- Hong Kong

- /

- Infrastructure

- /

- SEHK:144

Should You Investigate China Merchants Port Holdings Company Limited (HKG:144) At HK$10.68?

China Merchants Port Holdings Company Limited (HKG:144), is not the largest company out there, but it saw a decent share price growth of 13% on the SEHK over the last few months. While good news for shareholders, the company has traded much higher in the past year. As a mid-cap stock with high coverage by analysts, you could assume any recent changes in the company’s outlook is already priced into the stock. However, what if the stock is still a bargain? Let’s examine China Merchants Port Holdings’s valuation and outlook in more detail to determine if there’s still a bargain opportunity.

Check out our latest analysis for China Merchants Port Holdings

Is China Merchants Port Holdings Still Cheap?

Good news, investors! China Merchants Port Holdings is still a bargain right now. Our valuation model shows that the intrinsic value for the stock is HK$14.09, but it is currently trading at HK$10.68 on the share market, meaning that there is still an opportunity to buy now. What’s more interesting is that, China Merchants Port Holdings’s share price is theoretically quite stable, which could mean two things: firstly, it may take the share price a while to move to its intrinsic value, and secondly, there may be less chances to buy low in the future once it reaches that value. This is because the stock is less volatile than the wider market given its low beta.

Can we expect growth from China Merchants Port Holdings?

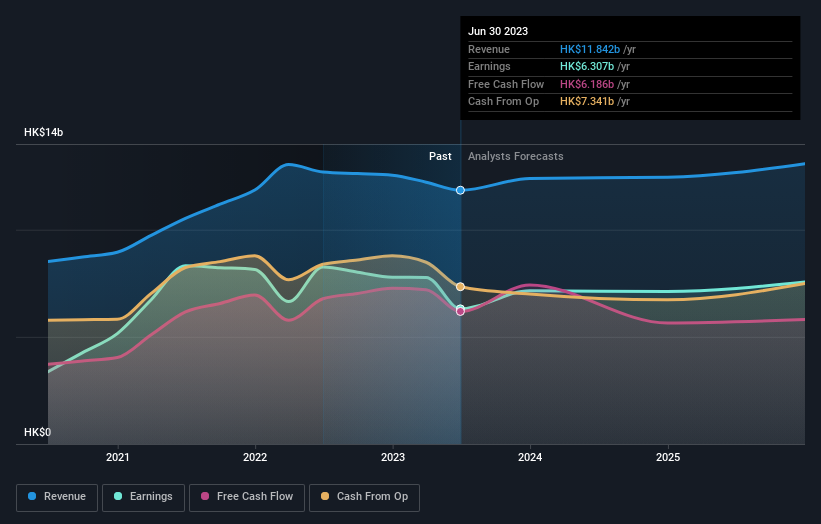

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. China Merchants Port Holdings' earnings growth are expected to be in the teens in the upcoming years, indicating a solid future ahead. This should lead to robust cash flows, feeding into a higher share value.

What This Means For You

Are you a shareholder? Since 144 is currently undervalued, it may be a great time to accumulate more of your holdings in the stock. With a positive outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as capital structure to consider, which could explain the current undervaluation.

Are you a potential investor? If you’ve been keeping an eye on 144 for a while, now might be the time to enter the stock. Its prosperous future outlook isn’t fully reflected in the current share price yet, which means it’s not too late to buy 144. But before you make any investment decisions, consider other factors such as the track record of its management team, in order to make a well-informed investment decision.

Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. At Simply Wall St, we found 2 warning signs for China Merchants Port Holdings and we think they deserve your attention.

If you are no longer interested in China Merchants Port Holdings, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:144

China Merchants Port Holdings

An investment holding company, operates as a port operator in Mainland China, Brazil, Hong Kong, Taiwan, and internationally.

Solid track record with adequate balance sheet.