- Hong Kong

- /

- Electric Utilities

- /

- SEHK:2

These 4 Measures Indicate That CLP Holdings (HKG:2) Is Using Debt Extensively

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that CLP Holdings Limited (HKG:2) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for CLP Holdings

How Much Debt Does CLP Holdings Carry?

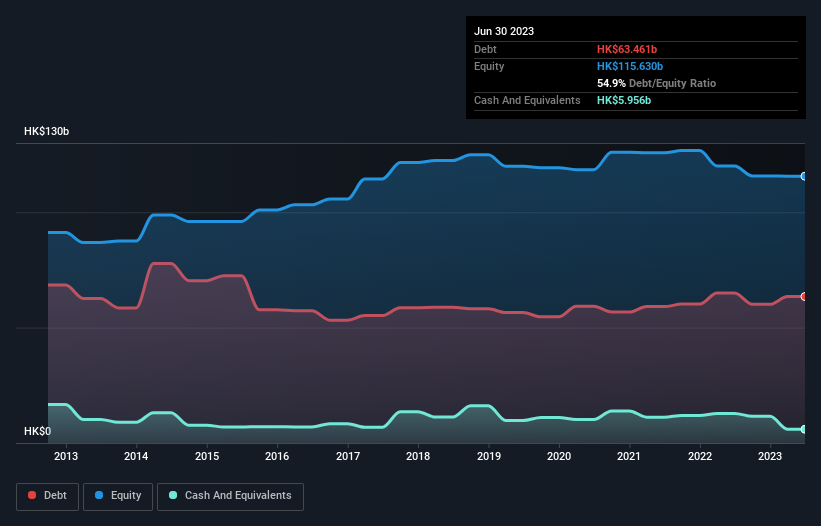

As you can see below, CLP Holdings had HK$63.5b of debt, at June 2023, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has HK$5.96b in cash leading to net debt of about HK$57.5b.

How Strong Is CLP Holdings' Balance Sheet?

According to the last reported balance sheet, CLP Holdings had liabilities of HK$43.7b due within 12 months, and liabilities of HK$75.6b due beyond 12 months. On the other hand, it had cash of HK$5.96b and HK$15.3b worth of receivables due within a year. So its liabilities total HK$98.0b more than the combination of its cash and short-term receivables.

This is a mountain of leverage even relative to its gargantuan market capitalization of HK$156.6b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

We'd say that CLP Holdings's moderate net debt to EBITDA ratio ( being 2.3), indicates prudence when it comes to debt. And its commanding EBIT of 10.9 times its interest expense, implies the debt load is as light as a peacock feather. Notably, CLP Holdings made a loss at the EBIT level, last year, but improved that to positive EBIT of HK$17b in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine CLP Holdings's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Considering the last year, CLP Holdings actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

CLP Holdings's struggle to convert EBIT to free cash flow had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. For example its interest cover was refreshing. We should also note that Electric Utilities industry companies like CLP Holdings commonly do use debt without problems. When we consider all the factors discussed, it seems to us that CLP Holdings is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for CLP Holdings that you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2

CLP Holdings

An investment holding company, engages in the generation, retail, transmission, and distribution of electricity in Hong Kong, Mainland China, India Thailand, Taiwan, and Australia.

Proven track record average dividend payer.