- Hong Kong

- /

- Renewable Energy

- /

- SEHK:412

Shandong Hi-Speed Holdings Group (SEHK:412) Faces Index Removal—How Might This Shape Its Market Perception?

Reviewed by Sasha Jovanovic

- On October 27, 2025, Shandong Hi-Speed Holdings Group Limited was removed from the Hang Seng China Affiliated Corporations Index, a development affecting its visibility among major investors.

- Index changes such as this one often prompt large institutional portfolio adjustments, reflecting the importance of index membership in shaping investment activity and stock demand.

- We’ll explore how Shandong Hi-Speed Holdings Group’s removal from the index could reshape investors’ perception of its market positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Shandong Hi-Speed Holdings Group's Investment Narrative?

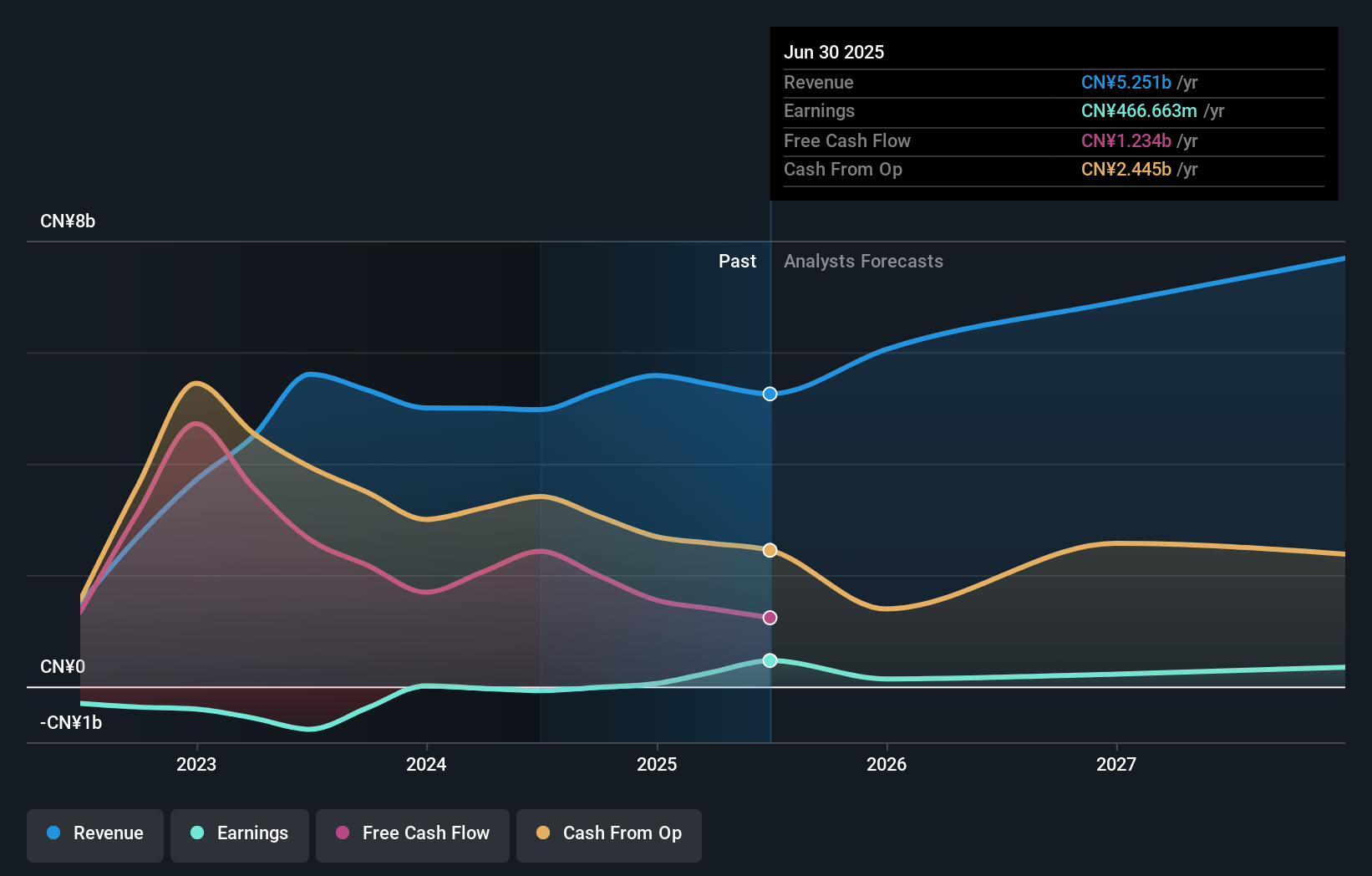

To be a shareholder in Shandong Hi-Speed Holdings Group right now, you’d want confidence in its ability to sustain earnings growth and execute on renewable energy ambitions, even as market sentiment shifts. The recent removal from the Hang Seng China Affiliated Corporations Index is a visible setback that may dampen short-term demand, especially from index-tracking funds, but doesn’t necessarily derail the company’s main catalysts, like its transition to profitability and ongoing share buybacks. There’s no sign yet this change will fundamentally alter strategic drivers, but it does spotlight liquidity concerns amid a highly volatile share price and recent heavy declines. Investors now face a bigger question mark around short-term capital flows and whether recent governance upgrades and earnings stability can offset reduced index visibility. Recent price moves suggest the market was already pricing in significant risk, but the index removal could still affect sentiment further.

But not all eyes are on governance, liquidity challenges could prove even more pressing. Shandong Hi-Speed Holdings Group's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Shandong Hi-Speed Holdings Group - why the stock might be worth just HK$5.50!

Build Your Own Shandong Hi-Speed Holdings Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shandong Hi-Speed Holdings Group research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Shandong Hi-Speed Holdings Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shandong Hi-Speed Holdings Group's overall financial health at a glance.

No Opportunity In Shandong Hi-Speed Holdings Group?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:412

Shandong Hi-Speed Holdings Group

An investment holding company, operates photovoltaic and wind power plants in the People’s Republic of China.

Slight risk with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)