- Hong Kong

- /

- Hospitality

- /

- SEHK:3918

3 Stocks That May Be Undervalued By Up To 43.6% Based On Intrinsic Estimates

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are closely watching sectors like financials and energy, which have shown resilience amid hopes for deregulation. Amidst this backdrop of fluctuating indices and economic signals, identifying undervalued stocks can offer opportunities for those seeking to align their investments with intrinsic value estimates.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Giant Biogene Holding (SEHK:2367) | HK$49.10 | HK$97.67 | 49.7% |

| Wistron (TWSE:3231) | NT$114.00 | NT$227.48 | 49.9% |

| Business First Bancshares (NasdaqGS:BFST) | US$27.67 | US$55.07 | 49.8% |

| A.L.A. società per azioni (BIT:ALA) | €24.80 | €49.51 | 49.9% |

| Telix Pharmaceuticals (ASX:TLX) | A$22.20 | A$44.23 | 49.8% |

| EnomotoLtd (TSE:6928) | ¥1481.00 | ¥2941.30 | 49.6% |

| Enento Group Oyj (HLSE:ENENTO) | €18.06 | €36.11 | 50% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.96 | THB9.87 | 49.7% |

| Saipem (BIT:SPM) | €2.327 | €4.65 | 50% |

| Nokian Renkaat Oyj (HLSE:TYRES) | €7.39 | €14.68 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

Kingsoft (SEHK:3888)

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally, with a market cap of HK$42.39 billion.

Operations: The company's revenue is primarily derived from two segments: Online Games and Others, which generated CN¥4.93 billion, and Office Software and Services, contributing CN¥4.91 billion.

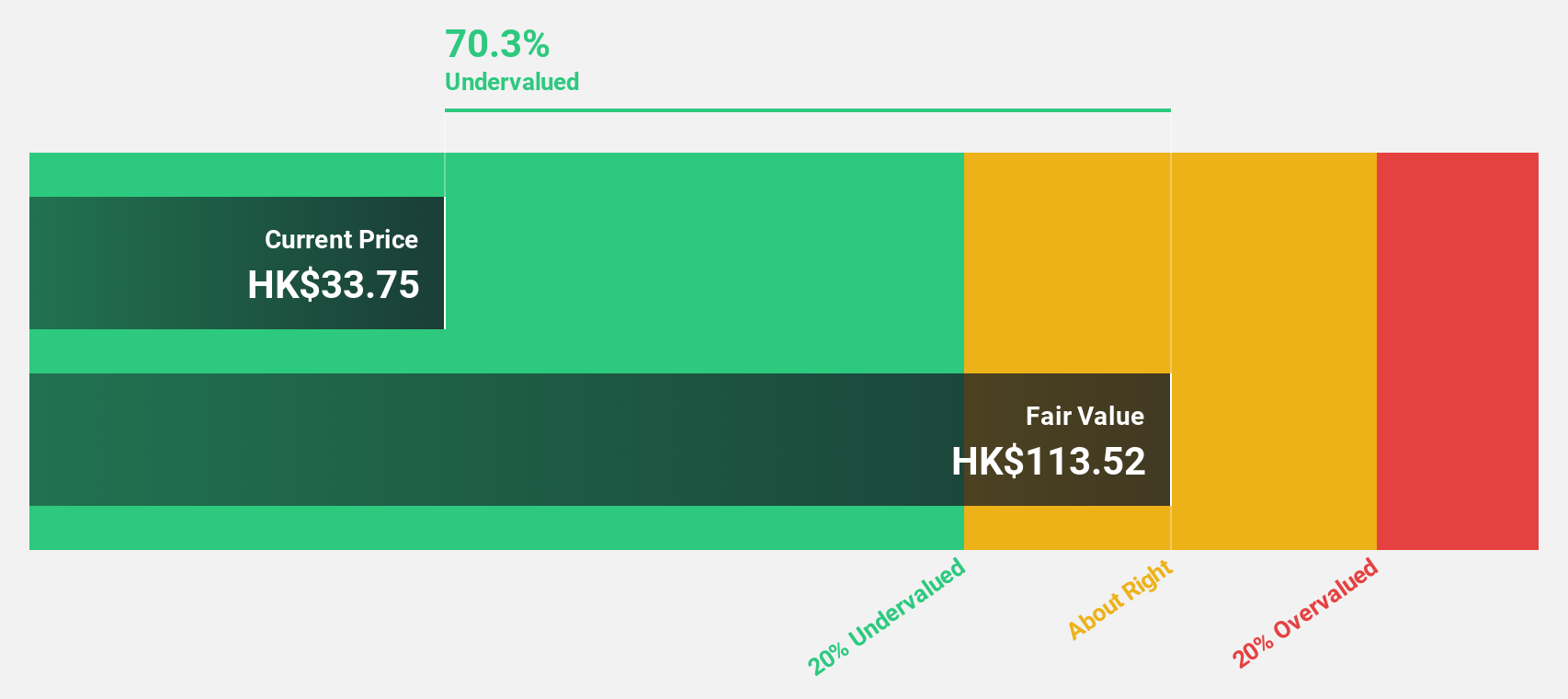

Estimated Discount To Fair Value: 43.6%

Kingsoft's recent earnings report shows a significant increase in net income, reaching CNY 413.45 million for Q3 2024, compared to CNY 28.49 million the previous year. The stock is trading at HK$32.5, notably below its estimated fair value of HK$57.59, suggesting it may be undervalued based on cash flows. Earnings are expected to grow significantly over the next three years, outpacing both revenue growth and the Hong Kong market average.

