- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:137

Do Jinhui Holdings' (HKG:137) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Jinhui Holdings (HKG:137). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Jinhui Holdings

How Fast Is Jinhui Holdings Growing Its Earnings Per Share?

Jinhui Holdings has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Jinhui Holdings' EPS skyrocketed from HK$0.81 to HK$1.11, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 37%.

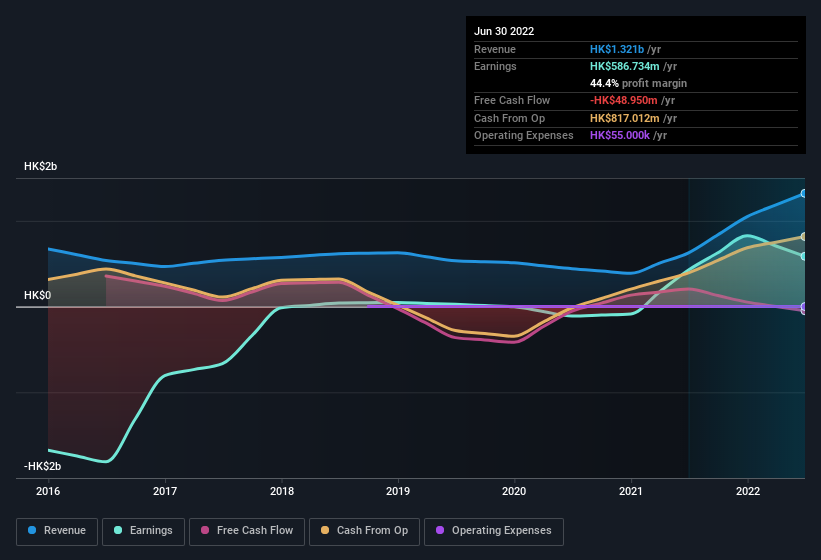

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Jinhui Holdings' revenue last year was revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that Jinhui Holdings is growing revenues, and EBIT margins improved by 13.0 percentage points to 42%, over the last year. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Jinhui Holdings is no giant, with a market capitalisation of HK$536m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Jinhui Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

With strong conviction, Jinhui Holdings insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Executive Chairman, Siu Fai Ng, paid HK$565k to buy shares at an average price of HK$1.21. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Jinhui Holdings insiders own more than a third of the company. Indeed, with a collective holding of 75%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. In terms of absolute value, insiders have HK$401m invested in the business, at the current share price. That's nothing to sneeze at!

Is Jinhui Holdings Worth Keeping An Eye On?

For growth investors, Jinhui Holdings' raw rate of earnings growth is a beacon in the night. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. These things considered, this is one stock worth watching. You should always think about risks though. Case in point, we've spotted 4 warning signs for Jinhui Holdings you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Jinhui Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:137

Jinhui Holdings

An investment holding company, engages in ship chartering and owning activities worldwide.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives