- Hong Kong

- /

- Transportation

- /

- SEHK:2129

Legion Consortium's (HKG:2129) Conservative Accounting Might Explain Soft Earnings

Soft earnings didn't appear to concern Legion Consortium Limited's (HKG:2129) shareholders over the last week. We think that the softer headline numbers might be getting counterbalanced by some positive underlying factors.

Check out our latest analysis for Legion Consortium

Examining Cashflow Against Legion Consortium's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

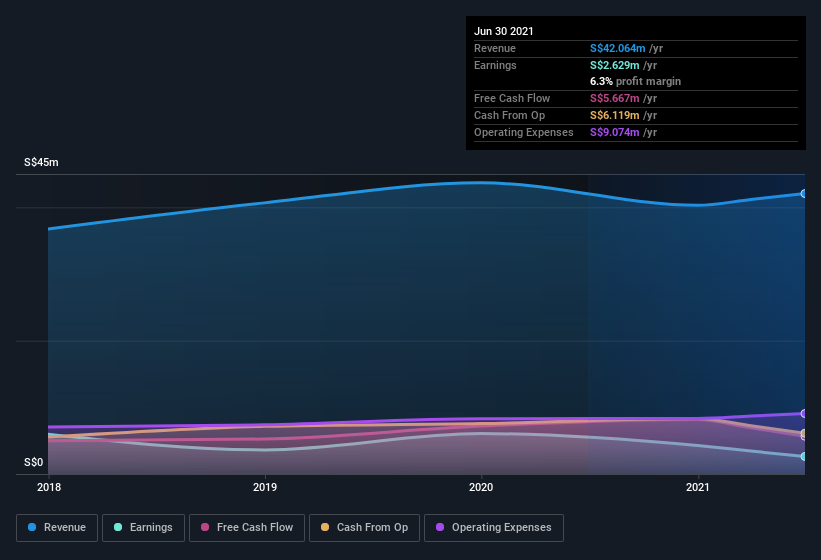

Legion Consortium has an accrual ratio of -0.20 for the year to June 2021. That indicates that its free cash flow quite significantly exceeded its statutory profit. In fact, it had free cash flow of S$5.7m in the last year, which was a lot more than its statutory profit of S$2.63m. Legion Consortium's free cash flow actually declined over the last year, which is disappointing, like non-biodegradable balloons. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Legion Consortium.

The Impact Of Unusual Items On Profit

On top of the noteworthy accrual ratio and the spike in non-operating revenue, we can also see that Legion Consortium benefitted from unusual items worth S$775k in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Legion Consortium's Profit Performance

Legion Consortium's profits got a boost from unusual items, which indicates they might not be sustained and yet its accrual ratio still indicated solid cash conversion, which is promising. Considering all the aforementioned, we'd venture that Legion Consortium's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Our analysis shows 5 warning signs for Legion Consortium (1 is a bit unpleasant!) and we strongly recommend you look at these before investing.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2129

Legion Consortium

A logistics service provider, offers trucking, freight forwarding, transportation, and value-added transport services in Singapore.

Flawless balance sheet and good value.

Market Insights

Community Narratives