- Hong Kong

- /

- Wireless Telecom

- /

- SEHK:941

China Mobile (SEHK:941) Margin Improvement Reinforces Value Narrative Despite Growth Concerns

Reviewed by Simply Wall St

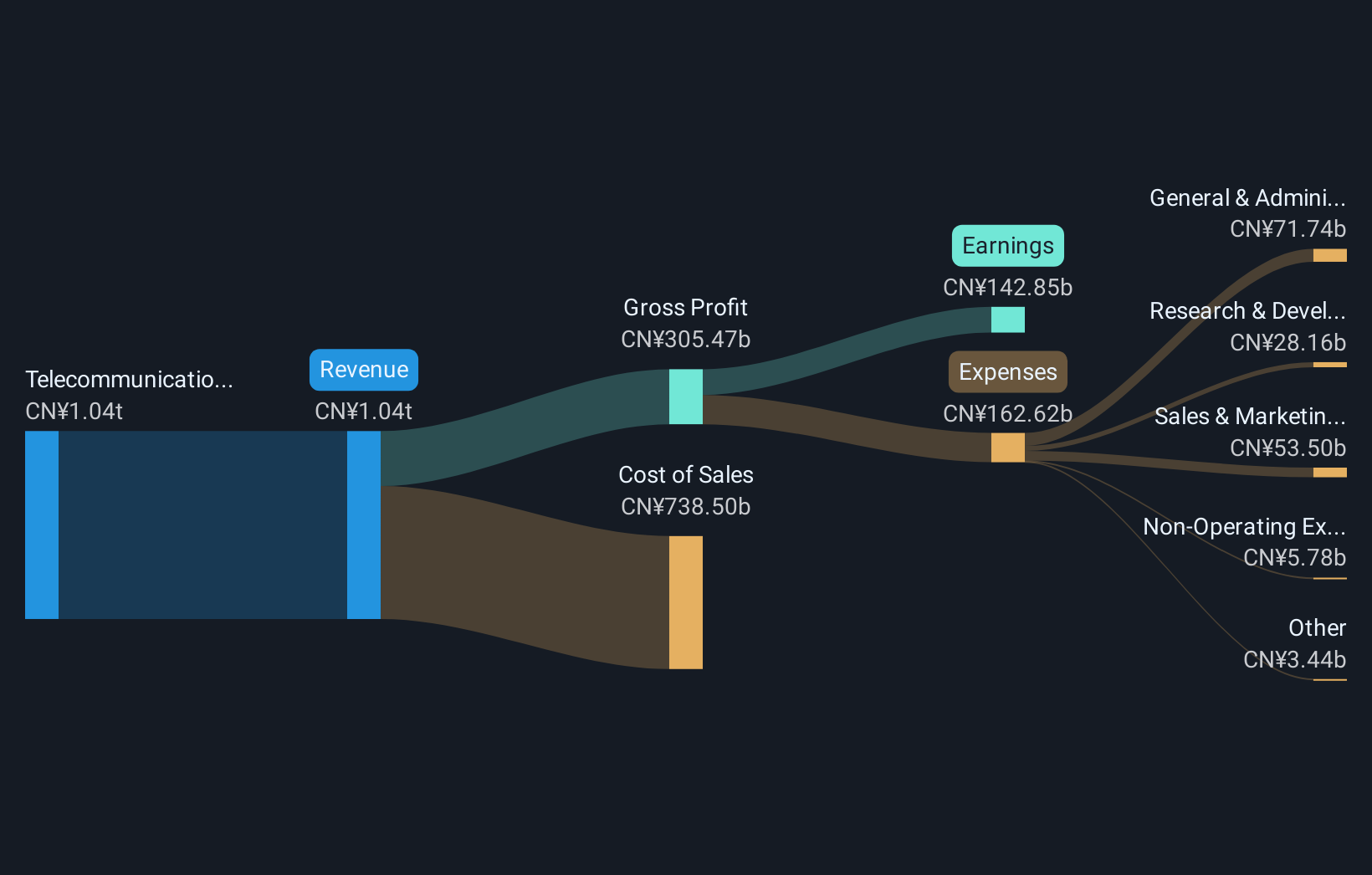

China Mobile (SEHK:941) posted a net profit margin of 13.7% in its latest results, slightly up from 13.4% last year, with earnings growing by 4.2% this year versus a 6% annual average over the past five years. The stock is currently trading at HK$85.2, putting its price-to-earnings multiple at 11.8x, well below both the Asian Wireless Telecom industry average of 19.5x and the peer group average of 16.5x. It is also below a fair value estimate of HK$243.83. Investors may see value in the improved margins and ongoing earnings growth, but the slower pace of profit and revenue increases compared to the wider Hong Kong market, as well as a flag on dividend sustainability, suggest a more value-focused opportunity rather than a high-growth story right now.

See our full analysis for China Mobile.This is where things get interesting. Next up, we will see how these results measure against the most widely held market narratives and where some expectations might be put to the test.

See what the community is saying about China Mobile

Margin Gains Backed by Digital Expansion

- China Mobile's net profit margin increased from 13.4% last year to 13.7% currently, while analysts expect profit margins to reach 14.1% within three years.

- Analysts' consensus view suggests these margin gains are mainly driven by China Mobile's rapid buildout of digital transformation and AI-powered services, as well as growth in high-margin cloud and ecosystem offerings.

- Nearly 10% year-on-year growth in digital transformation revenue together with over 20% annual cloud revenue growth point to a structural shift toward higher-margin recurring income.

- Ongoing emphasis on operational efficiency and a declining CapEx-to-revenue ratio appear to be enabling stronger free cash flow and potential for further margin improvement.

Dividend Commitment Faces Free Cash Flow Test

- Management aims to maintain a dividend payout ratio above 75% over the next three years, supported by robust free cash flow and a stable balance sheet, but also flags risk to dividend sustainability.

- Analysts' consensus view notes investors are closely watching whether consistent profit growth and ongoing capital discipline will be enough to support higher payouts without compromising reinvestment.

- Bears highlight that intensifying competition, high transformation costs, and macroeconomic challenges could compress net margins and limit cash available for dividends or transformation efforts.

- So far, the improved margin and high-quality historical earnings are helping boost confidence in management's payout ambitions, but any slip in free cash flow could test this commitment quickly.

Valuation Discount Despite Slower Growth

- At a share price of HK$85.2 and a price-to-earnings ratio of 11.8x, China Mobile trades well below the Asian Wireless Telecom industry average of 19.5x and the peer group at 16.5x. It also trades at a deep discount to its DCF fair value of HK$243.83.

- Analysts' consensus view frames this discount as both a reward and a reflection of more moderate growth forecasts, with expected earnings and revenue growth rates (4.13% and 3% per year respectively) lagging the broader Hong Kong market.

- The gap between current price and analyst price target (HK$102.07) hints at upside if the company can deliver on efficiency gains and sustain new digital revenue streams.

- However, a fair value estimate much higher than the market price signals investors may still be holding back due to growth and payout risks weighing on sentiment.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for China Mobile on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Share your perspective and craft your own narrative in just a few minutes: Do it your way.

A great starting point for your China Mobile research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

China Mobile’s solid margins and value appeal are tempered by slower growth, as well as ongoing concerns about dividend sustainability and reinvestment capacity.

If you want steadier earnings and less reliance on uncertain cash flows, use our stable growth stocks screener (2090 results) to spot companies delivering consistent results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:941

China Mobile

Provides telecommunications and information related services in Mainland China and Hong Kong.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives