- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1277

Discovering Undiscovered Gems with Strong Potential This November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing a notable impact on key indices like the S&P 600 for small-cap stocks. This backdrop of fluctuating market sentiment and economic indicators presents a unique opportunity to explore undiscovered gems with strong potential, characterized by robust fundamentals and resilience amid shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.46% | 20.33% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Gallant Precision Machining | 29.51% | -2.07% | 4.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Song Hong Garment | 62.50% | 3.80% | -5.84% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Akums Drugs and Pharmaceuticals (NSEI:AKUMS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Akums Drugs and Pharmaceuticals Limited is engaged in the manufacturing and sale of pharmaceutical products and active pharmaceutical ingredients both in India and internationally, with a market capitalization of ₹91.39 billion.

Operations: Akums generates revenue primarily from its CDMO segment, which contributes ₹34.42 billion, followed by branded and generic formulations at ₹6.65 billion, and APIs at ₹3.12 billion.

Akums Drugs and Pharmaceuticals, a nimble player in the pharmaceutical industry, has recently turned profitable with high-quality earnings. Its interest payments are comfortably covered by EBIT at 8.4 times, indicating robust financial health. The company holds more cash than its total debt, enhancing its financial stability. Akums is trading at 20.9% below its estimated fair value, suggesting potential undervaluation in the market. Recent strategic moves include a partnership with Triple Hair Group for an innovative hair care product in India and launching new antacid products domestically, signaling growth ambitions and market expansion efforts.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited is an investment holding company involved in the extraction and sale of coal products in the People's Republic of China, with a market capitalization of HK$12.22 billion.

Operations: Kinetic Development Group generates revenue primarily from the extraction and sale of coal products in China. The company's financial performance is highlighted by a notable trend in its net profit margin, which has shown variability over recent periods.

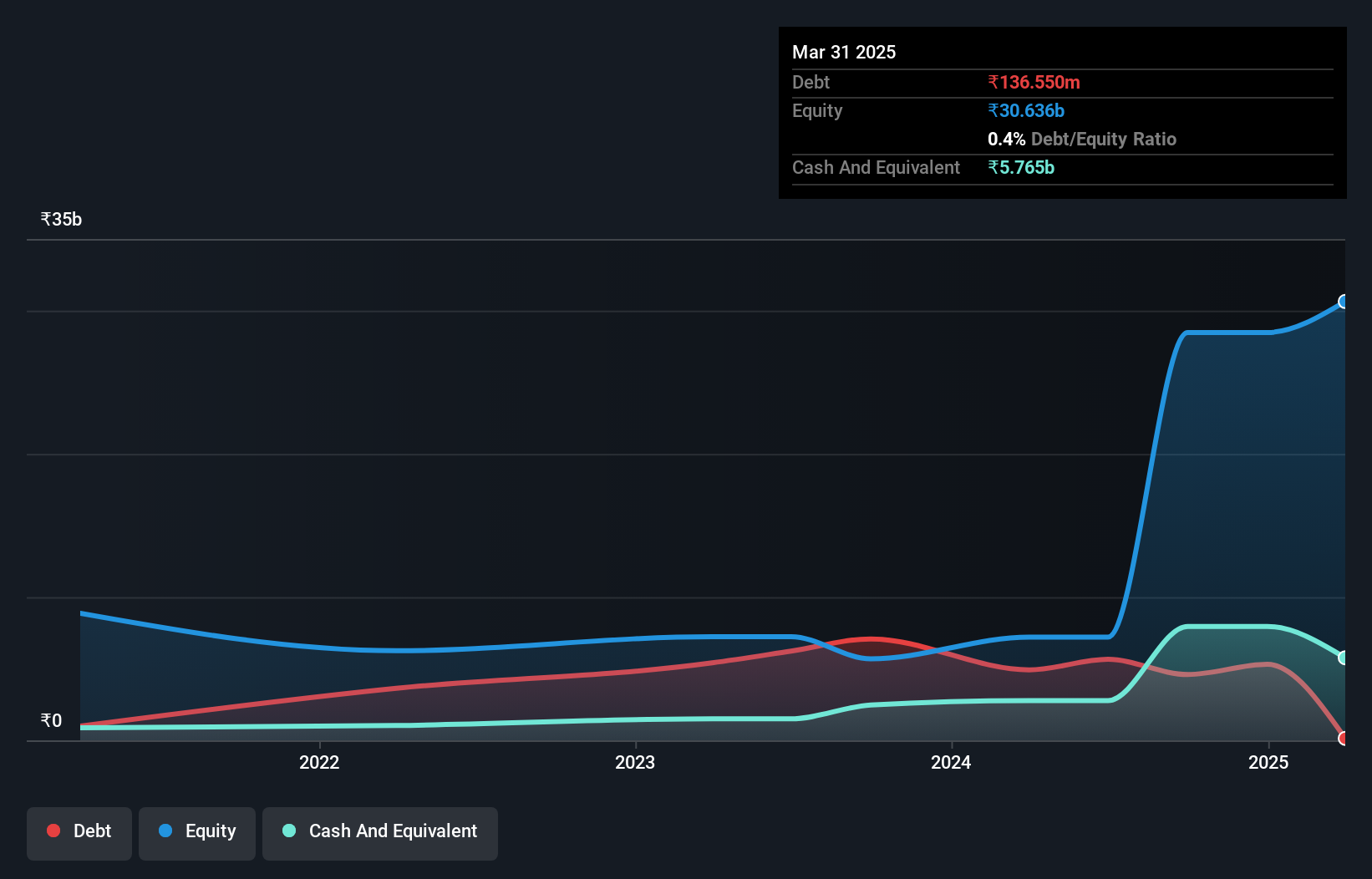

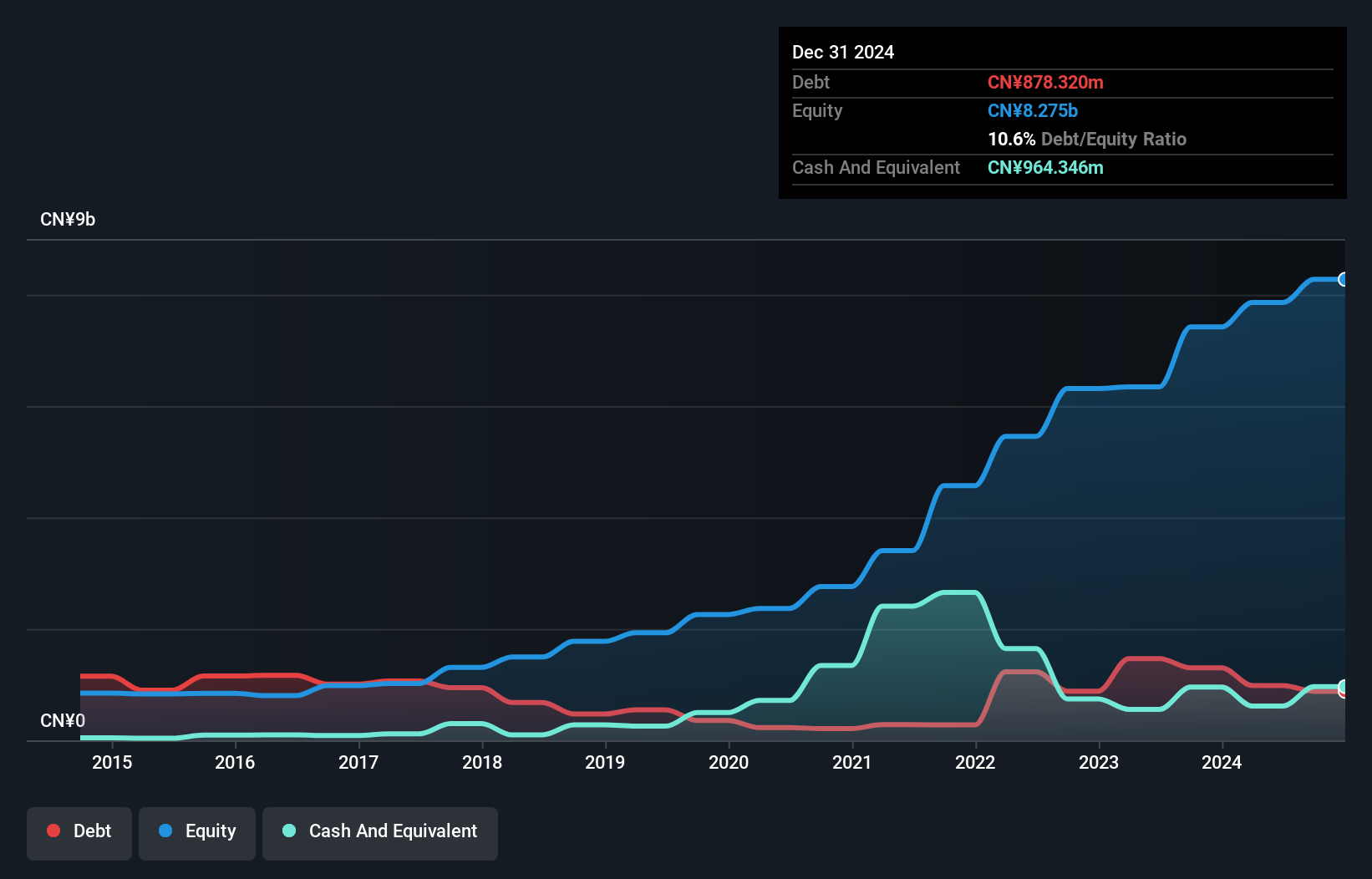

Kinetic Development Group, a nimble player in the oil and gas sector, has demonstrated impressive earnings growth of 39% over the past year, outpacing the industry average of -2.7%. The company is trading at 61% below its estimated fair value, suggesting potential undervaluation. With high-quality earnings and a robust EBIT covering interest payments 163 times over, Kinetic shows financial resilience. Over five years, it has improved its debt profile significantly with a reduction in debt to equity from 28.4% to 12.5%, while maintaining a satisfactory net debt to equity ratio of 4.7%.

TURVO International (TWSE:2233)

Simply Wall St Value Rating: ★★★★★☆

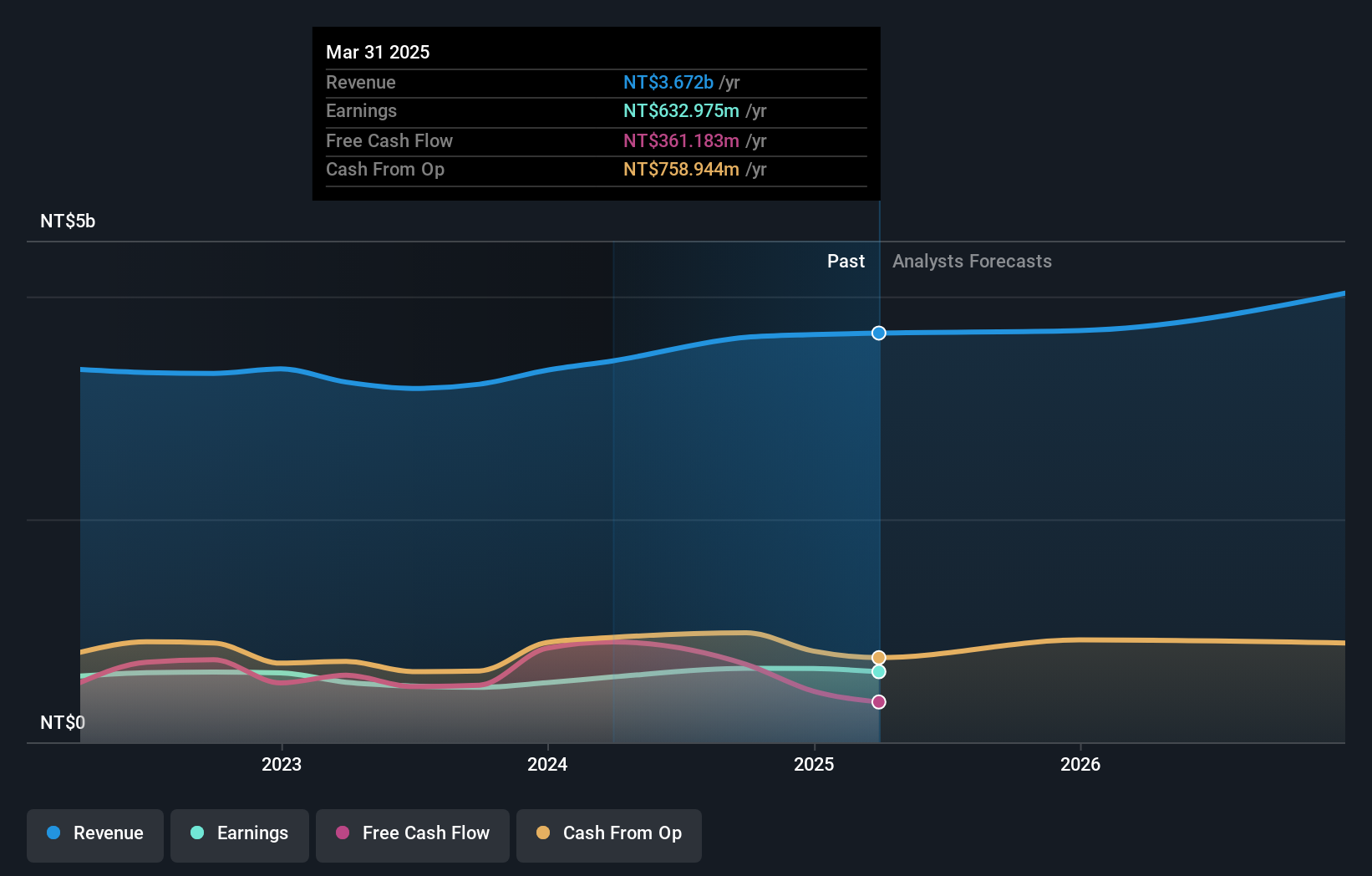

Overview: TURVO International Co., Ltd. specializes in the development, production, and sale of precision metal parts and components, with a market cap of NT$9.83 billion.

Operations: TURVO International generates revenue primarily from its precision metal parts and components. The company has a market capitalization of NT$9.83 billion.

TURVO International, a smaller player in its field, has shown robust performance recently. The company reported third-quarter sales of TWD 964 million, up from TWD 897.52 million last year, with net income rising to TWD 187.36 million from the previous year's TWD 155.37 million. Their earnings per share also improved to TWD 3.11 from TWD 2.58 a year ago, indicating strong operational efficiency and profitability growth of about 35% over the past year—outpacing industry averages significantly at just above double the rate—and trading at an attractive valuation below fair value estimates by approximately 23%.

Turning Ideas Into Actions

- Access the full spectrum of 4638 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinetic Development Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1277

Kinetic Development Group

An investment holding company, engages in the extraction and sale of coal products in the People’s Republic of China.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives