- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:1310

The three-year decline in earnings might be taking its toll on HKBN (HKG:1310) shareholders as stock falls 4.3% over the past week

Many investors define successful investing as beating the market average over the long term. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term HKBN Ltd. (HKG:1310) shareholders have had that experience, with the share price dropping 16% in three years, versus a market decline of about 5.8%.

If the past week is anything to go by, investor sentiment for HKBN isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for HKBN

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

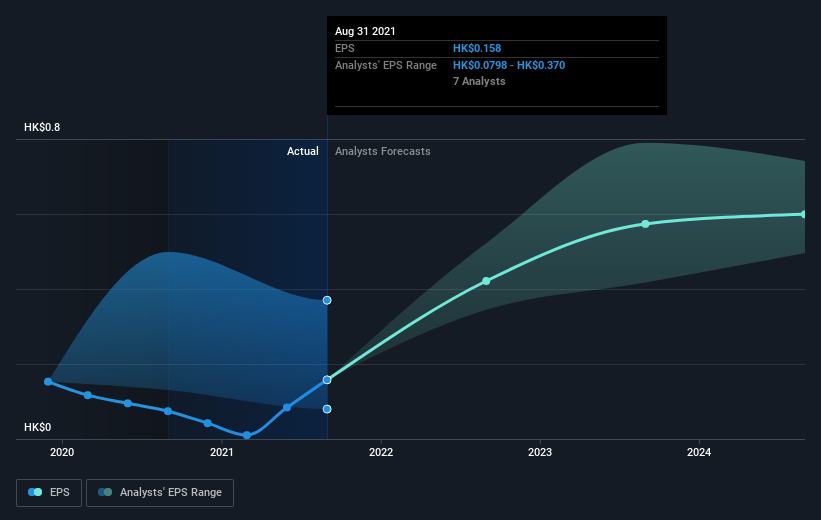

HKBN saw its EPS decline at a compound rate of 26% per year, over the last three years. In comparison the 6% compound annual share price decline isn't as bad as the EPS drop-off. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term. With a P/E ratio of 64.67, it's fair to say the market sees a brighter future for the business.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on HKBN's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, HKBN's TSR for the last 3 years was 1.2%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that HKBN shareholders have received a total shareholder return of 1.1% over the last year. Of course, that includes the dividend. However, the TSR over five years, coming in at 8% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. It's always interesting to track share price performance over the longer term. But to understand HKBN better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with HKBN (including 2 which can't be ignored) .

HKBN is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HKBN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1310

HKBN

An investment holding company, provides fixed telecommunications network, international telecommunications, and mobile services to residential and enterprise customers in Hong Kong, Mainland China, and Macao.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026