- Hong Kong

- /

- Gas Utilities

- /

- SEHK:384

Here's Why We're Wary Of Buying China Gas Holdings' (HKG:384) For Its Upcoming Dividend

Readers hoping to buy China Gas Holdings Limited (HKG:384) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. This means that investors who purchase China Gas Holdings' shares on or after the 6th of January will not receive the dividend, which will be paid on the 18th of February.

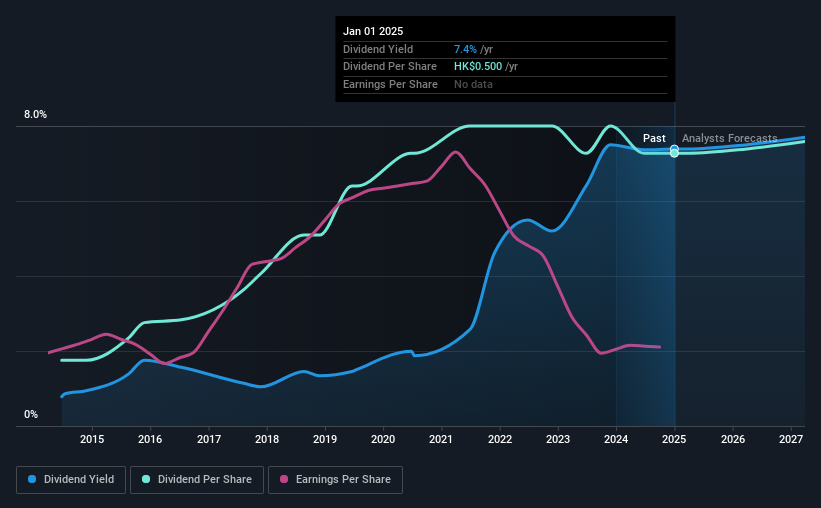

The company's next dividend payment will be HK$0.15 per share, and in the last 12 months, the company paid a total of HK$0.50 per share. Based on the last year's worth of payments, China Gas Holdings stock has a trailing yield of around 7.4% on the current share price of HK$6.77. If you buy this business for its dividend, you should have an idea of whether China Gas Holdings's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for China Gas Holdings

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. It paid out 86% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be worried about the risk of a drop in earnings. A useful secondary check can be to evaluate whether China Gas Holdings generated enough free cash flow to afford its dividend. Over the last year, it paid out dividends equivalent to 205% of what it generated in free cash flow, a disturbingly high percentage. Unless there were something in the business we're not grasping, this could signal a risk that the dividend may have to be cut in the future.

While China Gas Holdings's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were China Gas Holdings to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Readers will understand then, why we're concerned to see China Gas Holdings's earnings per share have dropped 19% a year over the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last 10 years, China Gas Holdings has lifted its dividend by approximately 15% a year on average. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. China Gas Holdings is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

To Sum It Up

From a dividend perspective, should investors buy or avoid China Gas Holdings? China Gas Holdings had an average payout ratio, but its free cash flow was lower and earnings per share have been declining. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

With that in mind though, if the poor dividend characteristics of China Gas Holdings don't faze you, it's worth being mindful of the risks involved with this business. We've identified 3 warning signs with China Gas Holdings (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:384

China Gas Holdings

An investment holding company, operates as a gas operator and service provider in the People’s Republic of China.

Proven track record average dividend payer.

Market Insights

Community Narratives