- Hong Kong

- /

- Water Utilities

- /

- SEHK:2281

What Did Luzhou Xinglu Water (Group)'s (HKG:2281) CEO Take Home Last Year?

This article will reflect on the compensation paid to Xingyue Liao who has served as CEO of Luzhou Xinglu Water (Group) Co., Ltd. (HKG:2281) since 2015. This analysis will also assess whether Luzhou Xinglu Water (Group) pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Luzhou Xinglu Water (Group)

How Does Total Compensation For Xingyue Liao Compare With Other Companies In The Industry?

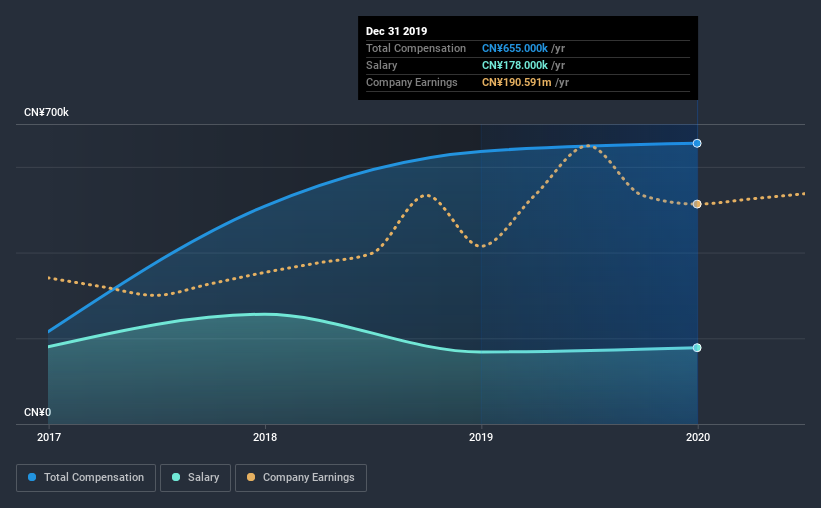

According to our data, Luzhou Xinglu Water (Group) Co., Ltd. has a market capitalization of HK$903m, and paid its CEO total annual compensation worth CN¥655k over the year to December 2019. That is, the compensation was roughly the same as last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CN¥178k.

On comparing similar-sized companies in the industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was CN¥2.0m. In other words, Luzhou Xinglu Water (Group) pays its CEO lower than the industry median.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CN¥178k | CN¥168k | 27% |

| Other | CN¥477k | CN¥468k | 73% |

| Total Compensation | CN¥655k | CN¥636k | 100% |

On an industry level, roughly 57% of total compensation represents salary and 43% is other remuneration. Luzhou Xinglu Water (Group) sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Luzhou Xinglu Water (Group) Co., Ltd.'s Growth

Luzhou Xinglu Water (Group) Co., Ltd. has seen its earnings per share (EPS) increase by 14% a year over the past three years. It achieved revenue growth of 82% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Luzhou Xinglu Water (Group) Co., Ltd. Been A Good Investment?

With a three year total loss of 30% for the shareholders, Luzhou Xinglu Water (Group) Co., Ltd. would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we touched on above, Luzhou Xinglu Water (Group) Co., Ltd. is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, the EPS growth over three years is certainly impressive. Considering EPS are on the up, we would say Xingyue is compensated fairly. Shareholders, though, would ideally like to see shareholder returns head north before they agree to any raise.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for Luzhou Xinglu Water (Group) (of which 2 are concerning!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Luzhou Xinglu Water (Group), if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Luzhou Xinglu Water (Group), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2281

Luzhou Xinglu Water (Group)

Operates as an integrated municipal water service provider in the People’s Republic of China.

Slight risk second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026