- Hong Kong

- /

- Water Utilities

- /

- SEHK:371

Beijing Enterprises Water Group Limited (HKG:371) Looks Just Right With A 26% Price Jump

Beijing Enterprises Water Group Limited (HKG:371) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.3% over the last year.

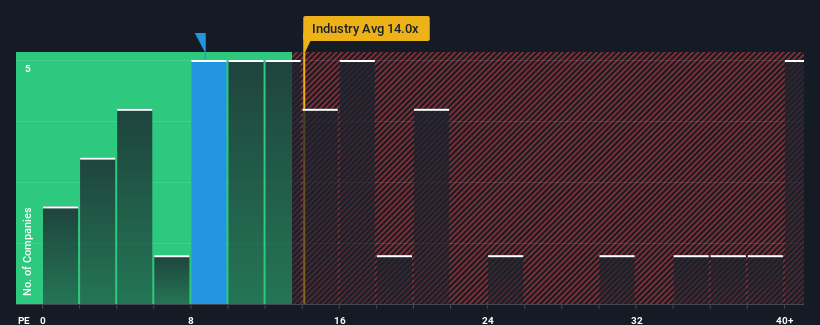

Even after such a large jump in price, it's still not a stretch to say that Beijing Enterprises Water Group's price-to-earnings (or "P/E") ratio of 8.7x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings that are retreating more than the market's of late, Beijing Enterprises Water Group has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Beijing Enterprises Water Group

Does Growth Match The P/E?

In order to justify its P/E ratio, Beijing Enterprises Water Group would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 9.2%. As a result, earnings from three years ago have also fallen 50% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 16% each year over the next three years. That's shaping up to be similar to the 15% per year growth forecast for the broader market.

In light of this, it's understandable that Beijing Enterprises Water Group's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Beijing Enterprises Water Group's P/E

Beijing Enterprises Water Group's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Beijing Enterprises Water Group's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 4 warning signs for Beijing Enterprises Water Group you should be aware of, and 2 of them are a bit unpleasant.

If you're unsure about the strength of Beijing Enterprises Water Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Enterprises Water Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:371

Beijing Enterprises Water Group

An investment holding company, provides water treatment services.

Slightly overvalued unattractive dividend payer.

Market Insights

Community Narratives