As global markets navigate a mix of moderate gains and fluctuating consumer confidence, investors are increasingly seeking stability amid economic uncertainties. In such an environment, dividend stocks can offer potential income and resilience, making them attractive considerations for those looking to bolster their portfolios with reliable returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.31% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

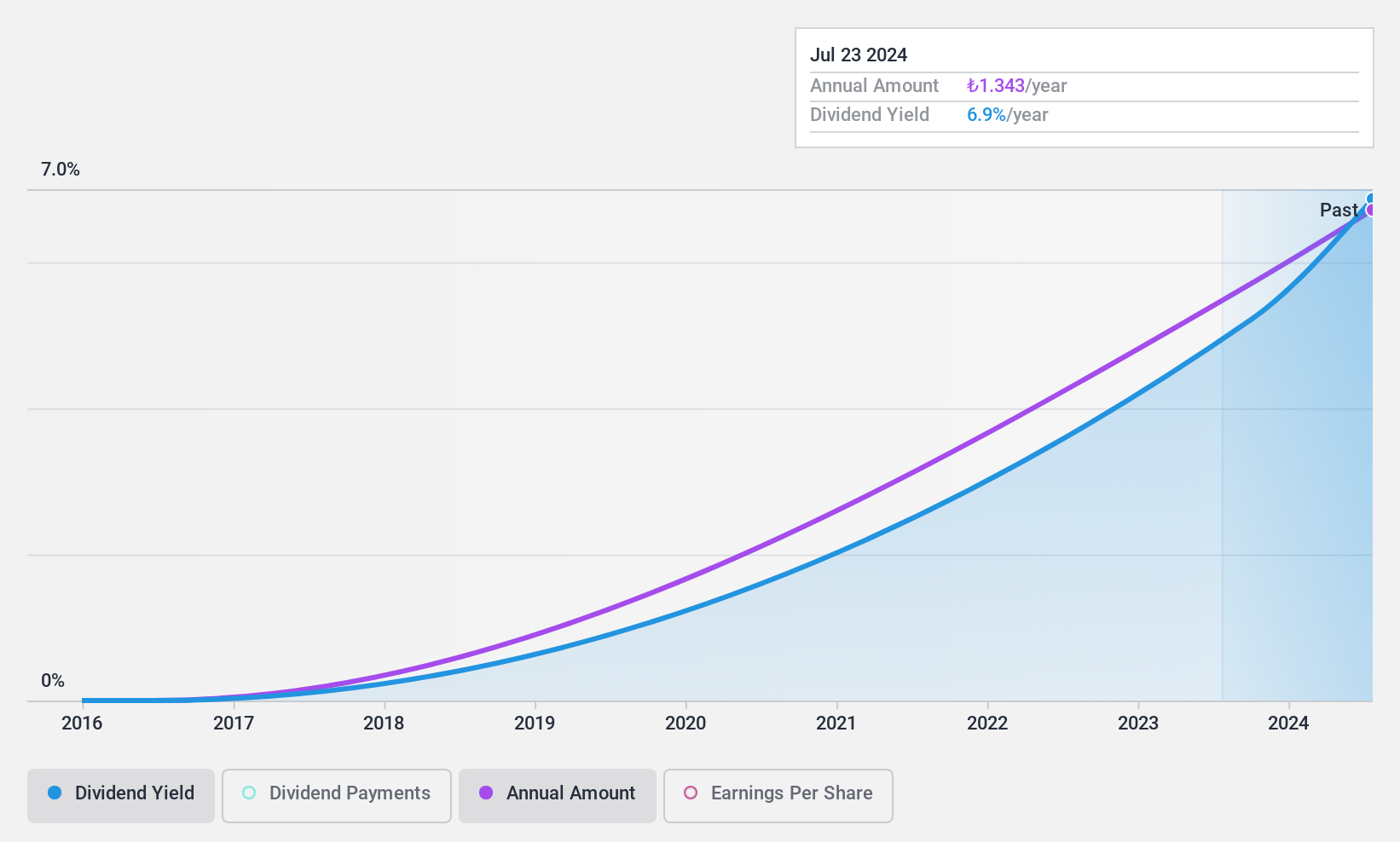

Park Elektrik Üretim Madencilik Sanayi ve Ticaret (IBSE:PRKME)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Park Elektrik Üretim Madencilik Sanayi ve Ticaret A.S., via its subsidiary Konya Ilgin Elektrik Üretim Sanayi ve Ticaret A.S., is engaged in the generation and sale of electricity in Turkey, with a market capitalization of TRY3.62 billion.

Operations: Park Elektrik Üretim Madencilik Sanayi ve Ticaret A.S. reports revenue of TRY438.20 million from its electricity generation and sales segment in Turkey.

Dividend Yield: 5.5%

Park Elektrik Üretim Madencilik Sanayi ve Ticaret's dividend yield of 5.52% ranks in the top 25% of Turkish market payers, yet its sustainability is questionable due to lack of free cash flow coverage. Despite a payout ratio of 77.8%, dividends have been volatile over the past decade and not reliably growing. Recent earnings show improvement with TRY 7.14 million net income for Q3, but sales have slightly decreased year-over-year, indicating potential challenges ahead.

- Take a closer look at Park Elektrik Üretim Madencilik Sanayi ve Ticaret's potential here in our dividend report.

- Our valuation report unveils the possibility Park Elektrik Üretim Madencilik Sanayi ve Ticaret's shares may be trading at a premium.

Xinyi Glass Holdings (SEHK:868)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinyi Glass Holdings Limited is an investment holding company that produces and sells glass products for automobile, construction, and industrial applications, with a market cap of approximately HK$34.77 billion.

