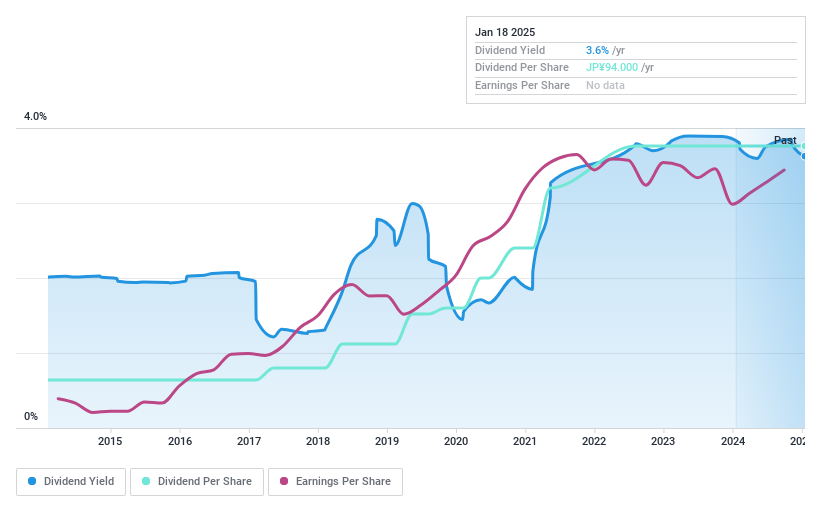

Dividend Yield: 3.5%

Enshu Truck Ltd. offers a stable dividend yield of 3.47%, slightly below the top quartile in Japan's market, but its dividends have been reliable and steadily increasing over the past decade. The company's payout ratio is well-managed at 28.4%, ensuring dividends are comfortably covered by earnings and cash flows, with a cash payout ratio of 47%. Additionally, Enshu Truck is trading at a significant discount to its estimated fair value, enhancing its appeal for value-focused investors seeking dividend stability.

- Get an in-depth perspective on Enshu TruckLtd's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Enshu TruckLtd shares in the market.

Seize The Opportunity

- Access the full spectrum of 1969 Top Dividend Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4116

Dainichiseika Color & Chemicals Mfg

Dainichiseika Color & Chemicals Mfg. Co., Ltd.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)