- Hong Kong

- /

- Tech Hardware

- /

- SEHK:992

Lenovo (SEHK:992): Valuation Insights After Broad AI Product Launch and Innovation World 2025 Event

Reviewed by Simply Wall St

Lenovo Group (SEHK:992) is grabbing investor attention after its latest Innovation World 2025 event, where the company revealed a broad lineup of new AI-powered PCs, tablets, gaming devices, and breakthrough software features. The scope of this launch covers both consumer and commercial products, signaling Lenovo’s intent to push generative AI into the core of everything it offers, from creative tools and immersive gaming to smarter workplace solutions. For anyone on the fence about Lenovo, this event could be more than just another product showcase, as the company is positioning itself to capture new demand and credibility in the fast-evolving AI market.

Looking at the bigger picture, Lenovo’s performance over the past year has quietly built momentum. The stock is up 25% in the past year, with gains accelerating more recently and showing a 16% jump over the past 3 months, even with some short-term dips in the past week and month. Growth in both annual revenue and net income has also kept up, albeit at a moderate pace. These results are coming on the heels of other partnerships, such as the recent agreement with Gruppo CRG to infuse Lenovo technology throughout advanced motorsport operations and youth driver development. Investors seem to be responding to Lenovo’s efforts to branch further into AI and data analytics, possibly leading to a reassessment of the stock’s future potential.

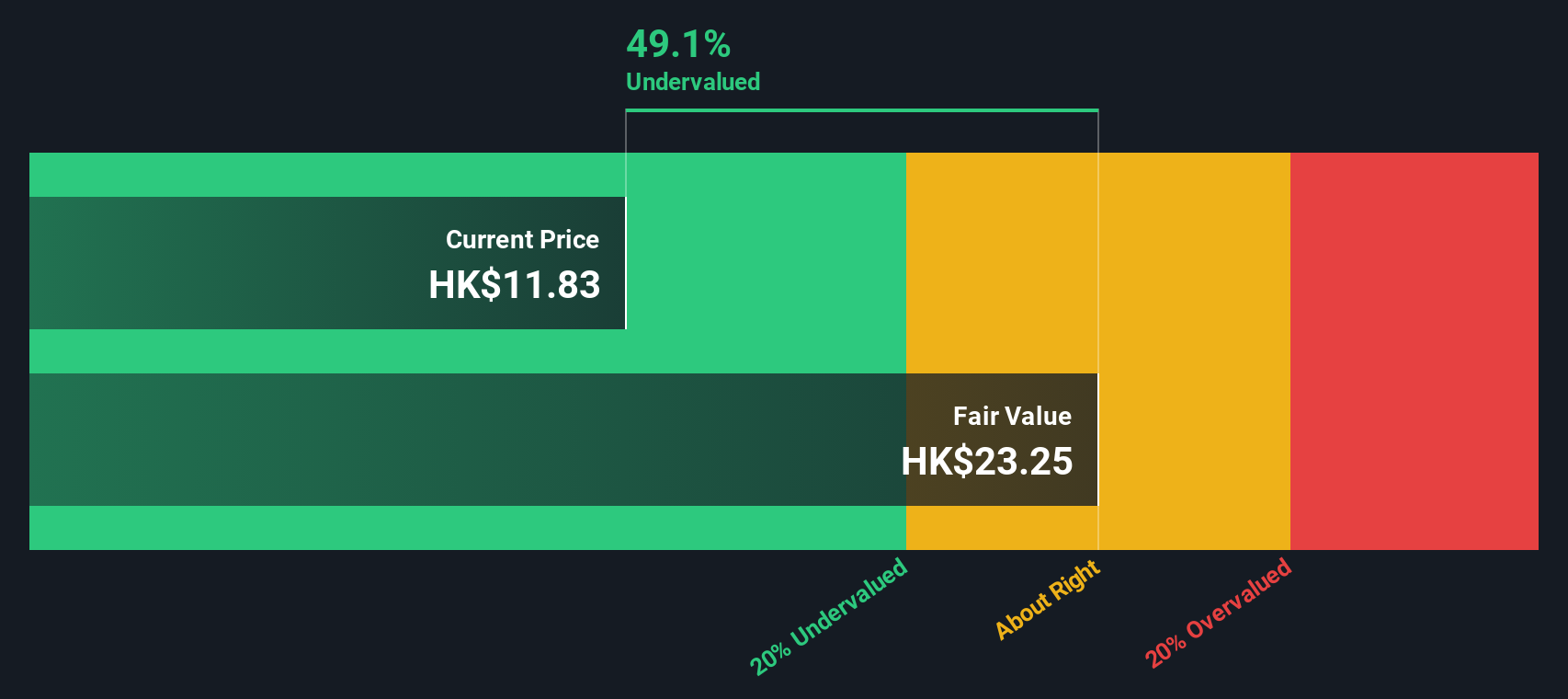

After this year’s gains and bold AI push, is Lenovo Group entering undervalued territory, or is the recent excitement already built into the share price?

Most Popular Narrative: 19.4% Undervalued

The most widely followed narrative sees Lenovo Group as significantly undervalued, with its current share price standing notably below analysts’ consensus fair value estimate.

The strategic shift toward solutions and services (including Device-as-a-Service, Infrastructure-as-a-Service, and managed services like TruScale) is generating recurring, higher-margin revenue streams. This is evidenced by rapid growth and margin expansion in Lenovo's Services & Solutions Group, supporting durable improvements in group net margins and earnings stability.

How do new revenue streams and higher profits boost Lenovo’s future worth? The calculations behind this undervaluation rely on eye-catching improvements in profitability, revenue, and operating efficiency. How do these analysts arrive at such a bullish number? Discover which financial levers need to outperform for Lenovo to hit its target price, and see how those projections compare with tech sector norms.

Result: Fair Value of $13.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there is still the risk that Lenovo’s heavy R&D spending or changing global trade policies could quickly impact margins and growth expectations.

Find out about the key risks to this Lenovo Group narrative.Another View: Discounted Cash Flow Model

Taking a different angle, our DCF model also points to Lenovo being undervalued. However, it relies on future cash flow projections that can shift quickly as markets change. Do the underlying cash assumptions hold?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lenovo Group Narrative

Of course, you might want to dive into the details and form your own perspective. There’s always time to build your own story in just minutes, so Do it your way.

A great starting point for your Lenovo Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Tap into fresh investing opportunities and make your next smart move. Don’t let big trends or hidden gems pass you by. Start searching with these powerful ideas today:

- Unlock opportunities with tech trailblazers at the frontier of artificial intelligence when you check out AI penny stocks.

- Boost your portfolio with reliable, income-generating businesses offering generous payouts through dividend stocks with yields > 3%.

- Seize bargains across promising companies trading below their value by exploring undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:992

Lenovo Group

An investment holding company, develops, manufactures, and markets technology products and services.

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives