- United Arab Emirates

- /

- Building

- /

- ADX:RAKCEC

Discover 3 Dividend Stocks Offering Up To 8.4% Yield

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape with fluctuating consumer confidence and varied regional performances, investors are keenly observing opportunities that offer stability and income potential. In this context, dividend stocks stand out as a compelling choice for those looking to balance risk and reward, providing consistent returns even amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

R.A.K. Ceramics P.J.S.C (ADX:RAKCEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: R.A.K. Ceramics P.J.S.C. manufactures and sells a range of ceramic products across the Middle East, Europe, Asia, and internationally with a market cap of AED 2.47 billion.

Operations: R.A.K. Ceramics P.J.S.C.'s revenue is primarily derived from Ceramic Products at AED 3.21 billion, followed by Faucets contributing AED 520.47 million, and Other Industrial segments adding AED 183.75 million.

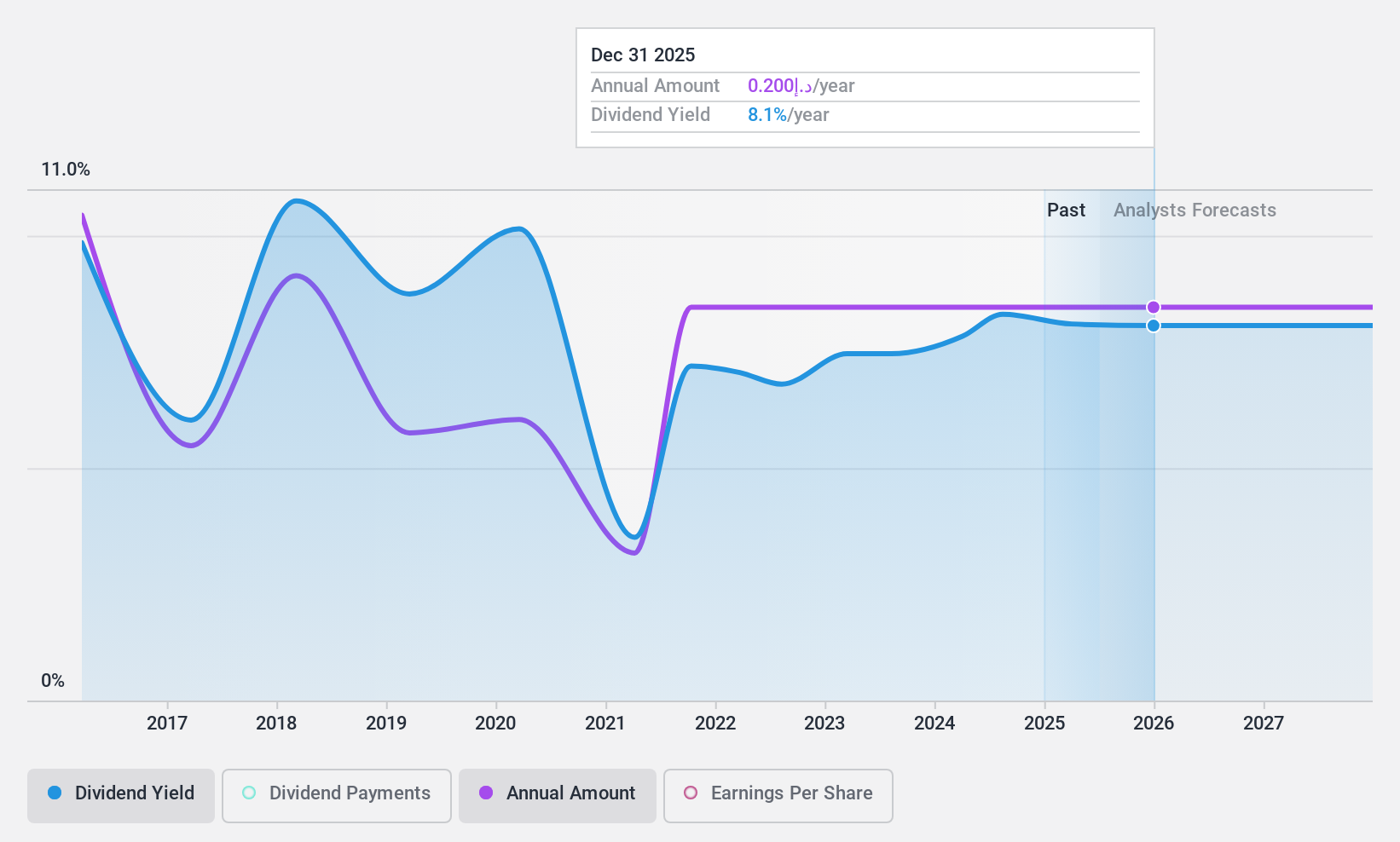

Dividend Yield: 8%

R.A.K. Ceramics P.J.S.C. offers a dividend yield of 8.03%, placing it in the top 25% of dividend payers in the AE market. However, its high payout ratio of 127.8% indicates dividends are not well covered by earnings, though they are supported by cash flows with a cash payout ratio of 65.7%. Despite past volatility and unreliability in payments, dividends have grown over the last decade, highlighting potential for cautious income-focused investors.

