- Hong Kong

- /

- Gas Utilities

- /

- SEHK:135

Kunlun Energy (HKG:135) Will Pay A Larger Dividend Than Last Year At CN¥0.3048

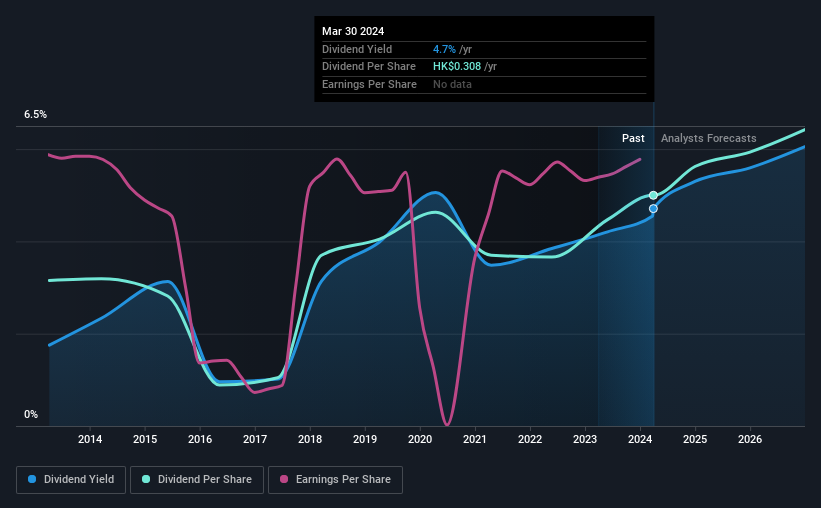

Kunlun Energy Company Limited (HKG:135) has announced that it will be increasing its dividend from last year's comparable payment on the 18th of July to CN¥0.3048. This makes the dividend yield about the same as the industry average at 4.7%.

View our latest analysis for Kunlun Energy

Kunlun Energy's Dividend Is Well Covered By Earnings

We aren't too impressed by dividend yields unless they can be sustained over time. Based on the last payment, Kunlun Energy was quite comfortably earning enough to cover the dividend. This means that a large portion of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 25.0%. Assuming the dividend continues along recent trends, we think the payout ratio could be 40% by next year, which is in a pretty sustainable range.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2014, the annual payment back then was CN¥0.179, compared to the most recent full-year payment of CN¥0.284. This implies that the company grew its distributions at a yearly rate of about 4.7% over that duration. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

Kunlun Energy May Find It Hard To Grow The Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. However, Kunlun Energy has only grown its earnings per share at 2.7% per annum over the past five years. Growth of 2.7% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

In Summary

Overall, this is a reasonable dividend, and it being raised is an added bonus. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 1 warning sign for Kunlun Energy that investors should know about before committing capital to this stock. Is Kunlun Energy not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kunlun Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:135

Kunlun Energy

An investment holding company, engages in the exploration, development, production, and sale of crude oil and natural gas in the Republic of Kazakhstan, the Sultanate of Oman, and the Kingdom of Thailand.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)