- Hong Kong

- /

- Infrastructure

- /

- SEHK:6119

Most Shareholders Will Probably Agree With Tian Yuan Group Holdings Limited's (HKG:6119) CEO Compensation

Key Insights

- Tian Yuan Group Holdings to hold its Annual General Meeting on 12th of June

- CEO Jinming Yang's total compensation includes salary of CN¥765.0k

- The total compensation is similar to the average for the industry

- Tian Yuan Group Holdings' EPS declined by 2.8% over the past three years while total shareholder return over the past three years was 139%

Despite strong share price growth of 139% for Tian Yuan Group Holdings Limited (HKG:6119) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 12th of June. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for Tian Yuan Group Holdings

How Does Total Compensation For Jinming Yang Compare With Other Companies In The Industry?

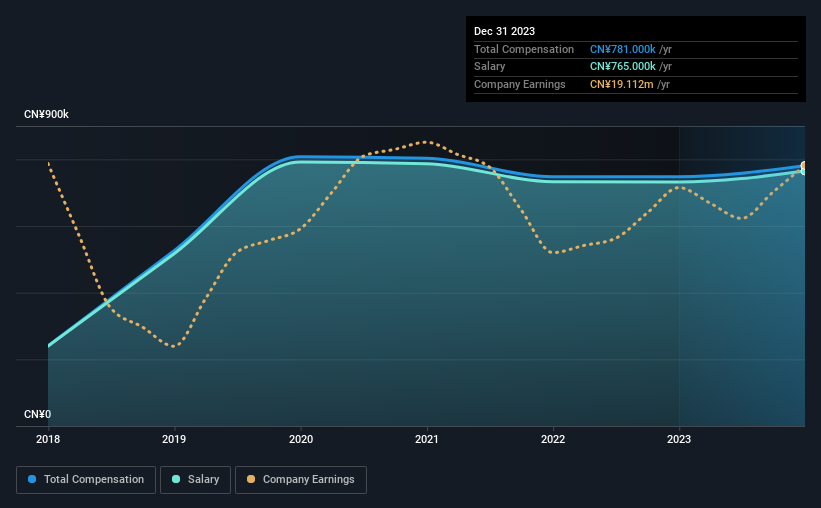

According to our data, Tian Yuan Group Holdings Limited has a market capitalization of HK$474m, and paid its CEO total annual compensation worth CN¥781k over the year to December 2023. That's a fairly small increase of 4.4% over the previous year. We note that the salary portion, which stands at CN¥765.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Hong Kong Infrastructure industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of CN¥831k. So it looks like Tian Yuan Group Holdings compensates Jinming Yang in line with the median for the industry. Moreover, Jinming Yang also holds HK$334m worth of Tian Yuan Group Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥765k | CN¥732k | 98% |

| Other | CN¥16k | CN¥16k | 2% |

| Total Compensation | CN¥781k | CN¥748k | 100% |

Talking in terms of the industry, salary represented approximately 65% of total compensation out of all the companies we analyzed, while other remuneration made up 35% of the pie. Tian Yuan Group Holdings has gone down a largely traditional route, paying Jinming Yang a high salary, giving it preference over non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Tian Yuan Group Holdings Limited's Growth Numbers

Over the last three years, Tian Yuan Group Holdings Limited has shrunk its earnings per share by 2.8% per year. In the last year, its revenue is down 4.7%.

Its a bit disappointing to see that the company has failed to grow its EPS. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Tian Yuan Group Holdings Limited Been A Good Investment?

We think that the total shareholder return of 139%, over three years, would leave most Tian Yuan Group Holdings Limited shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Tian Yuan Group Holdings pays its CEO a majority of compensation through a salary. Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for Tian Yuan Group Holdings that investors should look into moving forward.

Switching gears from Tian Yuan Group Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Tian Yuan Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6119

Tian Yuan Group Holdings

An investment holding company, provides bulk and general cargo uploading and unloading, and related ancillary port services in the People’s Republic of China.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026