- Get an in-depth perspective on R.A.K. Ceramics P.J.S.C's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, R.A.K. Ceramics P.J.S.C's share price might be too pessimistic.

Sinotrans (SEHK:598)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinotrans Limited offers integrated logistics services mainly in the People’s Republic of China and has a market cap of HK$37.20 billion.

Operations: Sinotrans Limited generates revenue through its integrated logistics services primarily in the People’s Republic of China.

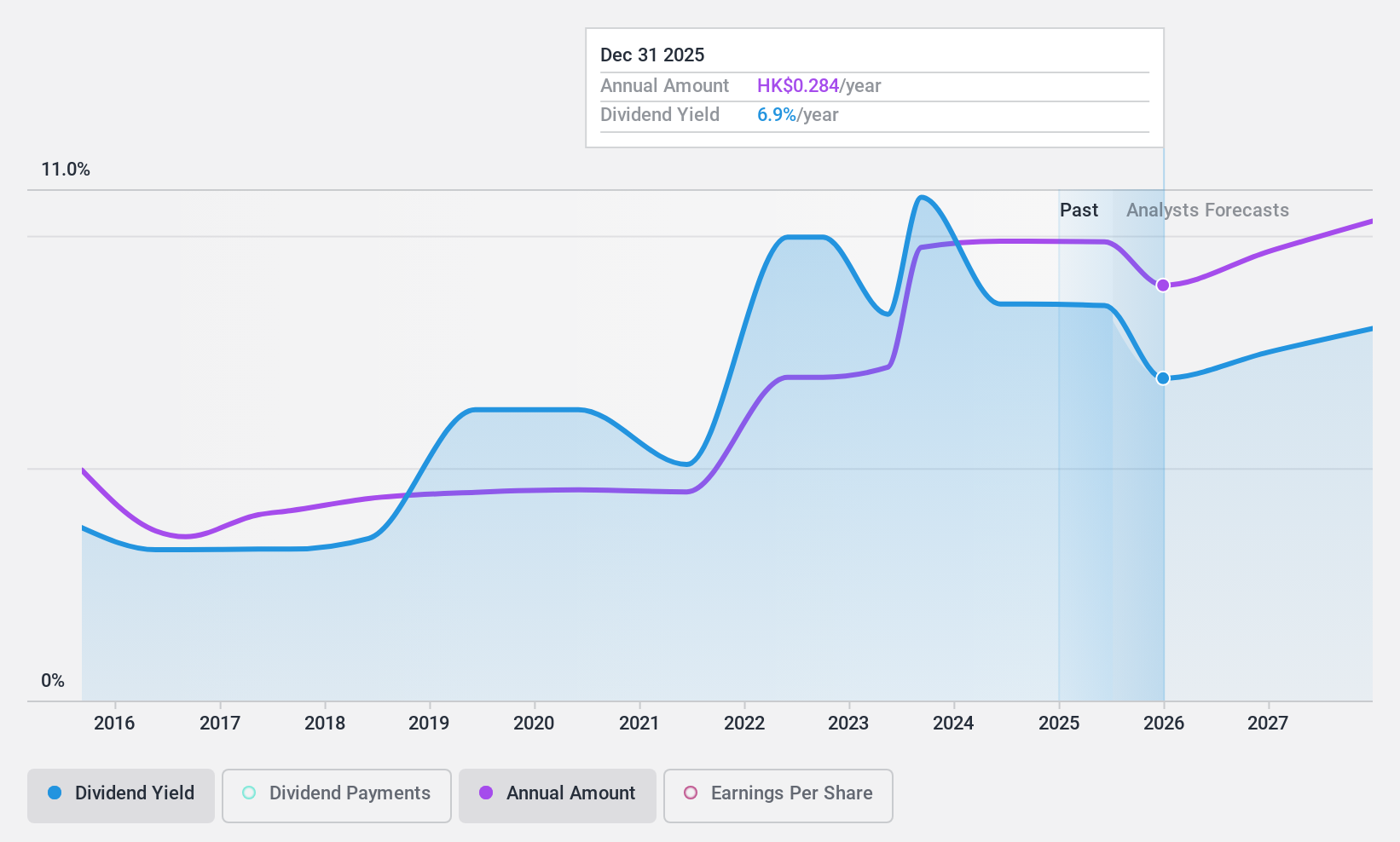

Dividend Yield: 8.4%

Sinotrans offers a dividend yield of 8.41%, ranking in the top 25% of Hong Kong market payers. Despite past volatility, dividends have grown over the last decade but remain unreliable due to a high cash payout ratio of 93.2%, indicating insufficient coverage by cash flows. The company trades at a favorable price-to-earnings ratio of 6.4x, below the market average, and has initiated a CNY 542 million share repurchase program to enhance shareholder value.

- Delve into the full analysis dividend report here for a deeper understanding of Sinotrans.

- Our valuation report unveils the possibility Sinotrans' shares may be trading at a discount.

Lion Travel Service (TWSE:2731)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lion Travel Service Co., Ltd. offers travel services both in Taiwan and internationally, with a market cap of NT$11.52 billion.

Operations: The Tour Department is the primary revenue segment for Lion Travel Service Co., Ltd., generating NT$28.15 billion.

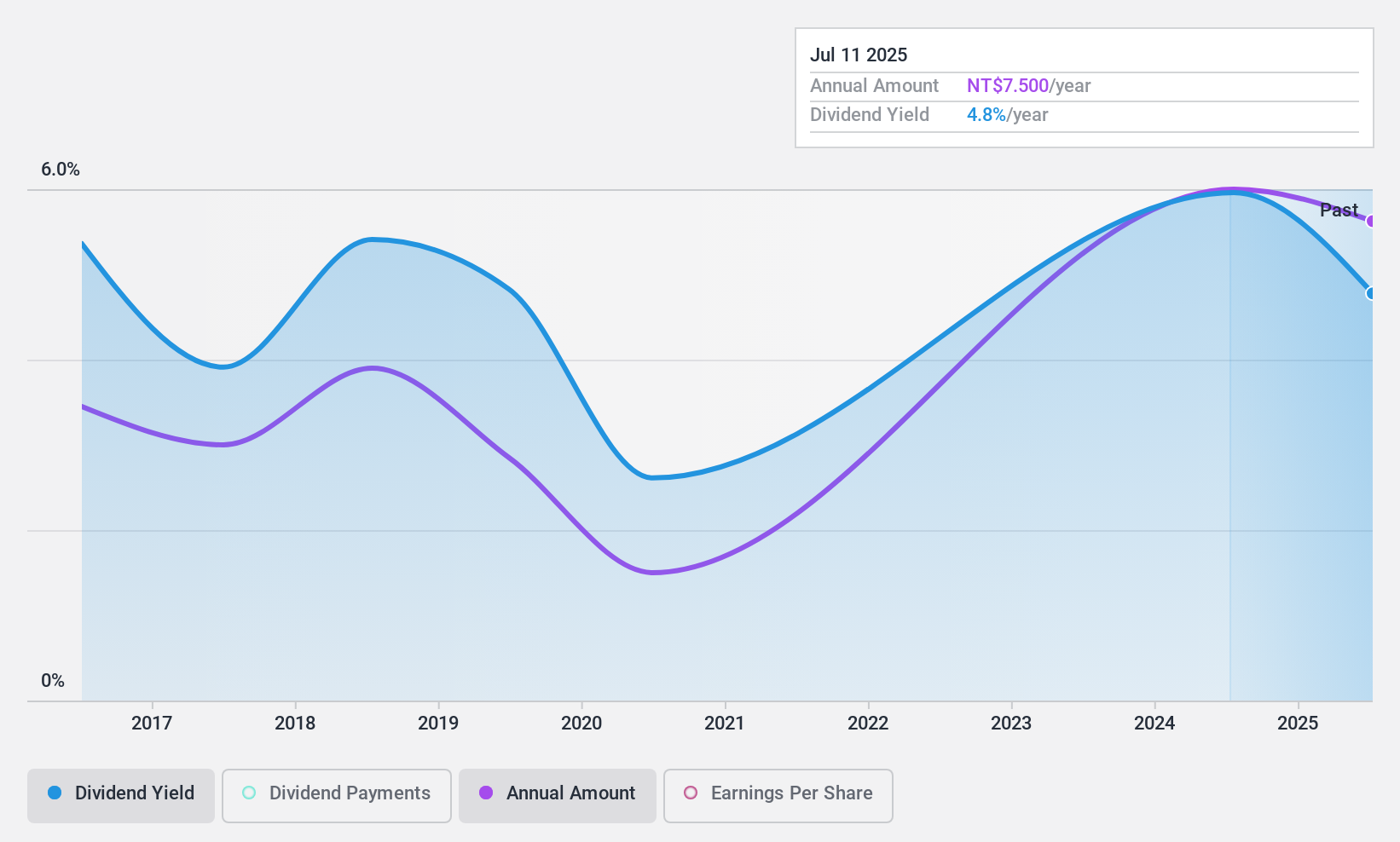

Dividend Yield: 6.5%

Lion Travel Service's dividend yield of 6.48% ranks in the top 25% in Taiwan, supported by a low payout ratio of 49.3% and cash payout ratio of 32.3%, ensuring coverage by earnings and cash flows. However, dividends have been volatile over the past decade, with large one-off items affecting earnings reliability. Recent third-quarter results show increased sales but a decline in net income to TWD 83.39 million from TWD 263.72 million year-on-year, impacting dividend sustainability perceptions.

- Unlock comprehensive insights into our analysis of Lion Travel Service stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Lion Travel Service is priced lower than what may be justified by its financials.

Summing It All Up

- Click here to access our complete index of 1940 Top Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:RAKCEC

R.A.K. Ceramics P.J.S.C

Engages in manufacture and sale of various ceramic products in the Middle East, Europe, Asian countries, and internationally.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives