Global markets have recently shown resilience, with U.S. stock indexes rising amid dovish Federal Reserve comments and weaker-than-expected economic reports hinting at potential rate cuts. As small-cap stocks outperformed larger peers, investors are increasingly looking toward lesser-known opportunities that might offer growth potential at a lower entry cost. Penny stocks, often associated with smaller or newer companies, remain relevant today as they can present unique opportunities for growth when backed by solid financials and robust fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.52 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.025 | £459.02M | ✅ 4 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$2.86 | A$444.16M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.63 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.95M | ✅ 3 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.05 | SGD425.55M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.40 | SGD13.38B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.68 | $395.3M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.215 | MYR331.28M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,572 stocks from our Global Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Xiangxing International Holding (SEHK:1732)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Xiangxing International Holding Limited is an investment holding company that offers intra-port services, logistics services, and supply chain operations in the People’s Republic of China, with a market cap of HK$409.60 million.

Operations: The company's revenue is primarily generated from intra-port container transportation services (CN¥74.54 million), trading of building materials and automobile accessories (CN¥60.19 million), intra-port ancillary services (CN¥56.84 million), container and stone blocks road freight forwarding services (CN¥20.49 million), and import and export agency services (CN¥8.15 million).

Market Cap: HK$409.6M

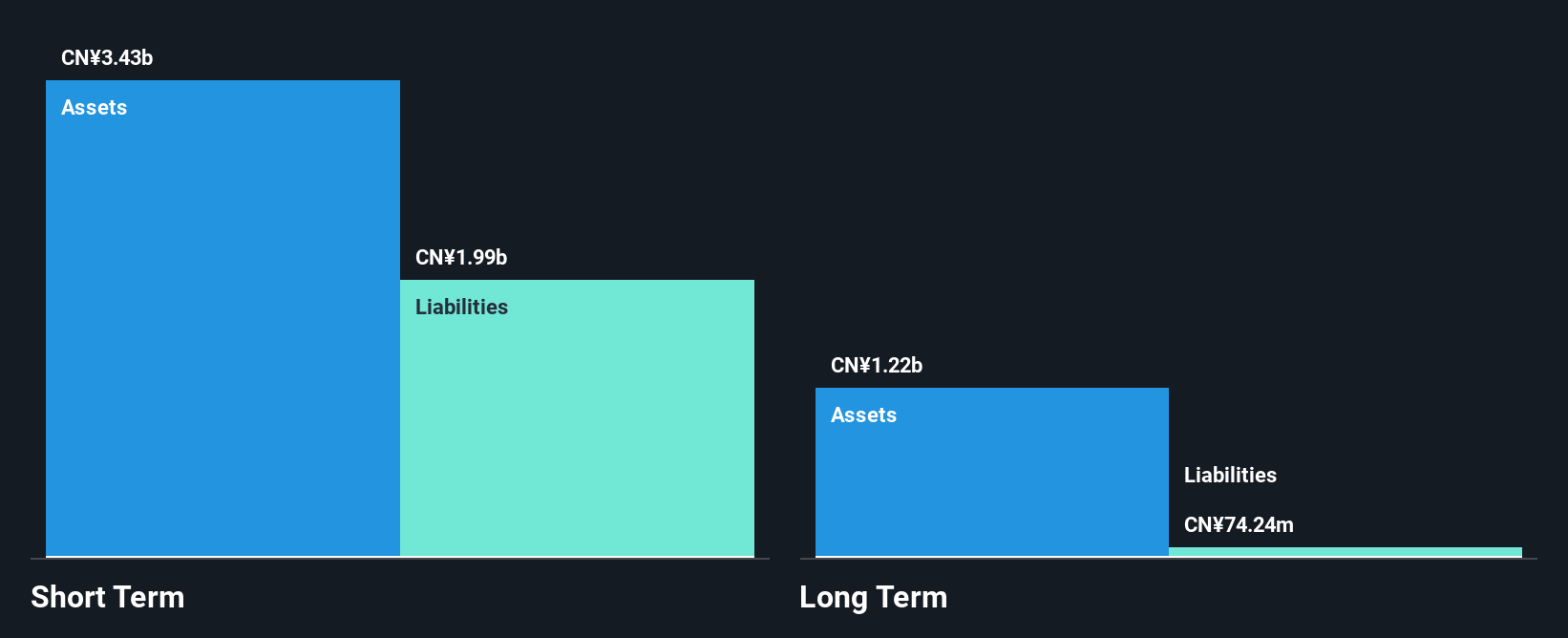

Xiangxing International Holding Limited has a market cap of HK$409.60 million, with its revenue primarily generated from intra-port services and trading activities. Despite having more cash than total debt, the company is currently unprofitable, with losses increasing by 30.1% annually over five years. Its short-term assets exceed both short-term and long-term liabilities, indicating a strong liquidity position. However, negative operating cash flow suggests challenges in debt coverage. Recent news includes a proposed acquisition by Westwell Holdings for a 29% stake at HKD 0.21 per share, potentially impacting shareholder dynamics if completed successfully.

- Take a closer look at Xiangxing International Holding's potential here in our financial health report.

- Review our historical performance report to gain insights into Xiangxing International Holding's track record.

Zhuzhou Tianqiao Crane (SZSE:002523)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhuzhou Tianqiao Crane Co., Ltd. specializes in manufacturing and selling material handling equipment for the electrolytic aluminum, steel, construction machinery, and non-ferrous industries both in China and internationally, with a market cap of CN¥5.78 billion.

