- Israel

- /

- Specialty Stores

- /

- TASE:CAST

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to 2025, driven by inflation concerns and political uncertainties, investors are keenly observing the impact on stock indices worldwide. With U.S. equities experiencing declines and mixed economic signals from major regions like Europe and Japan, dividend stocks present an attractive option for those seeking stability amid volatility. In such a climate, selecting dividend stocks with strong fundamentals can provide a reliable income stream while potentially mitigating market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.27% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.51% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.77% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.10% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.17% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.14% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1996 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

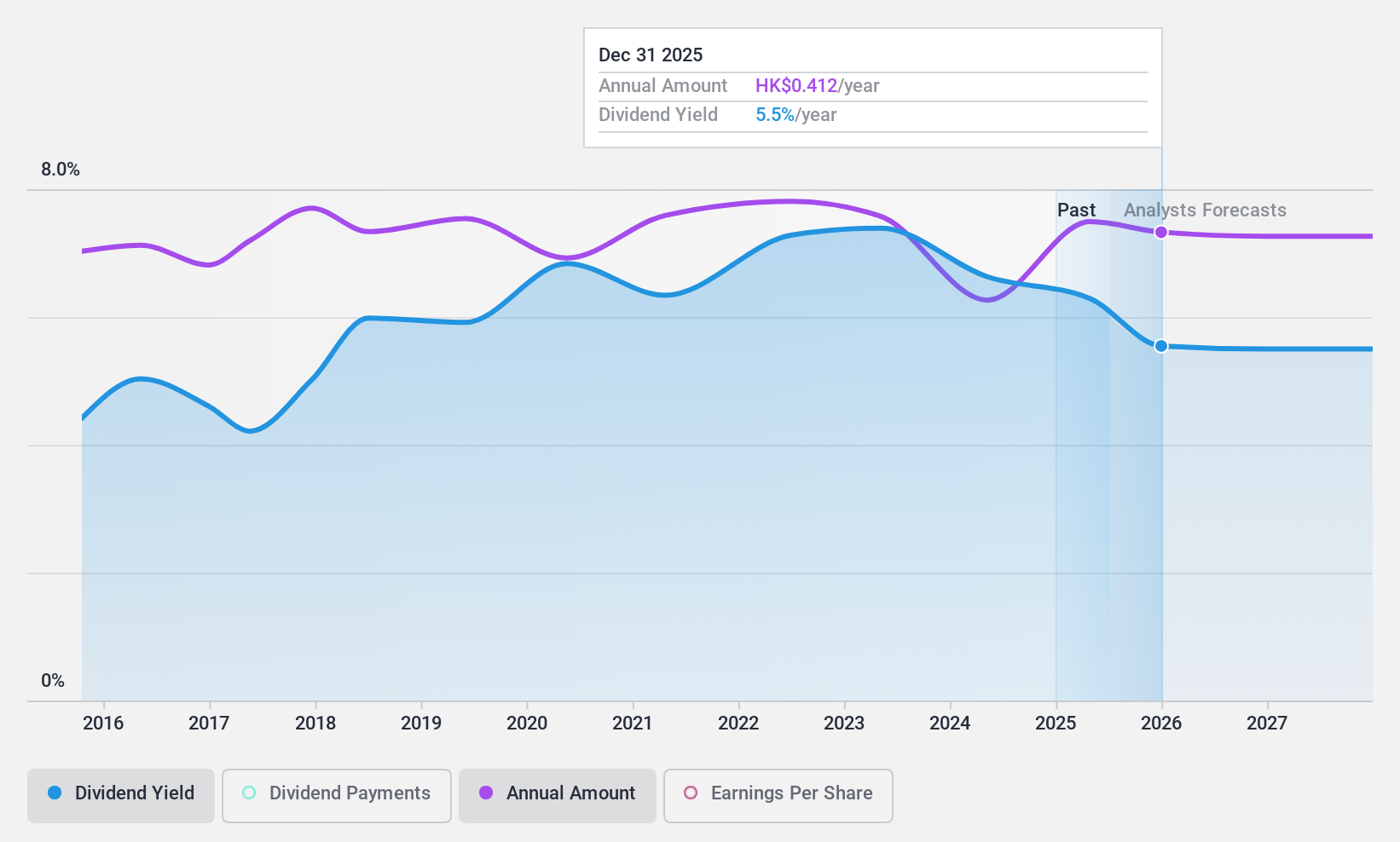

Zhejiang Expressway (SEHK:576)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Expressway Co., Ltd. is an investment holding company that constructs, operates, maintains, and manages roads in the People’s Republic of China, with a market cap of HK$32.55 billion.

Operations: Zhejiang Expressway Co., Ltd. generates revenue primarily through the construction, operation, maintenance, and management of roads in the People’s Republic of China.

Dividend Yield: 6.2%

Zhejiang Expressway's dividend payments are well covered by earnings, with a low payout ratio of 34.7%, though not well supported by free cash flow due to a high cash payout ratio of 137.9%. Despite this, the company has maintained stable and reliable dividends over the past decade, showing growth with minimal volatility. Recent infrastructure improvements and auditor changes could impact future financials. The stock trades at a favorable price-to-earnings ratio of 5.6x compared to the Hong Kong market average of 9.7x.

- Navigate through the intricacies of Zhejiang Expressway with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Zhejiang Expressway's current price could be quite moderate.

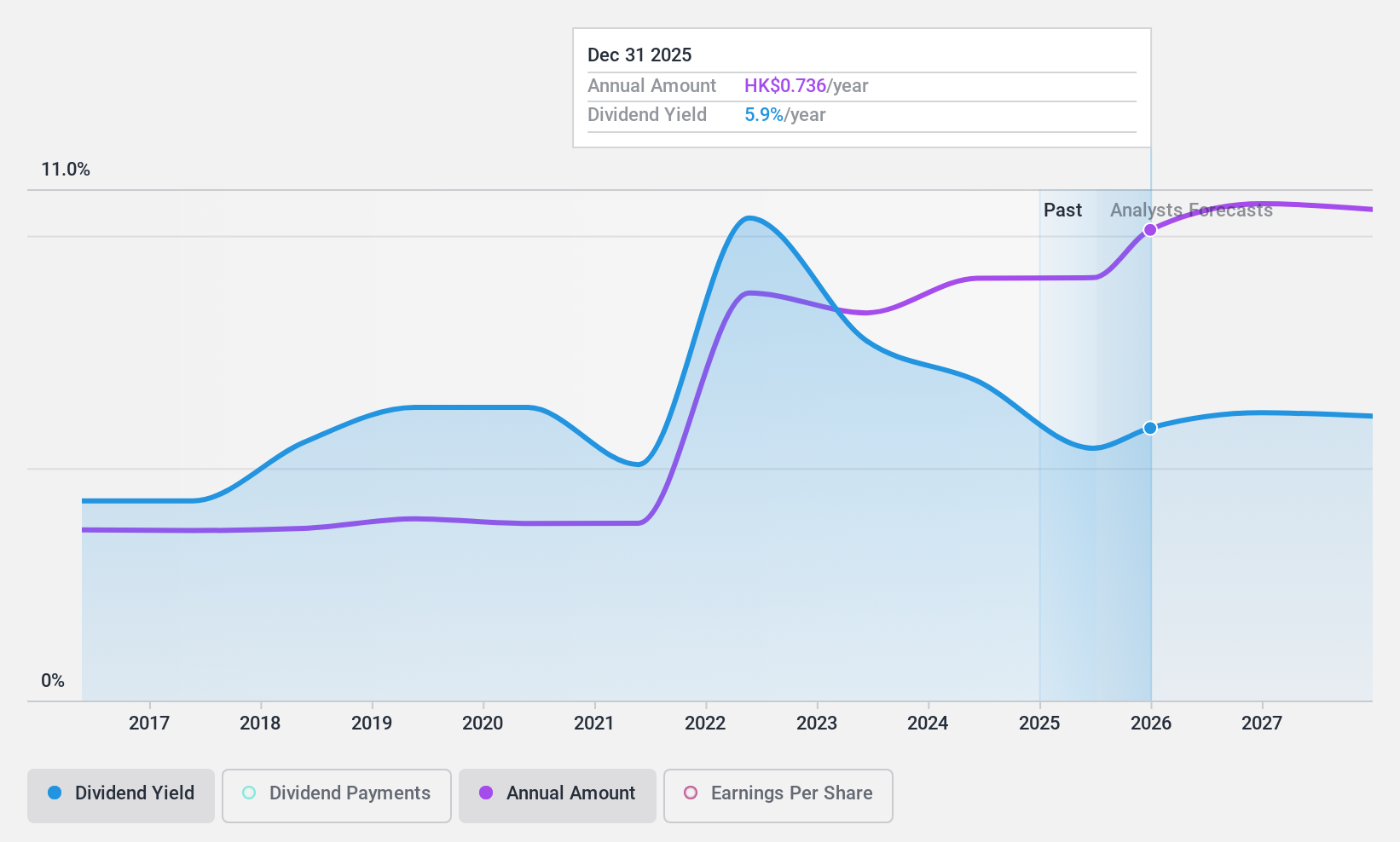

Anhui Expressway (SEHK:995)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anhui Expressway Company Limited is involved in the construction, operation, management, and development of toll roads and associated service sections in the People's Republic of China, with a market cap of HK$25.92 billion.

Operations: Anhui Expressway Company Limited generates its revenue primarily from the construction and operation of toll roads and related services in China.

Dividend Yield: 6.1%

Anhui Expressway has consistently increased its dividends over the past decade, maintaining stability and reliability. However, while the payout ratio of 65.1% indicates coverage by earnings, a high cash payout ratio of 321.5% suggests dividends are not well supported by free cash flows. The current yield of 6.08% is below top-tier dividend payers in Hong Kong's market. Recent earnings show revenue growth but a decline in net income to CNY 1.22 billion from CNY 1.35 billion last year.

- Take a closer look at Anhui Expressway's potential here in our dividend report.

- The analysis detailed in our Anhui Expressway valuation report hints at an inflated share price compared to its estimated value.

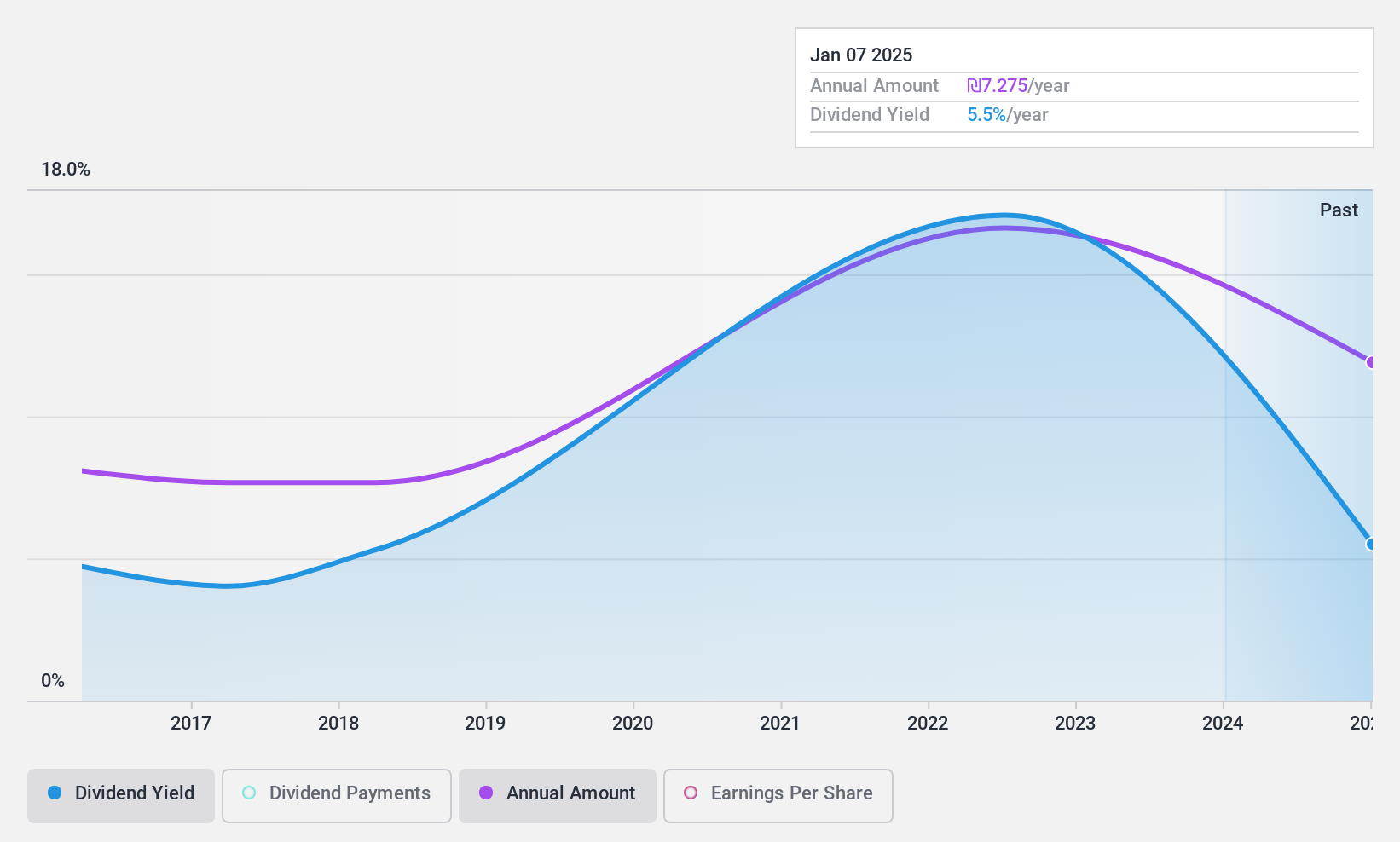

Castro Model (TASE:CAST)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Castro Model Ltd. operates in Israel, focusing on the retail sale of fashion products, home fashion, accessories, and cosmetics with a market cap of ₪882.50 million.

Operations: Castro Model Ltd. generates revenue from several segments, including Apparel Fashions at ₪1.36 billion, Fashion Accessories in Israel at ₪505.50 million, and Care and Cosmetics at ₪75.03 million.

Dividend Yield: 6.8%

Castro Model's dividend yield of 6.8% ranks it among the top 25% in Israel, but its dividends have been volatile over the past decade. Despite this instability, recent earnings growth is notable with net income rising to ILS 77.37 million for the first nine months of 2024 from ILS 14.37 million a year ago. The company's low cash payout ratio of 26.2% indicates dividends are well covered by cash flows, though overall sustainability remains uncertain due to insufficient data on earnings coverage.

- Get an in-depth perspective on Castro Model's performance by reading our dividend report here.

- The analysis detailed in our Castro Model valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 1996 Top Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:CAST

Castro Model

Engages in the retail sale of fashion products, home fashion, fashion accessories and cosmetics and care products in Israel.

Solid track record, good value and pays a dividend.