- Our expertly prepared growth report on Kingsoft implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Kingsoft here with our thorough financial health report.

NagaCorp (SEHK:3918)

Overview: NagaCorp Ltd. is an investment holding company that manages and operates a hotel and casino complex in the Kingdom of Cambodia, with a market cap of HK$13.53 billion.

Operations: The company's revenue segments consist of $545.61 million from casino operations and $23.22 million from hotel and entertainment operations.

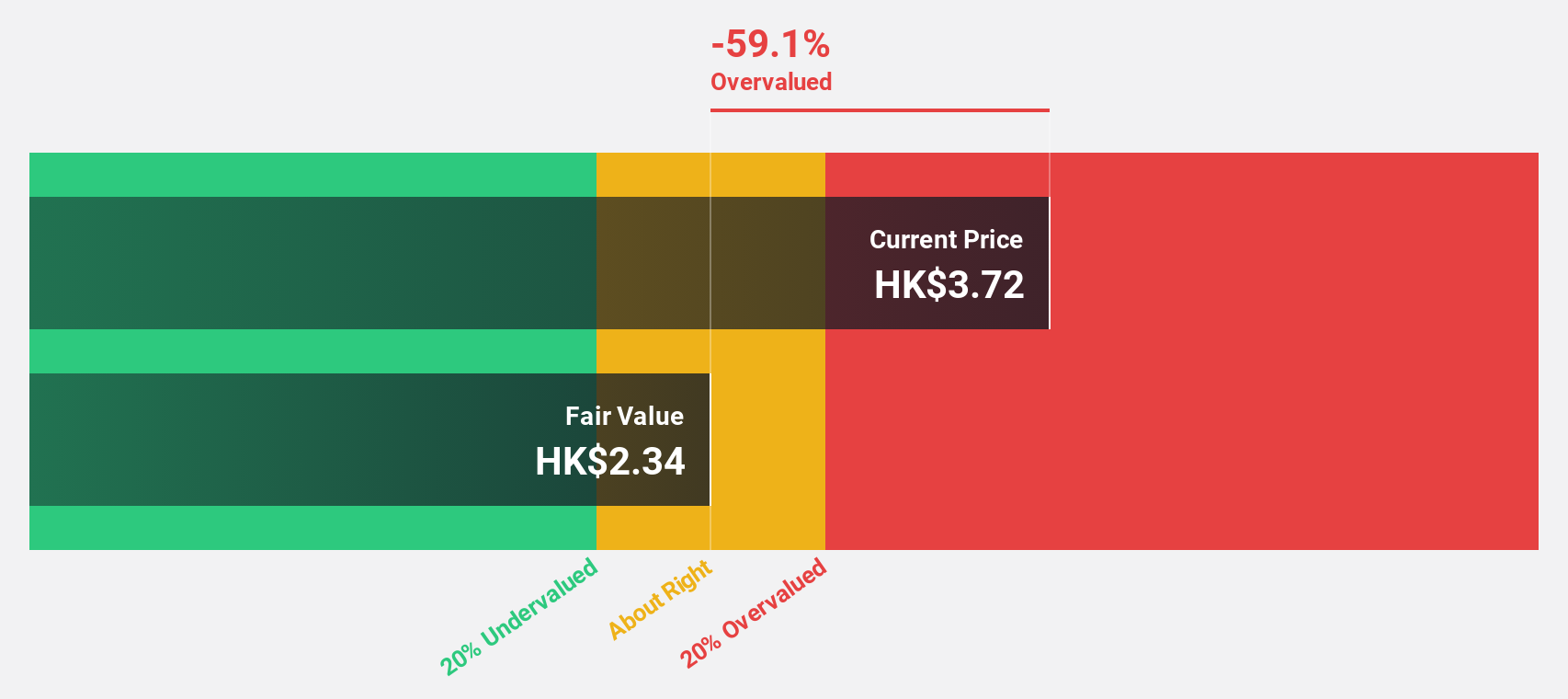

Estimated Discount To Fair Value: 15.5%

NagaCorp's recent earnings report revealed a net loss of US$0.963 million for the first half of 2024, contrasting with a net income of US$82.97 million the previous year. Despite this setback, the stock is trading at HK$3.07, below its estimated fair value of HK$3.63, indicating potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 42.4% annually over the next three years, surpassing Hong Kong market growth expectations.

