- Hong Kong

- /

- Infrastructure

- /

- SEHK:6119

Tian Yuan Group Holdings Limited's (HKG:6119) Popularity With Investors Under Threat As Stock Sinks 30%

Tian Yuan Group Holdings Limited (HKG:6119) shares have had a horrible month, losing 30% after a relatively good period beforehand. Longer-term, the stock has been solid despite a difficult 30 days, gaining 16% in the last year.

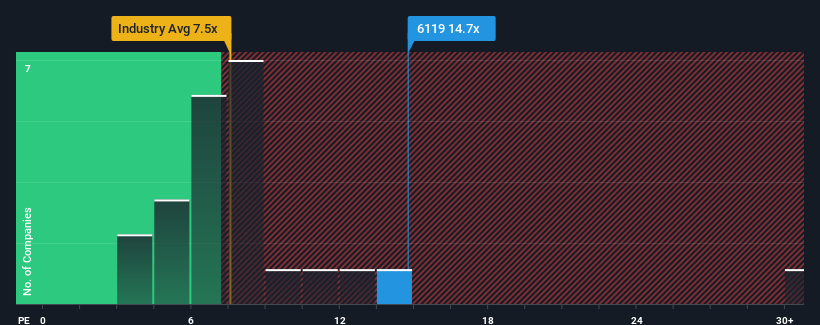

Although its price has dipped substantially, Tian Yuan Group Holdings' price-to-earnings (or "P/E") ratio of 14.7x might still make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 8x and even P/E's below 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Tian Yuan Group Holdings has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Tian Yuan Group Holdings

How Is Tian Yuan Group Holdings' Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Tian Yuan Group Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 9.3% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 8.2% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 19% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's alarming that Tian Yuan Group Holdings' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Tian Yuan Group Holdings' shares may have retreated, but its P/E is still flying high. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Tian Yuan Group Holdings currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for Tian Yuan Group Holdings you should be aware of, and 1 of them doesn't sit too well with us.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tian Yuan Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6119

Tian Yuan Group Holdings

An investment holding company, provides bulk and general cargo uploading and unloading, and related ancillary port services in the People’s Republic of China.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026