- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1811

Assessing CGN New Energy (SEHK:1811)’s Valuation After Its New Three-Year Maintenance Services Framework Deal

Reviewed by Simply Wall St

CGN New Energy Holdings (SEHK:1811) just signed a three year Maintenance Services Framework Agreement through its Yunnan subsidiary, formalising repair and testing work across wind, solar and energy storage assets within the CGN group.

See our latest analysis for CGN New Energy Holdings.

Against this backdrop, the HK$2.65 share price has seen a solid year to date, with a 13.25 percent year to date share price return and a standout 5 year total shareholder return of 190.96 percent, suggesting momentum is still broadly constructive as CGN New Energy leans further into long term service revenue.

If this kind of contract driven story has your attention, it could be a good moment to explore other renewable focused utilities and infrastructure names using our screener for fast growing stocks with high insider ownership.

With earnings still growing steadily, a value score on the low side and the shares trading at a material discount to analyst targets, is CGN New Energy still a mispriced transition play, or is the market already baking in years of growth?

Price to Earnings of 6.4x: Is it justified?

At the last close of HK$2.65, CGN New Energy trades on a 6.4x price to earnings multiple that screens as inexpensive versus both the Hong Kong market and its direct peers.

The price to earnings ratio compares what investors are paying today for each unit of current earnings. This can make it a useful yardstick for a mature, cash generative utility with steady but unspectacular growth prospects. For CGN New Energy, this multiple effectively packages the market’s expectations for future profit expansion and balance sheet risk into a single headline number.

On several fronts, the comparison looks favourable. The shares trade below the wider Hong Kong market multiple of 12.3x, below the Asian renewable energy peer average of 7.7x, and below an estimated fair price to earnings level of 9.7x. This gap points to meaningful rerating potential if earnings and cash flows stay on their current trajectory.

Explore the SWS fair ratio for CGN New Energy Holdings

Result: Price to Earnings of 6.4x (UNDERVALUED)

However, investors should watch for policy shifts in China’s power markets and potential project delays, either of which could pressure margins and derail rerating expectations.

Find out about the key risks to this CGN New Energy Holdings narrative.

Another View on Value

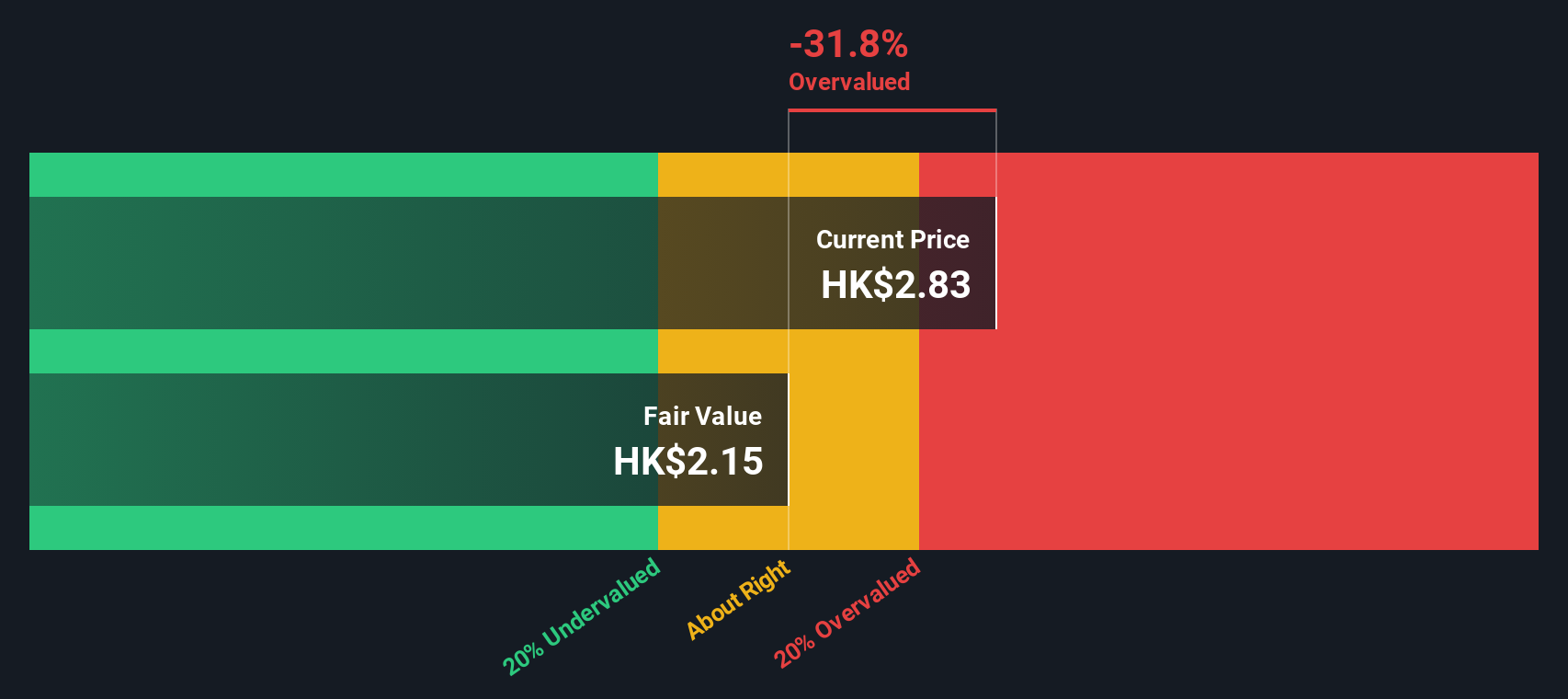

While the 6.4x earnings multiple hints at upside, our DCF model is more cautious, putting fair value nearer HK$2.12, which makes the current price look a bit rich. Is the market overestimating long term cash generation, or is the model too conservative on policy and funding risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CGN New Energy Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 935 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CGN New Energy Holdings Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your CGN New Energy Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction stock ideas?

Before you move on, lock in an edge by hunting for fresh opportunities in other corners of the market using the Simply Wall St screener.

- Capture potential mispricings by scanning these 935 undervalued stocks based on cash flows that trade below their estimated cash flow value yet still show durable fundamentals.

- Position ahead of the next tech wave by targeting these 25 AI penny stocks that link real AI adoption to revenue growth and expanding margins.

- Strengthen your income strategy using these 14 dividend stocks with yields > 3% that combine reliable payouts with balance sheets built to withstand market shocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1811

CGN New Energy Holdings

Generates and supplies electricity and steam in the People’s Republic of China and Republic of Korea.

Fair value second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026