- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:316

Orient Overseas (International) Limited's (HKG:316) Popularity With Investors Is Under Threat From Overpricing

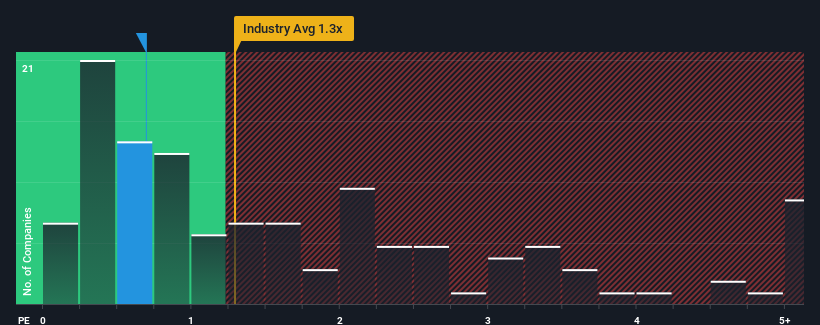

There wouldn't be many who think Orient Overseas (International) Limited's (HKG:316) price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S for the Shipping industry in Hong Kong is very similar. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Orient Overseas (International)

What Does Orient Overseas (International)'s Recent Performance Look Like?

With only a limited decrease in revenue compared to most other companies of late, Orient Overseas (International) has been doing relatively well. Perhaps the market is expecting future revenue performance fall back in line with the poorer industry performance, which has kept the P/S contained. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. But at the very least, you'd be hoping the company doesn't fall back into the pack if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Orient Overseas (International) will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Orient Overseas (International)?

The only time you'd be comfortable seeing a P/S like Orient Overseas (International)'s is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 36%. Even so, admirably revenue has lifted 90% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 38% as estimated by the six analysts watching the company. With the rest of the industry predicted to shrink by 18%, it's a sub-optimal result.

With this information, it's perhaps strange that Orient Overseas (International) is trading at a fairly similar P/S in comparison. When revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Orient Overseas (International) currently trades on a higher P/S than expected based on revenue decline, even more so since its revenue forecast is even worse than the struggling industry. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. We also have our reservations about the company's ability to sustain this level of performance amidst the challenging industry conditions. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Orient Overseas (International) (2 make us uncomfortable!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Orient Overseas (International), explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:316

Orient Overseas (International)

An investment holding company, provides container transport and logistics services in Asia, Europe, North and South America, Australia, and Africa.

Flawless balance sheet with solid track record and pays a dividend.