- Our earnings growth report unveils the potential for significant increases in NagaCorp's future results.

- Delve into the full analysis health report here for a deeper understanding of NagaCorp.

United Company RUSAL International (SEHK:486)

Overview: United Company RUSAL International is involved in the production and trading of aluminium and related products in Russia, with a market cap of approximately HK$49.93 billion.

Operations: The company's revenue is primarily derived from aluminium, generating $10.48 billion, and alumina, contributing $4.49 billion.

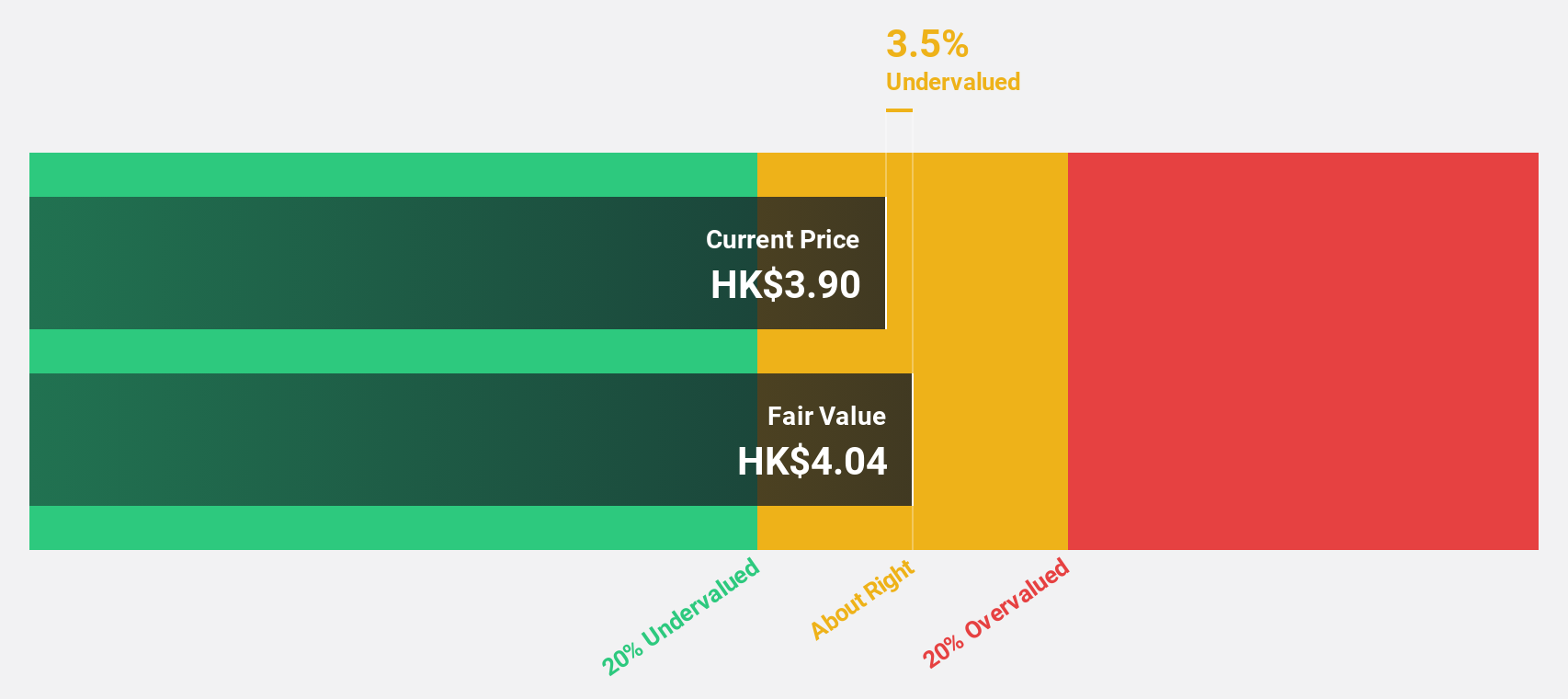

Estimated Discount To Fair Value: 32.3%

United Company RUSAL's recent announcement of a potential HK$15 billion share buyback could enhance shareholder value, especially as the stock trades at HK$3.22, below its estimated fair value of HK$4.75. Despite large one-off items affecting earnings quality and operating cash flow not fully covering debt, the company is significantly undervalued based on discounted cash flow analysis. Earnings are projected to grow substantially at 100.1% annually, outpacing market expectations in Hong Kong.

- Upon reviewing our latest growth report, United Company RUSAL International's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in United Company RUSAL International's balance sheet health report.

Summing It All Up

- Gain an insight into the universe of 918 Undervalued Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NagaCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3918

NagaCorp

An investment holding company, engages in the management and operation of hotel and casino complex in the Kingdom of Cambodia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives