- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:1883

CITIC Telecom International Holdings' (HKG:1883) Upcoming Dividend Will Be Larger Than Last Year's

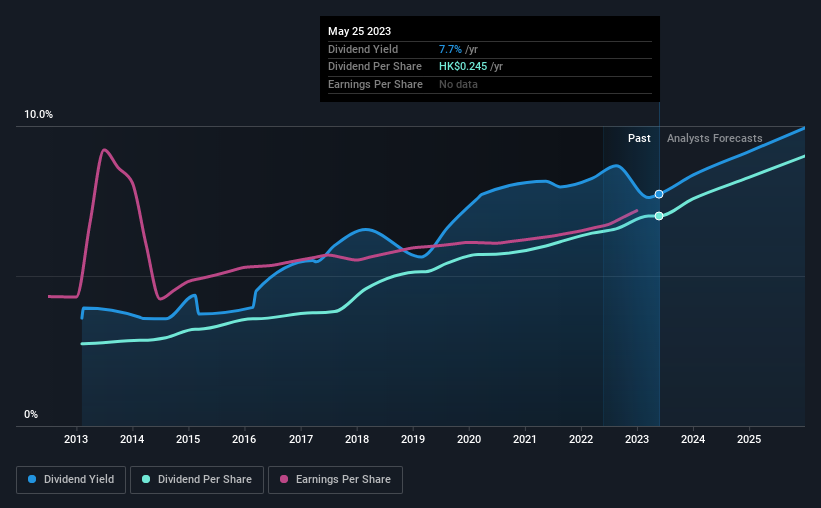

CITIC Telecom International Holdings Limited's (HKG:1883) dividend will be increasing from last year's payment of the same period to HK$0.185 on 14th of June. This will take the dividend yield to an attractive 7.7%, providing a nice boost to shareholder returns.

Check out our latest analysis for CITIC Telecom International Holdings

CITIC Telecom International Holdings' Payment Has Solid Earnings Coverage

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. The last payment made up 76% of earnings, but cash flows were much higher. This leaves plenty of cash for reinvestment into the business.

Looking forward, earnings per share is forecast to rise by 30.0% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 64%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

CITIC Telecom International Holdings Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2013, the dividend has gone from HK$0.096 total annually to HK$0.245. This implies that the company grew its distributions at a yearly rate of about 9.8% over that duration. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

The Dividend Has Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. It's encouraging to see that CITIC Telecom International Holdings has been growing its earnings per share at 5.3% a year over the past five years. The payout ratio is very much on the higher end, which could mean that the growth rate will slow down in the future, and that could flow through to the dividend as well.

Our Thoughts On CITIC Telecom International Holdings' Dividend

In summary, while it's always good to see the dividend being raised, we don't think CITIC Telecom International Holdings' payments are rock solid. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. We don't think CITIC Telecom International Holdings is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Are management backing themselves to deliver performance? Check their shareholdings in CITIC Telecom International Holdings in our latest insider ownership analysis. Is CITIC Telecom International Holdings not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1883

CITIC Telecom International Holdings

An investment holding company, engages in the provision of international telecommunications services in Hong Kong, China, Macau, Singapore, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.