- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:762

Is China Unicom Ready for a Rebound After Its 22% Rally in 2025?

Reviewed by Bailey Pemberton

If you are wondering what to do with China Unicom (Hong Kong) stock right now, you are not alone. The company has delivered some eye-catching returns over the past few years, and it is on the minds of investors looking for value and stability in a dynamic market.

The numbers speak for themselves. While the share price is flat over the past week and down 6.5% over the last month, it is up an impressive 22.3% year-to-date and 21.1% over the last year. Zoom out a bit further and China Unicom (Hong Kong) has soared 195.7% over three years and 129.0% over five years. Clearly, long-term shareholders have been rewarded, a run fueled by shifting market sentiment around the Chinese telecom sector and broader optimism about digital infrastructure demand. Even as short-term price moves reflect periodic risk-off sentiment and regional market developments, the big picture remains supportive for disciplined investors.

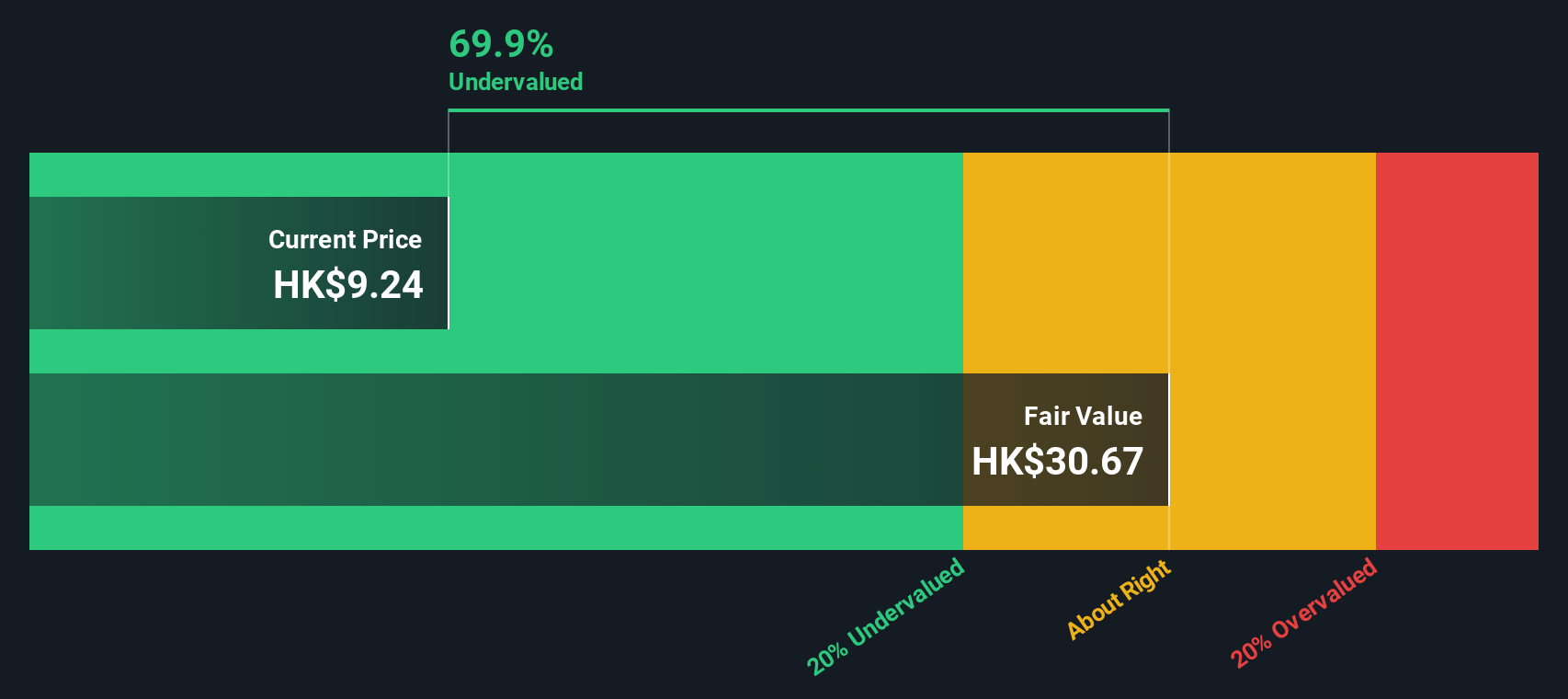

What makes China Unicom (Hong Kong) especially interesting right now is its stellar valuation. By running the company through six traditional valuation checks, it comes out undervalued in all six, earning a perfect value score of 6. That kind of clean sweep is rare, and it sets up a compelling case for value-focused buyers.

But, as many seasoned investors know, traditional valuation metrics are just one part of the story. Next, let’s dig into the specifics of these approaches, and then explore an even more insightful way to decide whether the stock is truly a buy at today’s price.

