- Hong Kong

- /

- Renewable Energy

- /

- SEHK:579

Does Beijing Jingneng Clean Energy (HKG:579) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Beijing Jingneng Clean Energy Co., Limited (HKG:579) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Beijing Jingneng Clean Energy

What Is Beijing Jingneng Clean Energy's Debt?

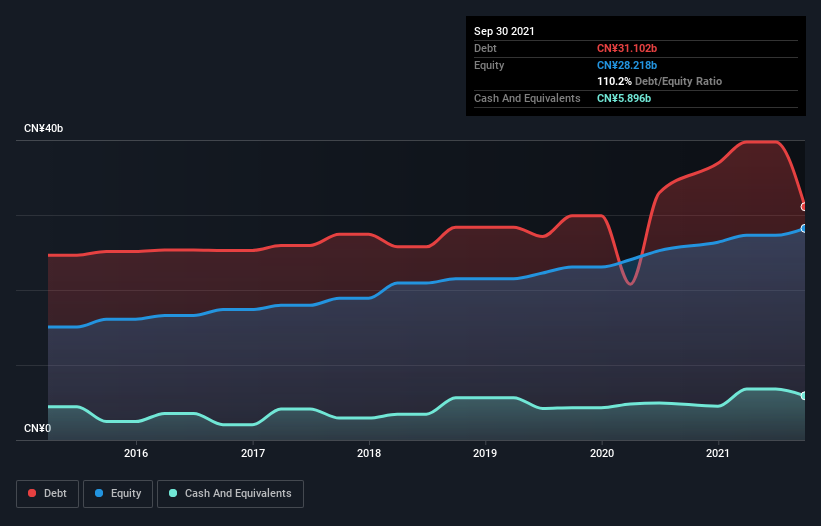

You can click the graphic below for the historical numbers, but it shows that Beijing Jingneng Clean Energy had CN¥31.1b of debt in September 2021, down from CN¥33.0b, one year before. On the flip side, it has CN¥5.90b in cash leading to net debt of about CN¥25.2b.

A Look At Beijing Jingneng Clean Energy's Liabilities

According to the last reported balance sheet, Beijing Jingneng Clean Energy had liabilities of CN¥24.5b due within 12 months, and liabilities of CN¥24.2b due beyond 12 months. Offsetting this, it had CN¥5.90b in cash and CN¥9.94b in receivables that were due within 12 months. So it has liabilities totalling CN¥32.8b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the CN¥15.3b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Beijing Jingneng Clean Energy would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Beijing Jingneng Clean Energy has a debt to EBITDA ratio of 3.4 and its EBIT covered its interest expense 3.1 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. On a lighter note, we note that Beijing Jingneng Clean Energy grew its EBIT by 22% in the last year. If it can maintain that kind of improvement, its debt load will begin to melt away like glaciers in a warming world. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Beijing Jingneng Clean Energy's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Beijing Jingneng Clean Energy burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, Beijing Jingneng Clean Energy's conversion of EBIT to free cash flow left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Overall, it seems to us that Beijing Jingneng Clean Energy's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Beijing Jingneng Clean Energy that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jingneng Clean Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:579

Beijing Jingneng Clean Energy

Generates gas-fired power and heat energy, wind power, photovoltaic power, and hydropower in Mainland China and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026