Operations: Xinyi Glass Holdings Limited generates revenue from its key segments, including Float Glass at HK$20.30 billion, Automobile Glass at HK$6.25 billion, and Architectural Glass at HK$3.30 billion.

Dividend Yield: 8.5%

Xinyi Glass Holdings offers a high dividend yield of 8.52%, placing it among the top 25% in Hong Kong, but its sustainability is uncertain due to inadequate free cash flow coverage and a high cash payout ratio of 162%. Despite trading below estimated fair value and recent earnings growth of 49.8%, dividends have been volatile over the past decade with inconsistent growth, raising concerns about future reliability for dividend investors.

- Dive into the specifics of Xinyi Glass Holdings here with our thorough dividend report.

- Our expertly prepared valuation report Xinyi Glass Holdings implies its share price may be lower than expected.

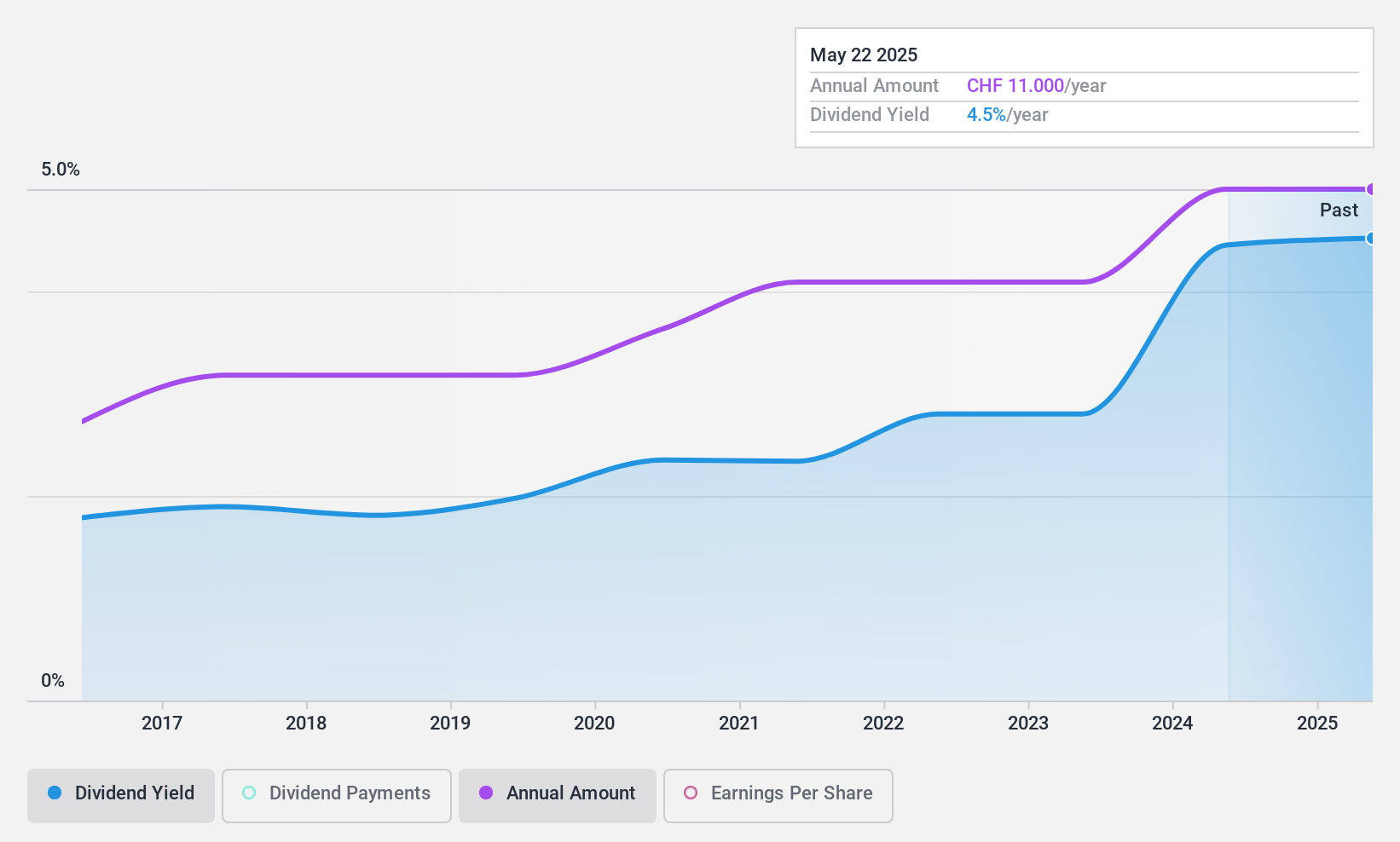

Groupe Minoteries (SWX:GMI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe Minoteries SA is involved in the processing and marketing of grain, plant, and food raw materials mainly in Switzerland, with a market cap of CHF91.08 million.

Operations: Groupe Minoteries SA generates its revenue from the Food Processing segment, which accounts for CHF147.61 million.

Dividend Yield: 4%

Groupe Minoteries offers a dividend yield of 3.99%, falling short of the top tier in the Swiss market. While dividends are well-covered by earnings and cash flows, with payout ratios of 58.1% and 30.3% respectively, their reliability is questionable due to volatility over the past decade, including annual drops over 20%. Despite trading significantly below its estimated fair value, its unstable dividend history may concern investors seeking consistent returns.

- Unlock comprehensive insights into our analysis of Groupe Minoteries stock in this dividend report.

- The valuation report we've compiled suggests that Groupe Minoteries' current price could be quite moderate.

Make It Happen

- Navigate through the entire inventory of 1949 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:868

Xinyi Glass Holdings

An investment holding company, produces and sells automobile, construction, float, and other glass products for commercial and industrial applications.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives