Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after investigating China Mobile (HKG:941), we don't think it's current trends fit the mold of a multi-bagger.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for China Mobile:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.098 = CN¥116b ÷ (CN¥1.7t - CN¥541b) (Based on the trailing twelve months to September 2020).

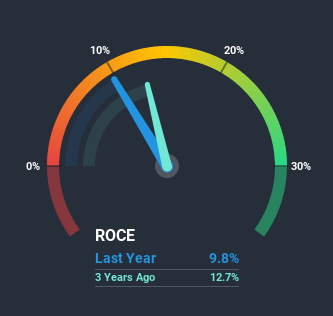

So, China Mobile has an ROCE of 9.8%. In absolute terms, that's a low return but it's around the Wireless Telecom industry average of 8.2%.

View our latest analysis for China Mobile

Above you can see how the current ROCE for China Mobile compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for China Mobile.

So How Is China Mobile's ROCE Trending?

On the surface, the trend of ROCE at China Mobile doesn't inspire confidence. Over the last five years, returns on capital have decreased to 9.8% from 16% five years ago. However it looks like China Mobile might be reinvesting for long term growth because while capital employed has increased, the company's sales haven't changed much in the last 12 months. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

The Bottom Line On China Mobile's ROCE

In summary, China Mobile is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. And investors appear hesitant that the trends will pick up because the stock has fallen 29% in the last five years. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

China Mobile does have some risks though, and we've spotted 1 warning sign for China Mobile that you might be interested in.

While China Mobile isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

When trading China Mobile or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:941

China Mobile

Provides telecommunications and information related services in Mainland China and Hong Kong.

Very undervalued with excellent balance sheet and pays a dividend.