Approach 1: China Unicom (Hong Kong) Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates how much a company is worth by projecting its future cash flows, then discounting them back to their present value. This approach gives investors an intrinsic value that reflects potential future earnings.

For China Unicom (Hong Kong), the DCF analysis uses a two-stage Free Cash Flow to Equity model. The company’s latest twelve months free cash flow stands at approximately CN¥11.2 Billion. According to analyst and model projections, free cash flow is expected to see robust growth, reaching around CN¥37.3 Billion by 2028 and continuing to grow over the next decade, albeit at a gradually moderating pace.

Using this DCF approach, the model calculates an intrinsic value per share of HK$23.46. Today’s share price sits well below that figure, implying the stock trades at a 62.4% discount to its estimated fair value. This substantial margin suggests the market is heavily undervaluing the company’s future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests China Unicom (Hong Kong) is undervalued by 62.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: China Unicom (Hong Kong) Price vs Earnings

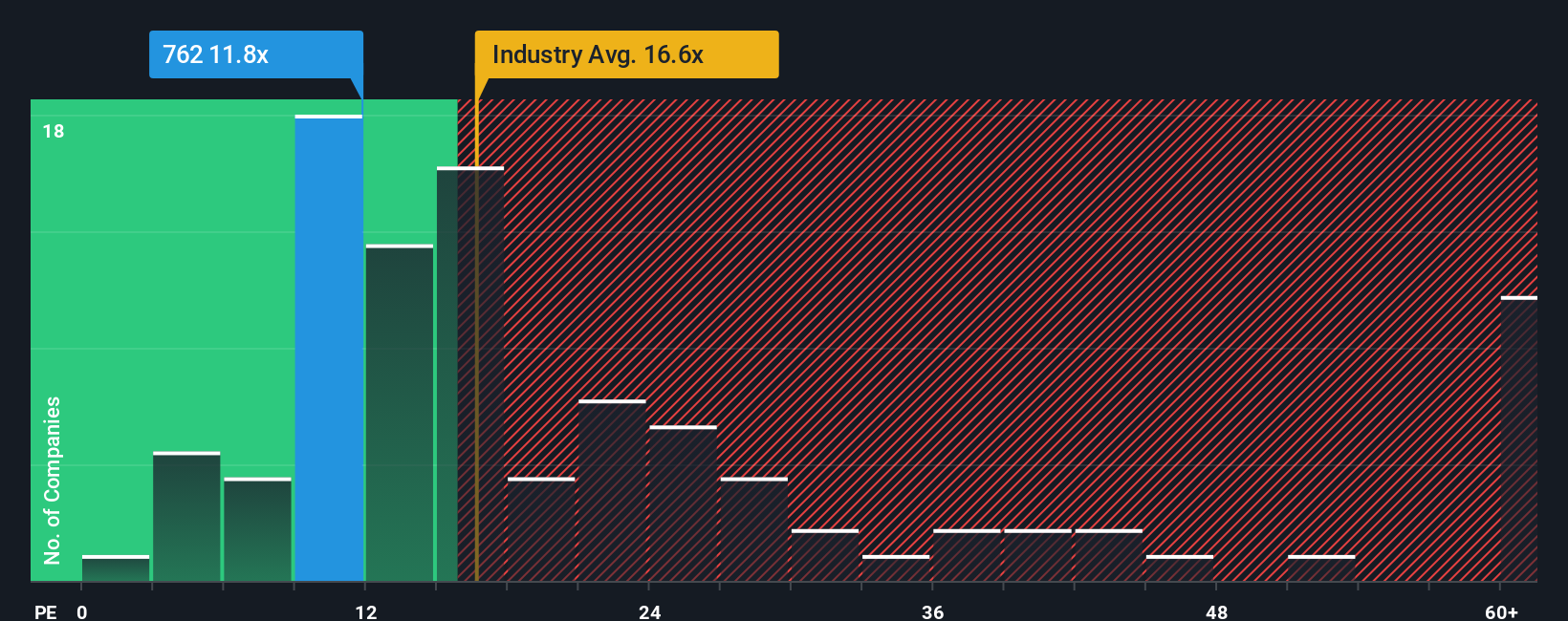

The price-to-earnings (PE) ratio is widely regarded as a useful valuation metric for profitable companies because it directly compares what investors are willing to pay for a business relative to its underlying earnings. For companies like China Unicom (Hong Kong) that consistently generate profits, the PE ratio helps investors quickly assess whether the stock is priced reasonably compared to its income.

It’s important to remember that higher growth expectations tend to justify higher PE ratios, while companies facing greater risks or lower growth prospects usually warrant lower multiples. Other factors like profit margins and market climate also help shape what experts consider a “normal” or “fair” PE value for a given business.

China Unicom (Hong Kong) currently trades at a PE ratio of 11.6x. That is notably lower than the industry average of 17.0x and the average among peers at 35.0x. While these benchmarks are helpful for context, they don’t reflect company-specific dynamics. That’s where Simply Wall St’s “Fair Ratio” comes in, using a proprietary model that calculates a tailored PE of 14.0x for China Unicom (Hong Kong). This model factors growth, risks, profit margin, industry profile, and market cap into the expected valuation.

Unlike broad peer or industry comparisons, the Fair Ratio offers a more objective standard by smoothing out distortions caused by outliers or sector-wide trends. It shines a spotlight on what China Unicom (Hong Kong) truly deserves based on its unique fundamentals.

With the stock trading at 11.6x, which is below the Fair Ratio of 14.0x, the numbers suggest China Unicom (Hong Kong) is undervalued by this key metric as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your China Unicom (Hong Kong) Narrative

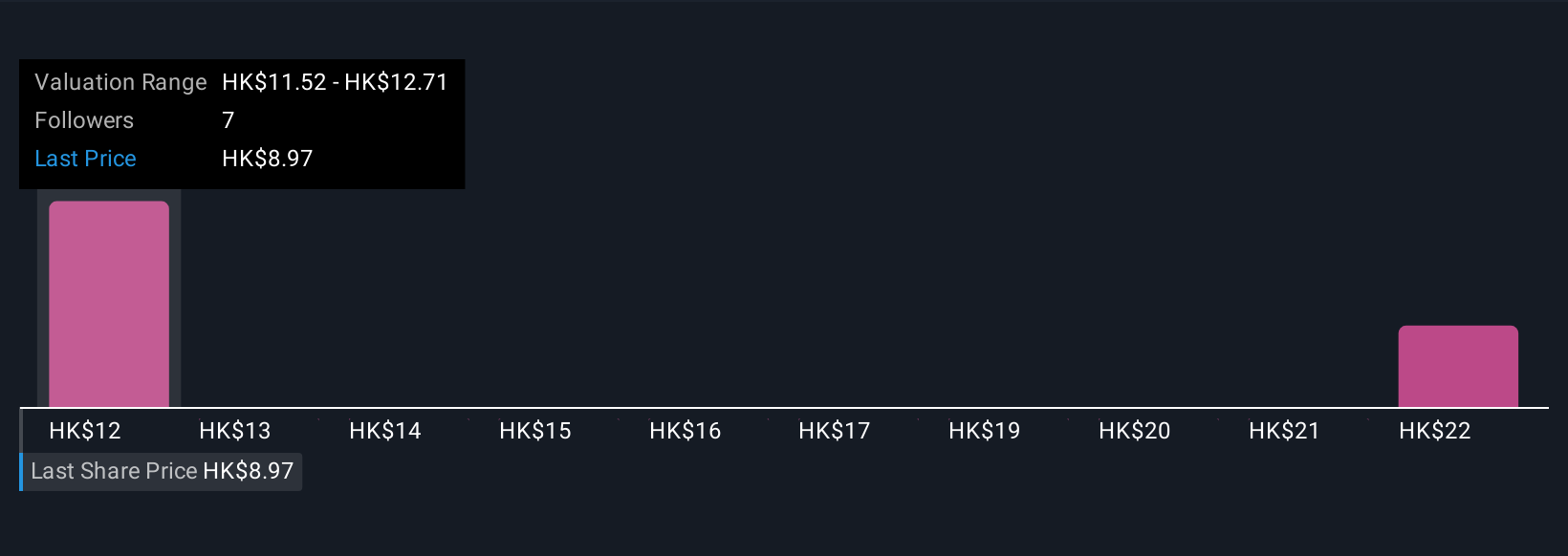

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives, a powerful tool that connects the company’s story to detailed financial forecasts and arrives at a fair value based on your unique perspective.

A Narrative is an easy, accessible way to express your view of China Unicom (Hong Kong) by combining your expectations of future revenue, margins, and growth with the “story” you believe about the business. This might include factors such as digital infrastructure demand or risks from domestic challenges.

On Simply Wall St’s Community page, you will find Narratives used by millions of investors worldwide. These are dynamic and update automatically when news or earnings are released, helping you make timely, informed decisions.

Narratives let you see how different fair values compare to today’s price, so you can quickly decide if a stock looks like a buy or a sell for your scenario, not someone else's.

For example, some investors expect China Unicom (Hong Kong) to benefit from 5G, IoT expansion, and network upgrades, setting fair values as high as HK$15.56. Others remain cautious about government influence and market stagnation, opting for more conservative targets like HK$9.21.

Your Narrative can help you sense-check analyst estimates and form your own conviction-driven plan.

Do you think there's more to the story for China Unicom (Hong Kong)? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:762

China Unicom (Hong Kong)

An investment holding company, provides telecommunications and related value-added services in the People’s Republic of China.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.