- Australia

- /

- Construction

- /

- ASX:SXE

Exploring 3 Undervalued Small Caps In Global With Notable Insider Actions

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's hints at potential rate cuts, small-cap stocks have shown resilience, with indices like the S&P Mid-Cap 400 and Russell 2000 posting strong returns. In this environment of shifting monetary policy and economic indicators, identifying small-cap companies that exhibit strong fundamentals and notable insider actions can offer intriguing opportunities for investors seeking value.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GDI Integrated Facility Services | 18.3x | 0.3x | 3.87% | ★★★★★☆ |

| Bytes Technology Group | 17.7x | 4.5x | 10.62% | ★★★★☆☆ |

| Hemisphere Energy | 5.8x | 2.3x | 9.76% | ★★★★☆☆ |

| East West Banking | 3.2x | 0.8x | 17.70% | ★★★★☆☆ |

| Sagicor Financial | 7.2x | 0.4x | -72.95% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 12.9x | 6.7x | 15.32% | ★★★★☆☆ |

| CVS Group | 47.6x | 1.4x | 34.72% | ★★★★☆☆ |

| A.G. BARR | 19.2x | 1.8x | 47.02% | ★★★☆☆☆ |

| Dicker Data | 21.2x | 0.7x | -25.73% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.9x | 1.8x | 19.36% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

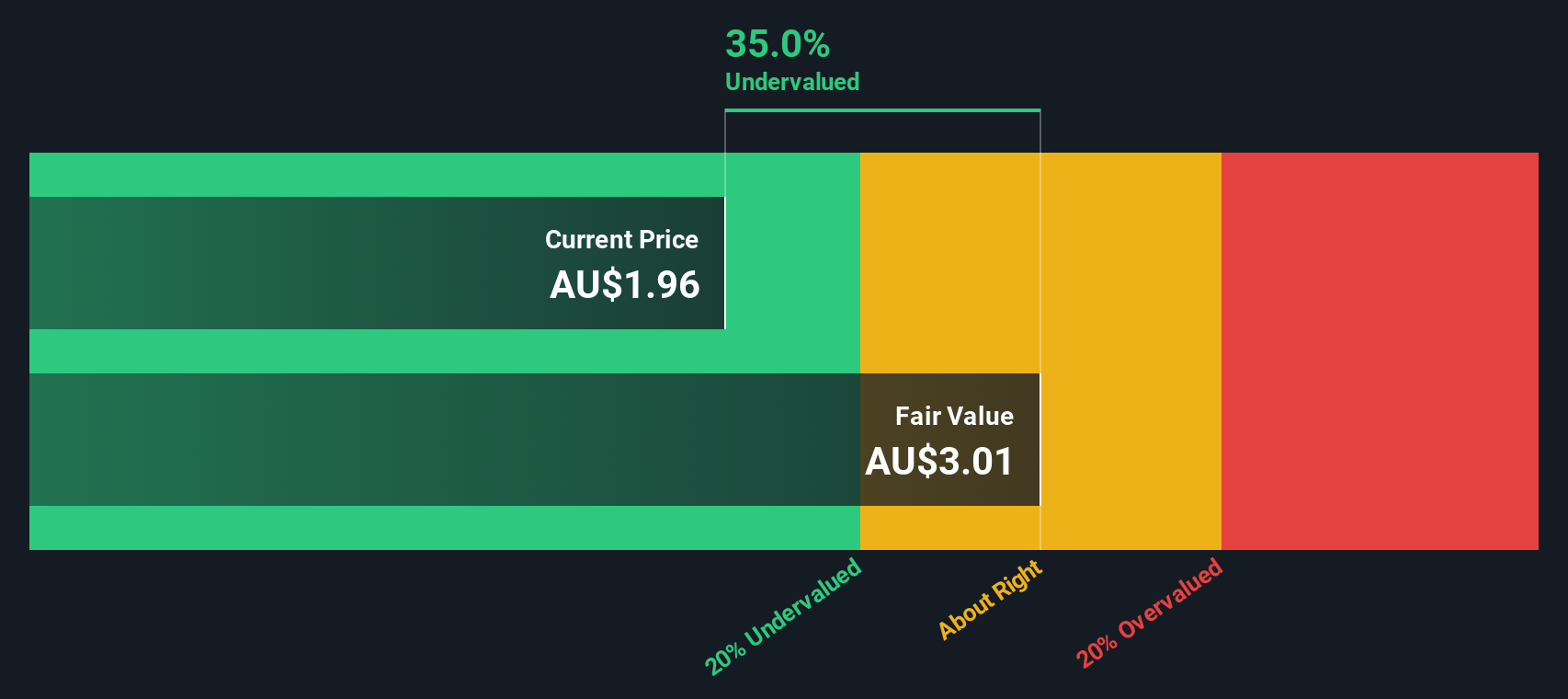

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Value Rating: ★★★★☆☆

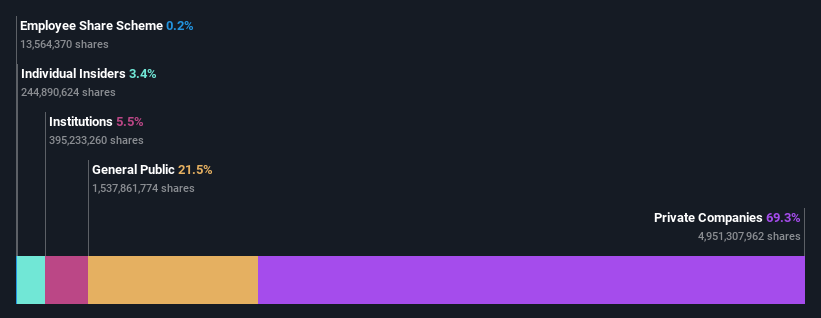

Overview: Southern Cross Electrical Engineering provides electrical services and has a market capitalization of A$0.22 billion.

Operations: Southern Cross Electrical Engineering generates its revenue primarily through the provision of electrical services, with a recent revenue figure of A$801.45 million. The company has seen fluctuations in its gross profit margin, reaching 16.42% in the latest period. Operating expenses are significant, with general and administrative expenses accounting for a notable portion at A$48.97 million recently. Net income has shown a positive trend, most recently recorded at A$31.67 million with a net income margin of 3.95%.

PE: 16.2x

Southern Cross Electrical Engineering (SCEE) is actively seeking acquisitions to enhance geographic diversification and capabilities, leveraging their financial capacity. With earnings for the year ending June 2025 showing A$801.45 million in sales, up from A$551.87 million last year, and net income rising to A$31.67 million, SCEE's growth trajectory appears promising. Insider confidence is evident with executive leadership changes aimed at strategic transformation. The company forecasts a 10% annual earnings growth rate while maintaining a fully franked dividend of A$0.05 per share for the half-year ended June 2025.

D&L Industries (PSE:DNL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: D&L Industries operates in various sectors including food ingredients, aerosols, colorant and plastic additives, and oleochemicals, resins and powder coatings with a market cap of ₱56.52 billion.

Operations: The company's revenue is primarily driven by its Food Ingredients and Oleochemicals, Resins, and Powder Coatings segments. Over recent periods, the gross profit margin has shown a decline from 20.91% in Q2 2019 to 14.18% in Q1 2025. Operating expenses have increased over time, impacting profitability despite growth in overall revenue figures.

PE: 14.1x

D&L Industries, a small company with potential, recently reported increased second-quarter revenue of PHP 12.34 billion and net income of PHP 714 million. Despite relying on external borrowing for funding, the firm demonstrates strong non-cash earnings and forecasts a promising annual growth rate of nearly 18%. Insider confidence is evident as insiders have been purchasing shares over the past months. Additionally, regular and special dividends were declared in June 2025, hinting at shareholder-focused strategies.

- Click here and access our complete valuation analysis report to understand the dynamics of D&L Industries.

Gain insights into D&L Industries' past trends and performance with our Past report.

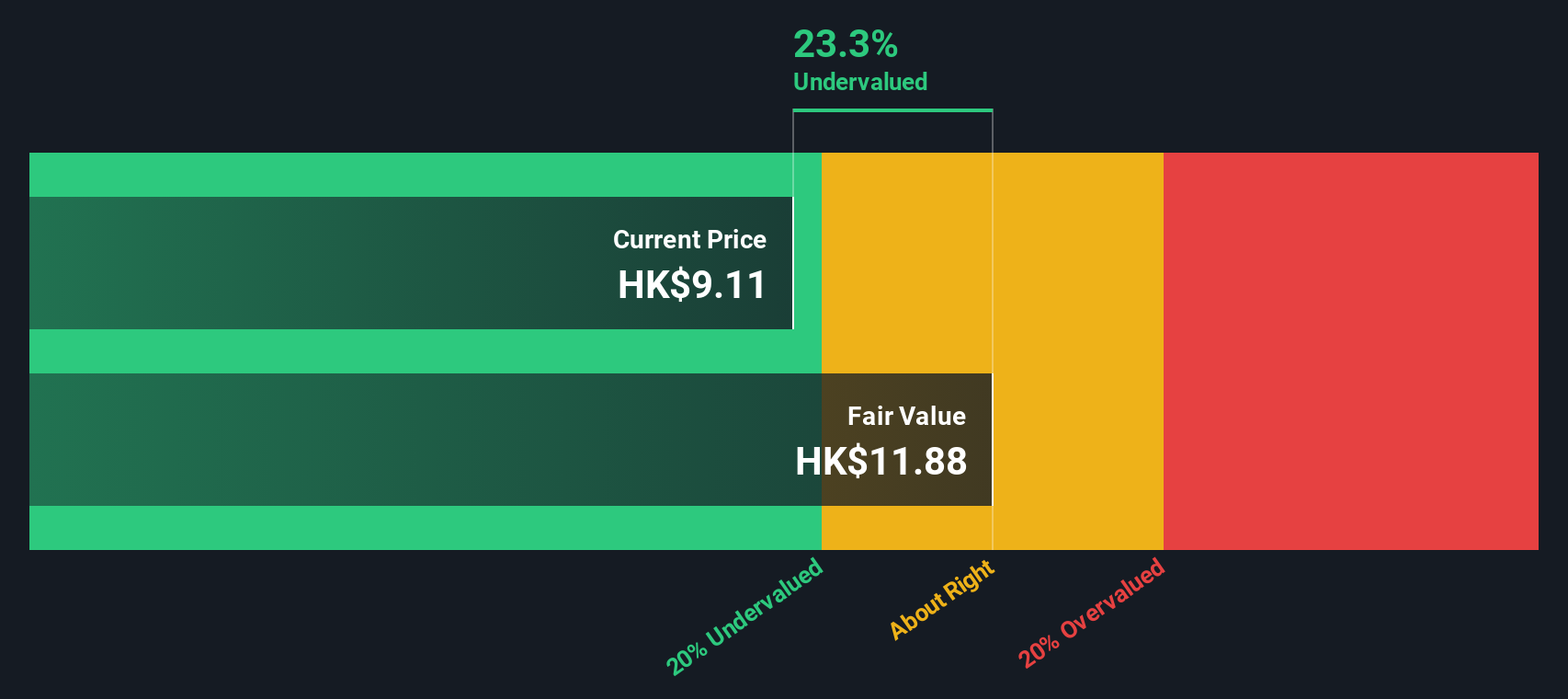

T.S. Lines (SEHK:2510)

Simply Wall St Value Rating: ★★★★★☆

Overview: T.S. Lines is a company primarily engaged in container shipping and related services, with operations contributing to a market capitalization of HK$2.75 billion.

Operations: The company generates revenue primarily from container shipping and related services, with a recent figure of $1.44 billion. Over the observed periods, the net income margin showed variability, reaching a high of 34.41% in mid-2025 after experiencing fluctuations in previous years. Operating expenses and cost of goods sold significantly impact profitability, with notable changes influencing gross profit margins across different periods.

PE: 3.9x

T.S. Lines, a smaller company in the shipping industry, has recently shown significant financial improvement. For the half year ending June 2025, sales rose to US$641.43 million from US$540.49 million a year earlier, with net income jumping to US$188.69 million from US$58.61 million previously. Despite this growth and insider confidence reflected by President & Executive Director Hung-Lin To's purchase of 412,000 shares valued at approximately US$2.67 million in August 2025, future earnings are forecasted to decline by an average of 2% annually over the next three years due to reliance on external borrowing and volatile share prices over recent months.

Seize The Opportunity

- Embark on your investment journey to our 97 Undervalued Global Small Caps With Insider Buying selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXE

Southern Cross Electrical Engineering

Provides electrical, instrumentation, communications, security, fire, and maintenance services and products in Australia.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)