Operations: Zhuzhou Tianqiao Crane Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥5.78B

Zhuzhou Tianqiao Crane Co., Ltd. has demonstrated significant earnings growth, with a 101.8% increase over the past year, surpassing its five-year average of 3.8% per annum. The company's financial health appears robust, as short-term assets of CN¥3.6 billion cover both short-term and long-term liabilities comfortably, and it holds more cash than debt. Despite a low return on equity of 3.7%, its debt-to-equity ratio has improved substantially to 3%. Recent earnings reports show a rise in net income to CN¥85.2 million for the first nine months of 2025 compared to CN¥17.62 million in the previous year, reflecting strong revenue growth amidst stable volatility levels.

- Unlock comprehensive insights into our analysis of Zhuzhou Tianqiao Crane stock in this financial health report.

- Learn about Zhuzhou Tianqiao Crane's historical performance here.

Fuan Pharmaceutical (Group) (SZSE:300194)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fuan Pharmaceutical (Group) Co., Ltd. and its subsidiaries focus on the research, development, production, and sale of chemical drugs in the People's Republic of China, with a market cap of CN¥5.50 billion.

Operations: The company generates revenue of CN¥1.71 billion from its operations in the pharmaceutical industry.

Market Cap: CN¥5.5B

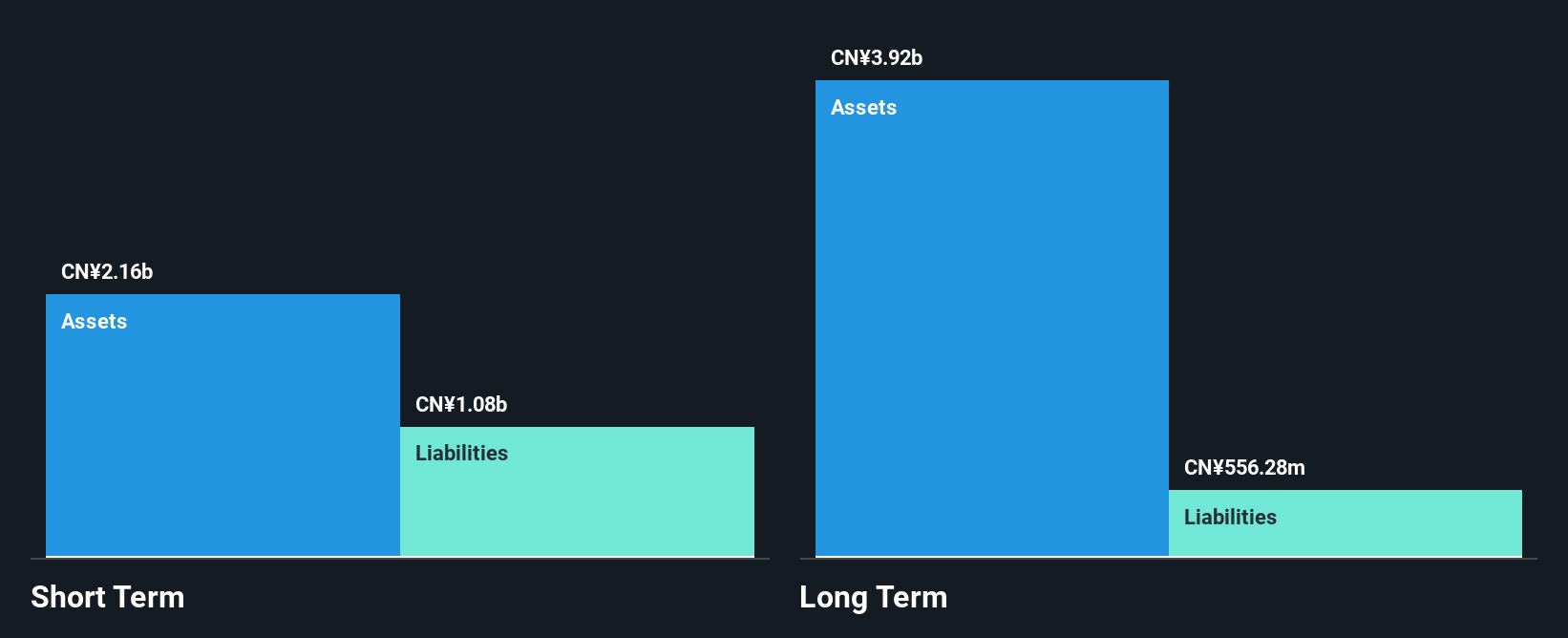

Fuan Pharmaceutical (Group) Co., Ltd. has experienced a decline in earnings, with net income falling to CN¥166.26 million for the first nine months of 2025 from CN¥301.61 million the previous year. Despite this, its financial stability is supported by short-term assets of CN¥2.1 billion exceeding both short-term and long-term liabilities, and it maintains more cash than total debt. The management team is highly experienced with an average tenure of 14.6 years, although return on equity remains low at 3.2%. The company's inclusion in the S&P Global BMI Index highlights its market presence amidst challenging growth conditions.

- Click here to discover the nuances of Fuan Pharmaceutical (Group) with our detailed analytical financial health report.

- Understand Fuan Pharmaceutical (Group)'s track record by examining our performance history report.

Where To Now?

- Reveal the 3,572 hidden gems among our Global Penny Stocks screener with a single click here.

- Seeking Other Investments? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300194

Fuan Pharmaceutical (Group)

Research and develops, produces, and sells chemical drugs in the People's Republic of China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026