- Hong Kong

- /

- Infrastructure

- /

- SEHK:152

Shareholders Will Most Likely Find Shenzhen International Holdings Limited's (HKG:152) CEO Compensation Acceptable

Key Insights

- Shenzhen International Holdings to hold its Annual General Meeting on 9th of May

- CEO Zhengyu Liu's total compensation includes salary of HK$412.0k

- Total compensation is similar to the industry average

- Shenzhen International Holdings' total shareholder return over the past three years was 14% while its EPS was down 9.3% over the past three years

Despite positive share price growth of 14% for Shenzhen International Holdings Limited (HKG:152) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 9th of May. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for Shenzhen International Holdings

Comparing Shenzhen International Holdings Limited's CEO Compensation With The Industry

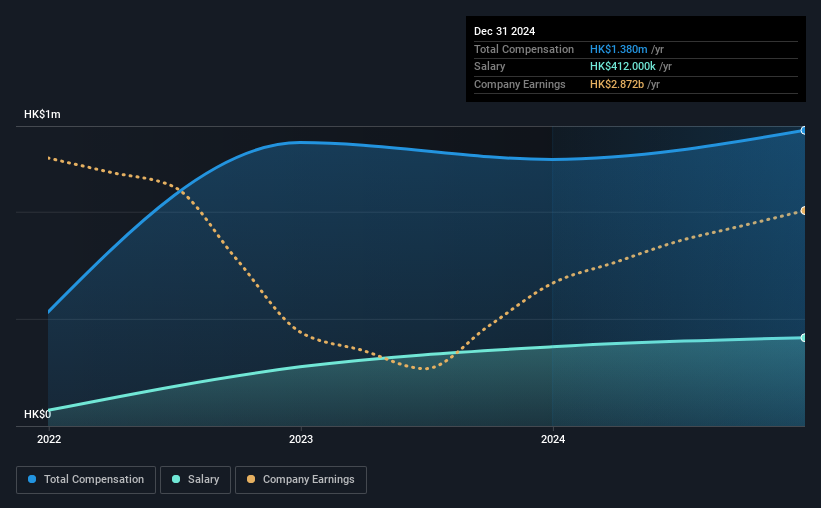

Our data indicates that Shenzhen International Holdings Limited has a market capitalization of HK$19b, and total annual CEO compensation was reported as HK$1.4m for the year to December 2024. Notably, that's an increase of 11% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at HK$412k.

For comparison, other companies in the Hong Kong Infrastructure industry with market capitalizations ranging between HK$16b and HK$50b had a median total CEO compensation of HK$1.2m. So it looks like Shenzhen International Holdings compensates Zhengyu Liu in line with the median for the industry. Moreover, Zhengyu Liu also holds HK$8.2m worth of Shenzhen International Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$412k | HK$370k | 30% |

| Other | HK$968k | HK$874k | 70% |

| Total Compensation | HK$1.4m | HK$1.2m | 100% |

On an industry level, roughly 60% of total compensation represents salary and 40% is other remuneration. In Shenzhen International Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Shenzhen International Holdings Limited's Growth Numbers

Shenzhen International Holdings Limited has reduced its earnings per share by 9.3% a year over the last three years. It saw its revenue drop 24% over the last year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Shenzhen International Holdings Limited Been A Good Investment?

Shenzhen International Holdings Limited has generated a total shareholder return of 14% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 2 warning signs for Shenzhen International Holdings (of which 1 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Shenzhen International Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:152

Shenzhen International Holdings

An investment holding company, invests in, constructs, and operates logistics infrastructure facilities primarily in the People’s Republic of China.

Undervalued with proven track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026