- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:137

Jinhui Holdings (HKG:137) adds HK$90m to market cap in the past 7 days, though investors from three years ago are still down 26%

Jinhui Holdings Company Limited (HKG:137) shareholders should be happy to see the share price up 29% in the last month. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 31% in the last three years, falling well short of the market return.

On a more encouraging note the company has added HK$90m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for Jinhui Holdings

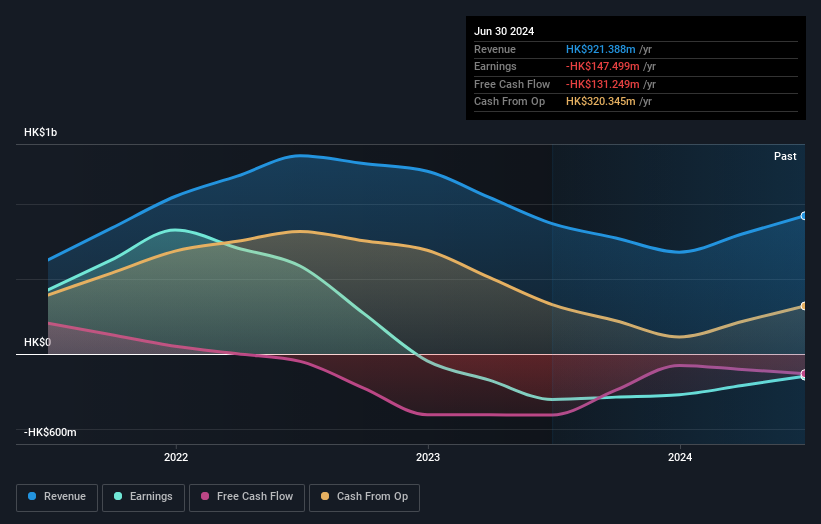

Because Jinhui Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Jinhui Holdings' revenue dropped 5.2% per year. That's not what investors generally want to see. The annual decline of 9% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Jinhui Holdings' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Jinhui Holdings' TSR, which was a 26% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

Jinhui Holdings shareholders gained a total return of 25% during the year. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 5% per year over five year. This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with Jinhui Holdings (including 2 which are potentially serious) .

But note: Jinhui Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:137

Jinhui Holdings

An investment holding company, engages in ship chartering and owning activities worldwide.

Adequate balance sheet low.

Market Insights

Community Narratives