In the current global market landscape, small-cap stocks have experienced a mixed performance, with the Russell 2000 index showing a decline amidst broader market volatility influenced by political changes and economic indicators. As investors navigate these uncertain times, identifying undervalued small-cap companies with insider buying can signal potential opportunities for growth, as such actions often reflect confidence from those closest to the company in its future prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Sagicor Financial | 1.2x | 0.3x | 35.19% | ★★★★★★ |

| Paradeep Phosphates | 23.6x | 0.8x | 29.71% | ★★★★★☆ |

| PSC | 7.5x | 0.4x | 43.98% | ★★★★☆☆ |

| Avia Avian | 16.6x | 3.8x | 9.50% | ★★★★☆☆ |

| Trican Well Service | 8.3x | 1.0x | 14.87% | ★★★★☆☆ |

| Rogers Sugar | 15.6x | 0.6x | 47.45% | ★★★★☆☆ |

| NCL Industries | 14.8x | 0.5x | -81.34% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 20.8x | 0.7x | 29.48% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 13.7x | 1.6x | -36.57% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

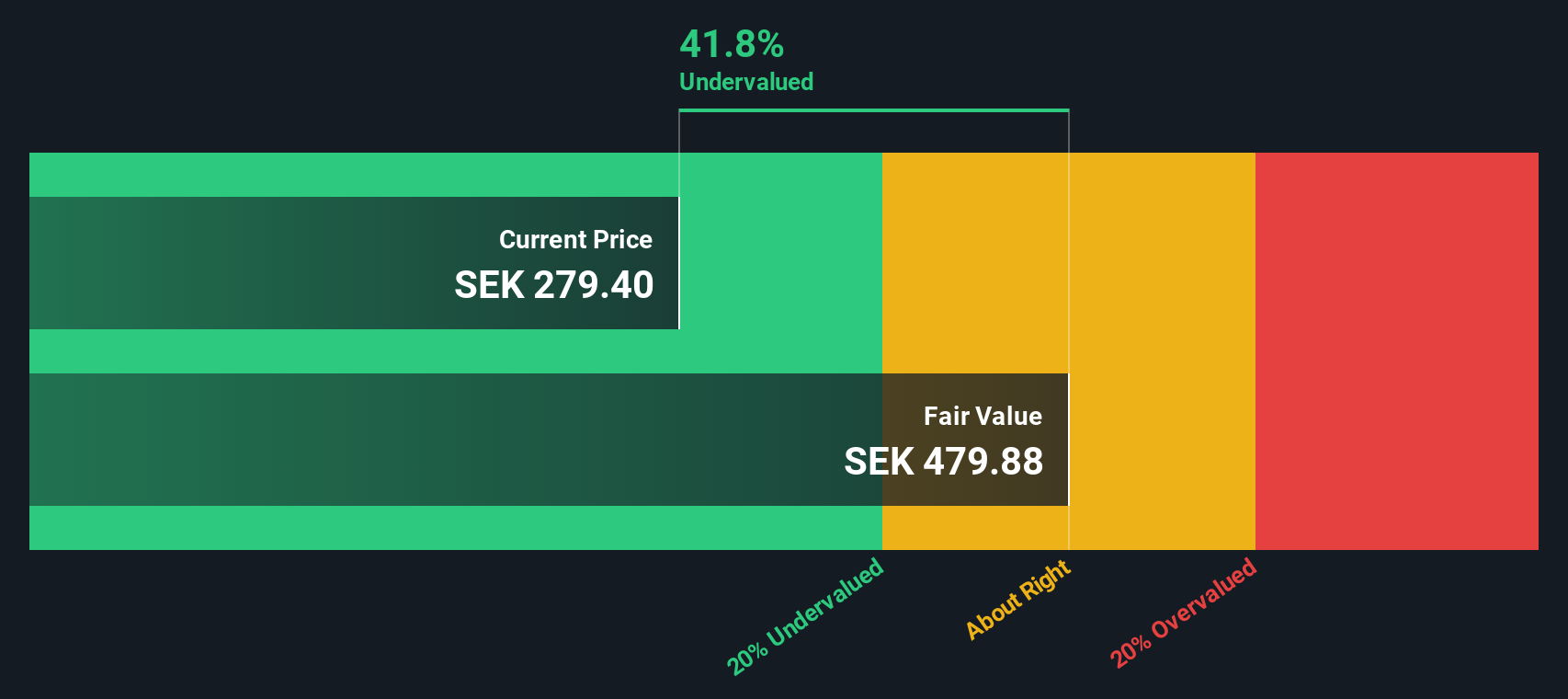

Xvivo Perfusion (OM:XVIVO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Xvivo Perfusion specializes in developing and providing advanced medical technologies for organ transplantation, with a market cap of approximately SEK 6.48 billion.

Operations: Xvivo Perfusion generates revenue primarily from its Thoracic, Abdominal, and Services segments. The company has experienced fluctuations in its net income margin, with a notable increase to 27.21% by September 2024. Operating expenses have consistently been a significant component of the cost structure, driven by sales and marketing as well as research and development activities.

PE: 68.9x

Xvivo Perfusion, a player in the medical technology sector, showcases promising growth with earnings projected to rise by 24.61% annually. Recent financials highlight significant improvement; third-quarter sales reached SEK 198 million, up from SEK 147 million last year, and net income soared to SEK 86 million from just SEK 2 million. Despite relying entirely on external borrowing for funding, insider confidence is evident through recent purchases. The appointment of Lena Hagman as deputy CEO adds strategic depth to its leadership team.

- Dive into the specifics of Xvivo Perfusion here with our thorough valuation report.

Review our historical performance report to gain insights into Xvivo Perfusion's's past performance.

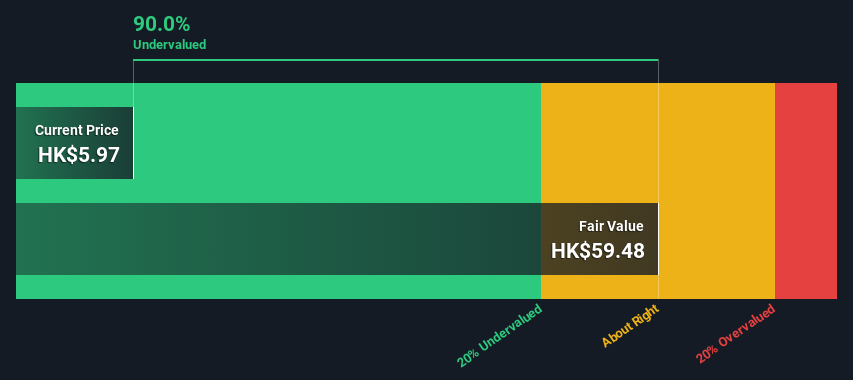

Cutia Therapeutics (SEHK:2487)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cutia Therapeutics is a company focused on developing innovative and comprehensive solutions, with operations contributing to a market capitalization of CN¥3.45 billion.

Operations: The company generates revenue primarily from developing innovative and comprehensive solutions, with recent figures reaching CN¥198.86 million. Over the observed periods, the gross profit margin has shown a declining trend from 78.99% to 50.33%. Operating expenses are significant, with research and development costs consistently high, alongside substantial sales and marketing expenditures. The net income margin reflects ongoing challenges in achieving profitability despite revenue growth.

PE: -4.5x

Cutia Therapeutics, a small player in the biotech sector, recently received marketing approval for its innovative CU-10201 topical minocycline foam in China, marking a significant milestone. The company reported impressive revenue growth of 129.9% for the first nine months of 2024 compared to the previous year. Despite being currently unprofitable and relying on external borrowing, insider confidence is evident as Yuqing Huang purchased 35,000 shares worth approximately RMB 421,697 between September and November 2024.

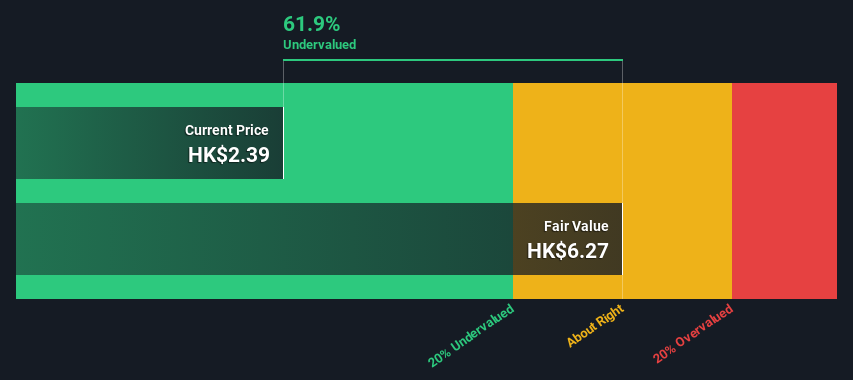

Shougang Fushan Resources Group (SEHK:639)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Shougang Fushan Resources Group is engaged in coking coal mining operations with a focus on producing and selling coking coal, boasting a market capitalization of HK$12.34 billion.

Operations: The primary revenue stream is from coking coal mining, with recent revenue reported at HK$4.95 billion. The gross profit margin has shown fluctuations, most recently recorded at 53.36%. Operating expenses include significant allocations to general and administrative as well as sales and marketing expenses.

PE: 9.2x

Shougang Fushan Resources Group, a smaller company in the resource sector, recently completed a follow-on equity offering of HK$427 million. Despite declining sales and net income for the first half of 2024 compared to last year, with sales at HK$2.5 billion and net income at HK$837 million, insider confidence is evident as they continue purchasing shares. The appointment of Mr. Li Zeping as an independent director could enhance governance amid challenging earnings forecasts over the next few years.

- Click to explore a detailed breakdown of our findings in Shougang Fushan Resources Group's valuation report.

Learn about Shougang Fushan Resources Group's historical performance.

Where To Now?

- Unlock our comprehensive list of 171 Undervalued Small Caps With Insider Buying by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2487

Cutia Therapeutics

An investment holding company, engages in the research, development, manufacture, and commercialization of scalp diseases and care products, and skin care products in the People’s Republic of China and Hong Kong.

High growth potential and good value.

Market Insights

Community Narratives