- Hong Kong

- /

- Gas Utilities

- /

- SEHK:1600

The Market Lifts Tian Lun Gas Holdings Limited (HKG:1600) Shares 26% But It Can Do More

Tian Lun Gas Holdings Limited (HKG:1600) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

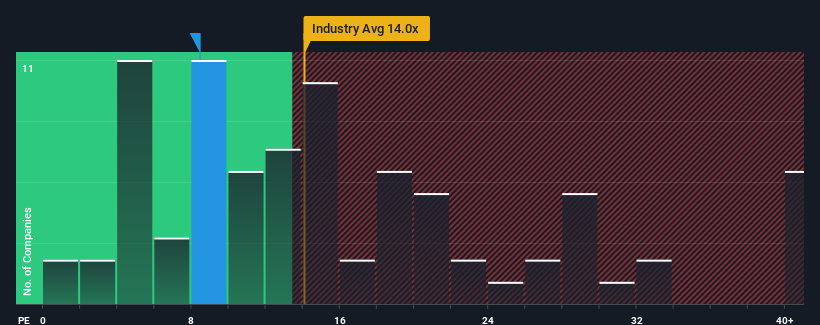

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Tian Lun Gas Holdings' P/E ratio of 8.4x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times haven't been advantageous for Tian Lun Gas Holdings as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

See our latest analysis for Tian Lun Gas Holdings

Is There Some Growth For Tian Lun Gas Holdings?

The only time you'd be comfortable seeing a P/E like Tian Lun Gas Holdings' is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 29%. As a result, earnings from three years ago have also fallen 38% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 22% per annum as estimated by the two analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 15% per year, which is noticeably less attractive.

With this information, we find it interesting that Tian Lun Gas Holdings is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Tian Lun Gas Holdings' P/E

Tian Lun Gas Holdings' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Tian Lun Gas Holdings currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Tian Lun Gas Holdings (1 doesn't sit too well with us!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Tian Lun Gas Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tian Lun Gas Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1600

Tian Lun Gas Holdings

Engages in the transportation, distribution, and sale of natural gas and compressed natural gas through its gas pipeline connections in the People’ Republic of China.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026