- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:762

China Unicom (SEHK:762) Margin Improvement Reframes Value Narrative Despite Slower Growth

Reviewed by Simply Wall St

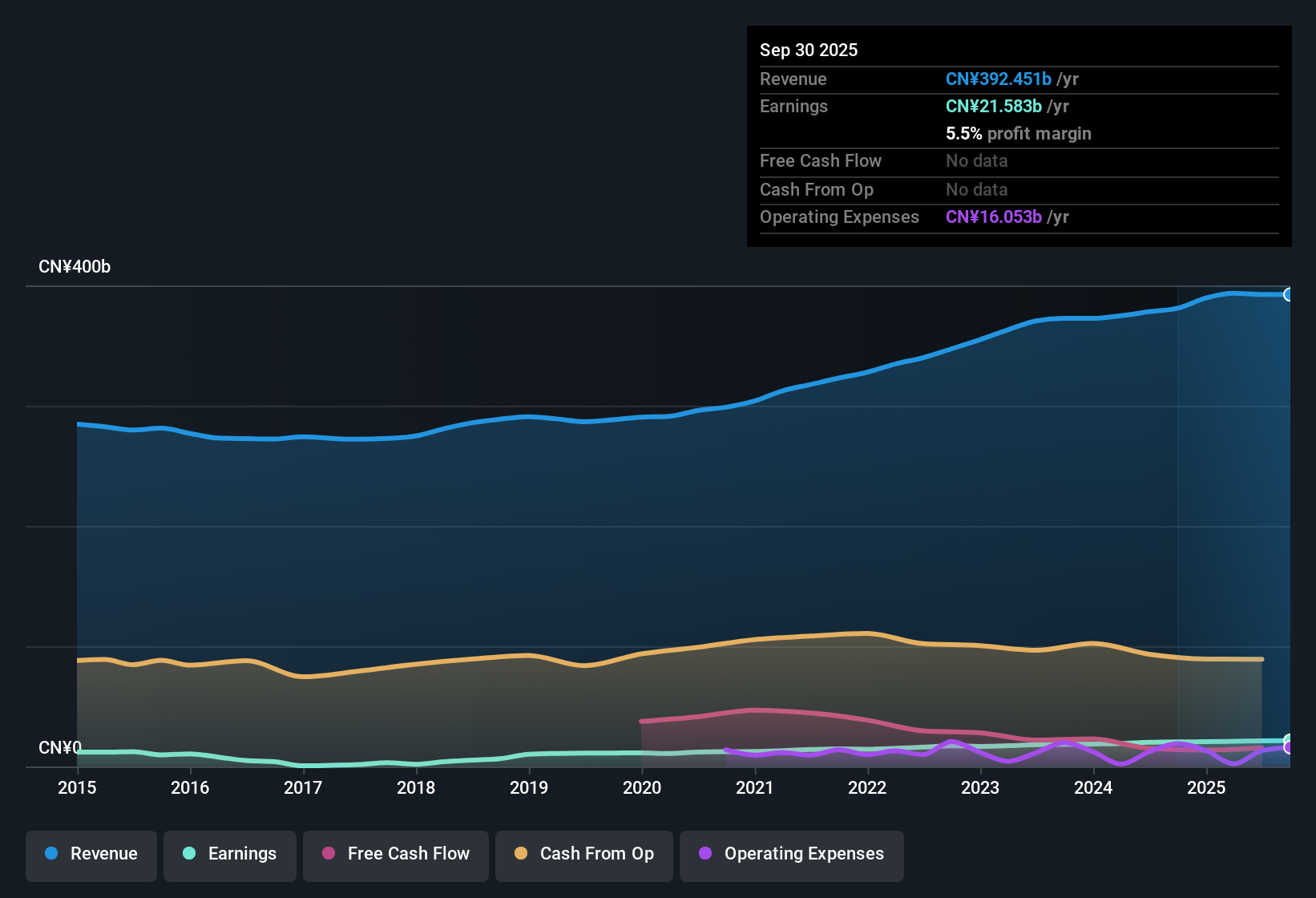

China Unicom (Hong Kong) (SEHK:762) posted earnings growth of 5.2% over the past year, behind its five-year average of 11.2% per year. Net profit margins inched up to 5.5% from 5.4% previously, and the company’s Price-to-Earnings ratio of 12.2x remains below both the industry average and its peer group. With forecast revenue and earnings growth expected to lag the broader Hong Kong market, these results indicate moderating momentum while also highlighting improved profitability and continued value in the current share price.

See our full analysis for China Unicom (Hong Kong).Next, we will see how these headline numbers compare with the market narratives commonly discussed by investors and analysts.

See what the community is saying about China Unicom (Hong Kong)

Digital Expansion Delivers Margin Gains

- Unicom Cloud revenue jumped 17.1% year-over-year, while data center revenue climbed 7.4%. This reflects strong traction in higher-margin digital services.

- Analysts' consensus view sees revenue diversification and investment in AI and sustainable infrastructure as supporting long-term earnings growth.

- Ongoing digital segment gains and a 9.1% uplift in R&D spending bolster confidence that future profit margins will climb from 5.4% today to 6.0% over the next three years.

- This higher-margin trend is expected to help the company offset the slower overall revenue growth projected versus market peers.

- Consensus narrative highlights China Unicom's progress modernizing its networks and its success scaling new digital platforms. This paints a picture of slow but steady value creation for shareholders.

- Despite a below-market forecast of 3.3% annual sales growth compared with 8.6% for Hong Kong Telcos, China Unicom's strategy targets more durable and profitable market opportunities.

- Cloud and IoT expansion are expected to remain catalysts for higher returns and operating resilience in coming years.

See how analysts are balancing these positives against China Unicom's structural pressures and growth ambitions: 📊 Read the full China Unicom (Hong Kong) Consensus Narrative.

Capex Reductions Spark Debate on Innovation

- Year-on-year Capex fell 17%, standing out from the industry’s ongoing network and AI upgrade cycle. This signals a sharper discipline in spending but raises questions about innovation pace.

- Consensus narrative points to a mixed impact:

- On one hand, persistent lag in capex and technology could risk further market share erosion if rivals extend their lead in 5G/6G deployment and network quality.

- Yet, focused investments in AI computing and platform-based industrial solutions are cited as vital to maintaining future margin expansion and competitive relevance, despite near-term spend restraint.

Valuation Discount Draws Interest vs Peers

- China Unicom trades at a price-to-earnings ratio of 12.2x, below the Asian telecom industry average of 16.5x and peer group average of 33.1x. The current share price of HK$9.39 is at a 22% discount to the analyst price target of HK$11.46.

- Consensus narrative observes that these valuation gaps, when combined with healthy profits and anticipated margin improvement,

- make China Unicom attractive to value-focused investors willing to accept slower growth in exchange for steadier defensiveness and a potential re-rating over time.

- However, it remains critical for investors to continually assess whether discounted multiples reflect an overlooked upside or persistent strategic risks that could cap long-term outperformance.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for China Unicom (Hong Kong) on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got your own take on the figures? Make your perspective count by building your own narrative in just a few minutes. Do it your way

A great starting point for your China Unicom (Hong Kong) research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite improving profitability, China Unicom’s muted revenue growth and below-industry expansion highlight a struggle to keep pace with faster-growing market peers.

If you want to focus on companies with stronger and more reliable long-term growth, use stable growth stocks screener (2097 results) to filter for steady performers that deliver consistent results regardless of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:762

China Unicom (Hong Kong)

An investment holding company, provides telecommunications and related value-added services in the People’s Republic of China.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives