- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:762

3 Dividend Stocks Offering Yields Up To 5.3%

Reviewed by Simply Wall St

As global markets respond to the recent U.S. election results and a Federal Reserve rate cut, investors are eyeing potential growth opportunities amid expectations of looser regulations and lower corporate taxes. With major indices like the S&P 500 reaching record highs, dividend stocks offering yields up to 5.3% present an attractive option for those seeking income in a dynamic market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Globeride (TSE:7990) | 4.17% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

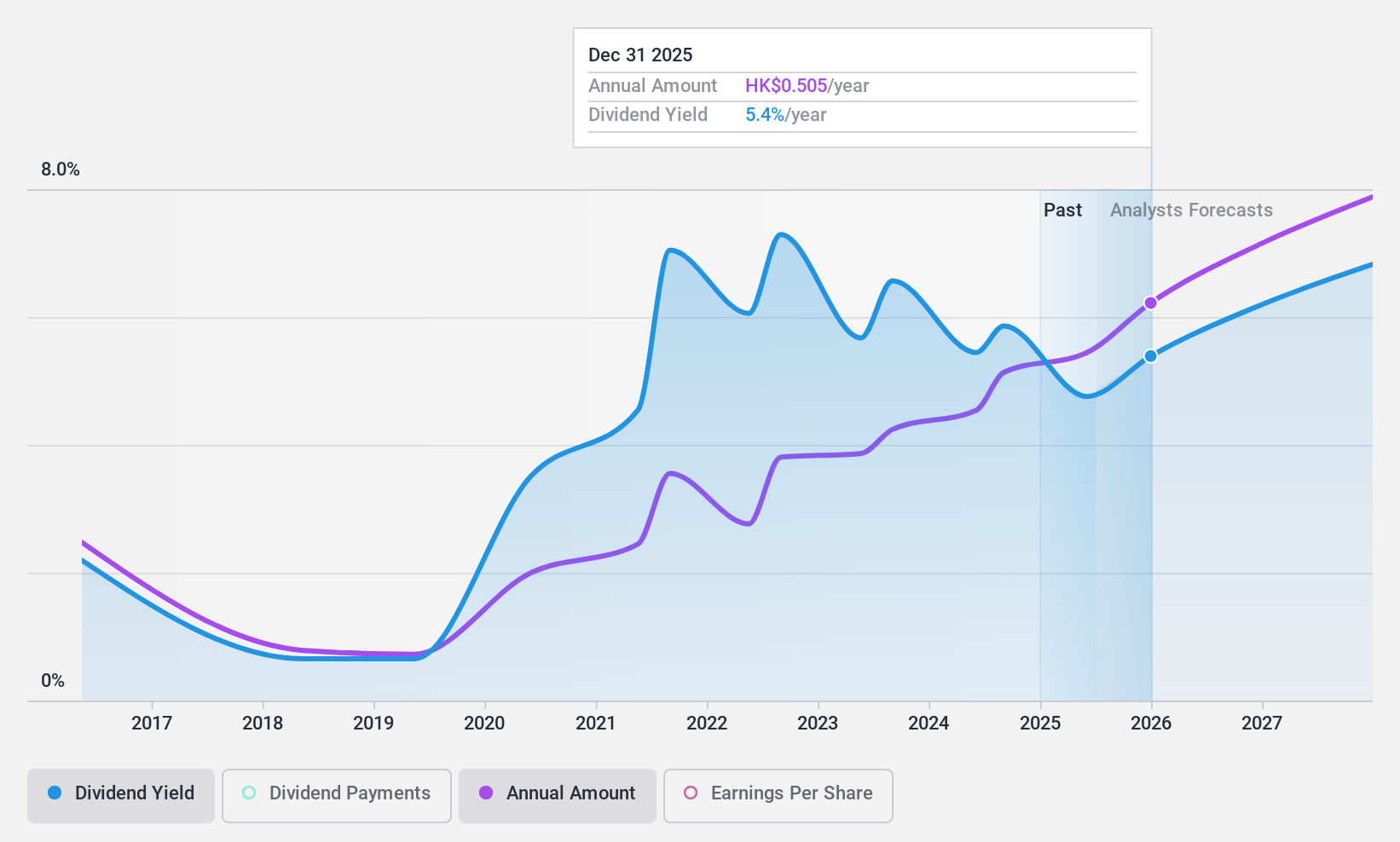

China Unicom (Hong Kong) (SEHK:762)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Unicom (Hong Kong) Limited is an investment holding company offering telecommunications and related value-added services in the People’s Republic of China, with a market cap of HK$198.58 billion.

Operations: China Unicom (Hong Kong) Limited generates revenue primarily from its Wireless Communications Services segment, which amounts to CN¥381.03 billion.

Dividend Yield: 5.4%

China Unicom (Hong Kong) Limited reported a revenue increase to CNY 290.12 billion for the nine months ending September 2024, with net income rising to CNY 19.03 billion. The company announced an interim dividend of RMB 0.2481 per share for the first half of 2024, reflecting its commitment to returning value to shareholders despite executive changes and ongoing disciplinary reviews within its leadership team.

- Click here to discover the nuances of China Unicom (Hong Kong) with our detailed analytical dividend report.

- The valuation report we've compiled suggests that China Unicom (Hong Kong)'s current price could be quite moderate.

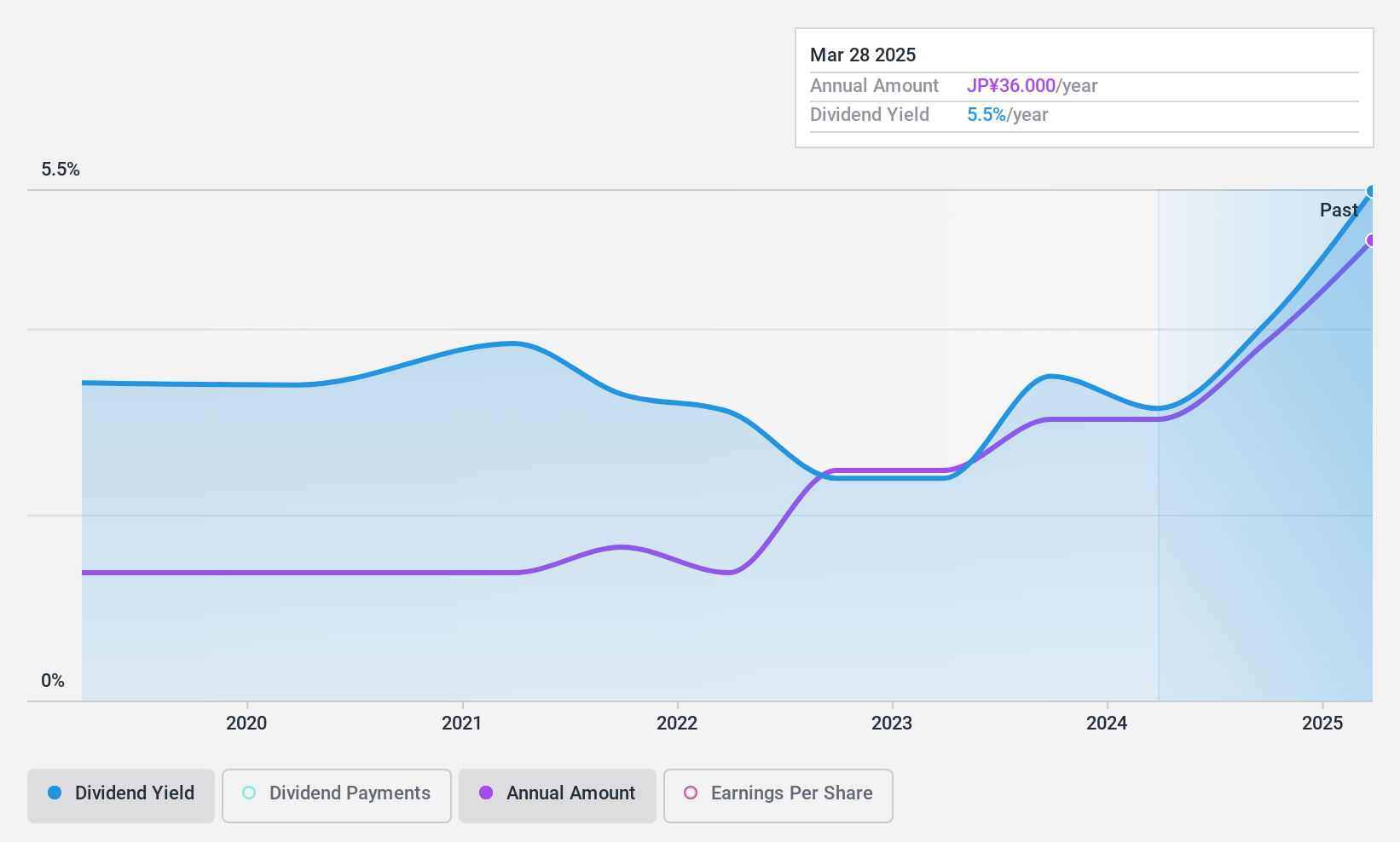

Kpp Group Holdings (TSE:9274)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kpp Group Holdings Co., Ltd. is a paper-trading company involved in the buying, selling, importing, and exporting of various paper-related products and materials, with a market cap of ¥45.67 billion.

Operations: Kpp Group Holdings Co., Ltd. generates revenue from several segments, including ¥53.90 billion from Asia Pacific, ¥305.58 billion from Northeast Asia, and ¥287.49 billion from Europe/Americas, along with a smaller contribution of ¥1.96 billion from Real Estate Rental activities.

Dividend Yield: 4.1%

Kpp Group Holdings recently completed a share buyback, acquiring 798,000 shares for ¥538.48 million, which may support future dividend stability. The upcoming earnings release on November 14, 2024, could provide further insights into its financial health and potential for sustained dividends. While the buyback indicates a focus on shareholder value, investors should assess how these actions align with Kpp's overall dividend strategy and financial performance before making any investment decisions.

- Get an in-depth perspective on Kpp Group Holdings' performance by reading our dividend report here.

- Our valuation report here indicates Kpp Group Holdings may be undervalued.

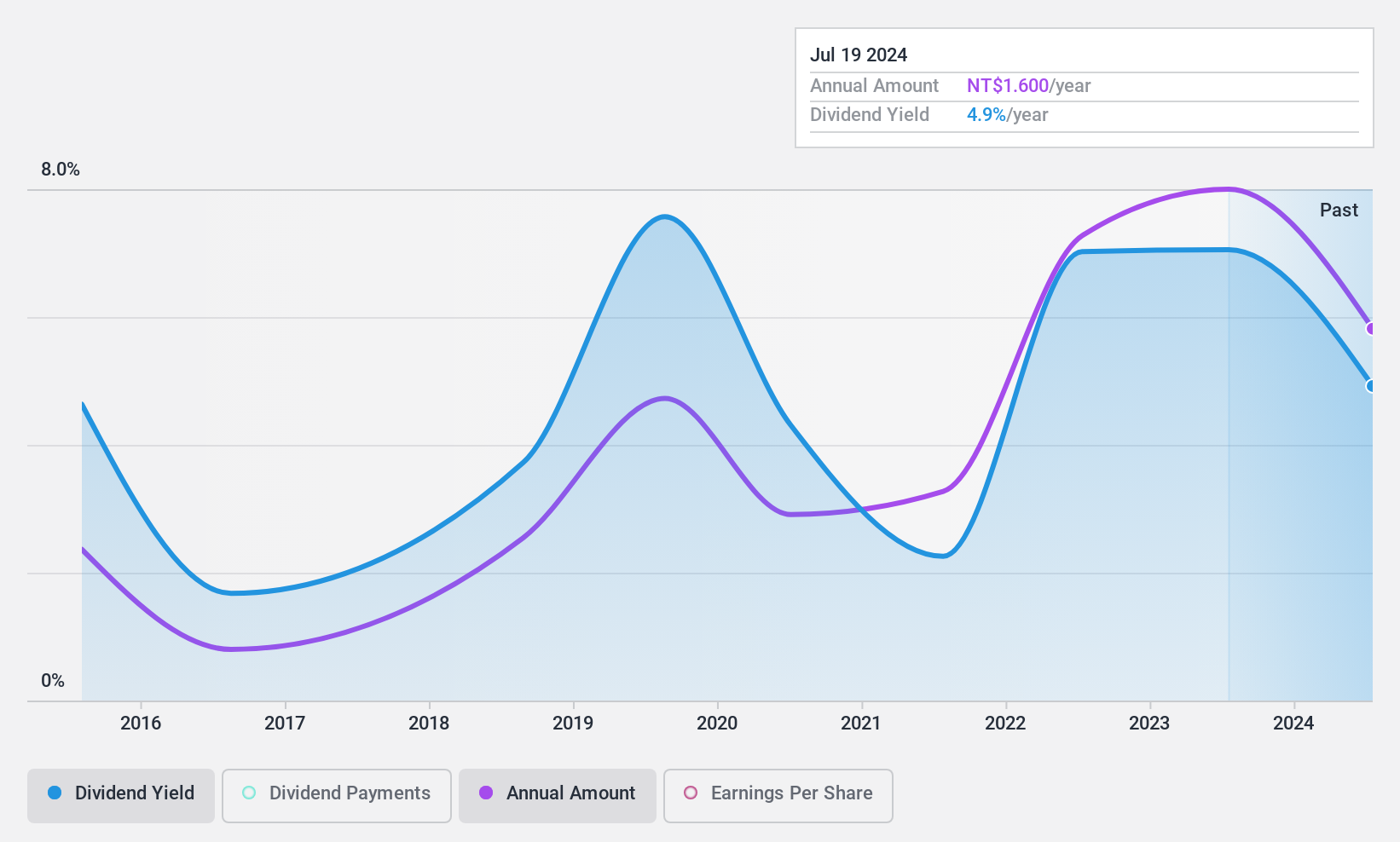

Taiwan Navigation (TWSE:2617)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Navigation Co., Ltd., along with its subsidiaries, offers shipping services in Taiwan and has a market capitalization of NT$13.42 billion.

Operations: Taiwan Navigation Co., Ltd.'s revenue from its Cargo Transportation and Shipping Agency segment amounts to NT$4.18 billion.

Dividend Yield: 4.9%

Taiwan Navigation's upcoming Q3 2024 earnings release on November 12 may offer insights into its dividend sustainability. The board meeting scheduled for the same day will review the financial statements, potentially impacting future dividend decisions. While recent events highlight a focus on financial evaluation, investors should consider how Taiwan Navigation's operational performance and strategic decisions align with their dividend expectations, especially given the importance of consistent cash flow in supporting dividends.

- Take a closer look at Taiwan Navigation's potential here in our dividend report.

- Our expertly prepared valuation report Taiwan Navigation implies its share price may be too high.

Seize The Opportunity

- Gain an insight into the universe of 1955 Top Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:762

China Unicom (Hong Kong)

An investment holding company, provides telecommunications and related value-added services in the People’s Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives