- Hong Kong

- /

- Tech Hardware

- /

- SEHK:992

High Growth Tech Stocks To Watch This February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, global markets are witnessing a dynamic period with U.S. stock indexes nearing record highs and growth stocks outpacing value shares, despite small-cap stocks trailing behind their larger counterparts. In this environment of heightened inflation and rate expectations, identifying high growth tech stocks requires a keen focus on innovation potential and resilience to macroeconomic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Xspray Pharma | 127.78% | 104.91% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 1202 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Lenovo Group (SEHK:992)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services, with a market capitalization of HK$146.13 billion.

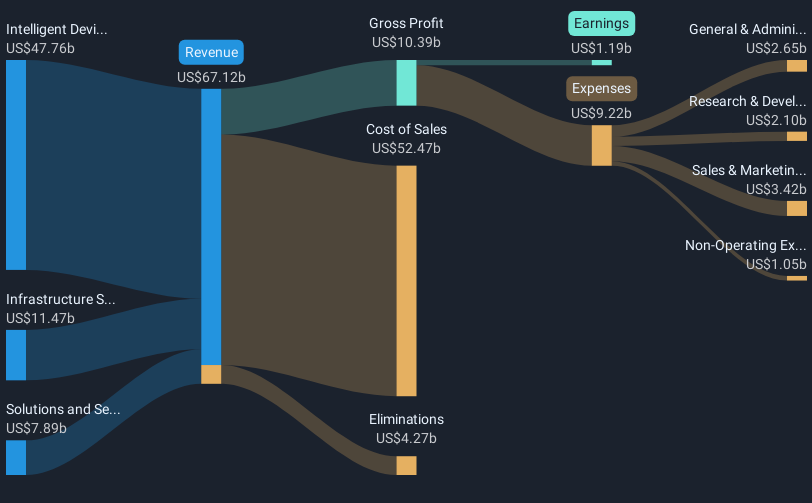

Operations: Lenovo Group's revenue primarily comes from its Intelligent Devices Group (IDG), generating $47.76 billion, followed by the Infrastructure Solutions Group (ISG) at $11.47 billion and the Solutions and Services Group (SSG) at $7.89 billion.

Lenovo Group's strategic focus on integrating artificial intelligence into its offerings is evident from its recent product launches and R&D initiatives. With an 8.2% annual revenue growth and a 15.1% rise in earnings, the company is outpacing the Hong Kong market averages of 7.9% and 11.7%, respectively, showcasing robust financial health. Notably, Lenovo's commitment to innovation is underscored by its substantial investment in R&D, which has been crucial in developing AI-driven solutions like the AI Now assistant for PCs and advanced robotics for retail environments, aligning with industry shifts towards more intelligent technologies.

Synektik Spólka Akcyjna (WSE:SNT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Synektik Spólka Akcyjna offers products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications in Poland, with a market capitalization of PLN1.95 billion.

Operations: Synektik Spólka Akcyjna focuses on providing specialized solutions in surgery, diagnostic imaging, and nuclear medicine within Poland. The company's revenue is derived from its diverse offerings in these medical fields, supported by a market capitalization of PLN1.95 billion.

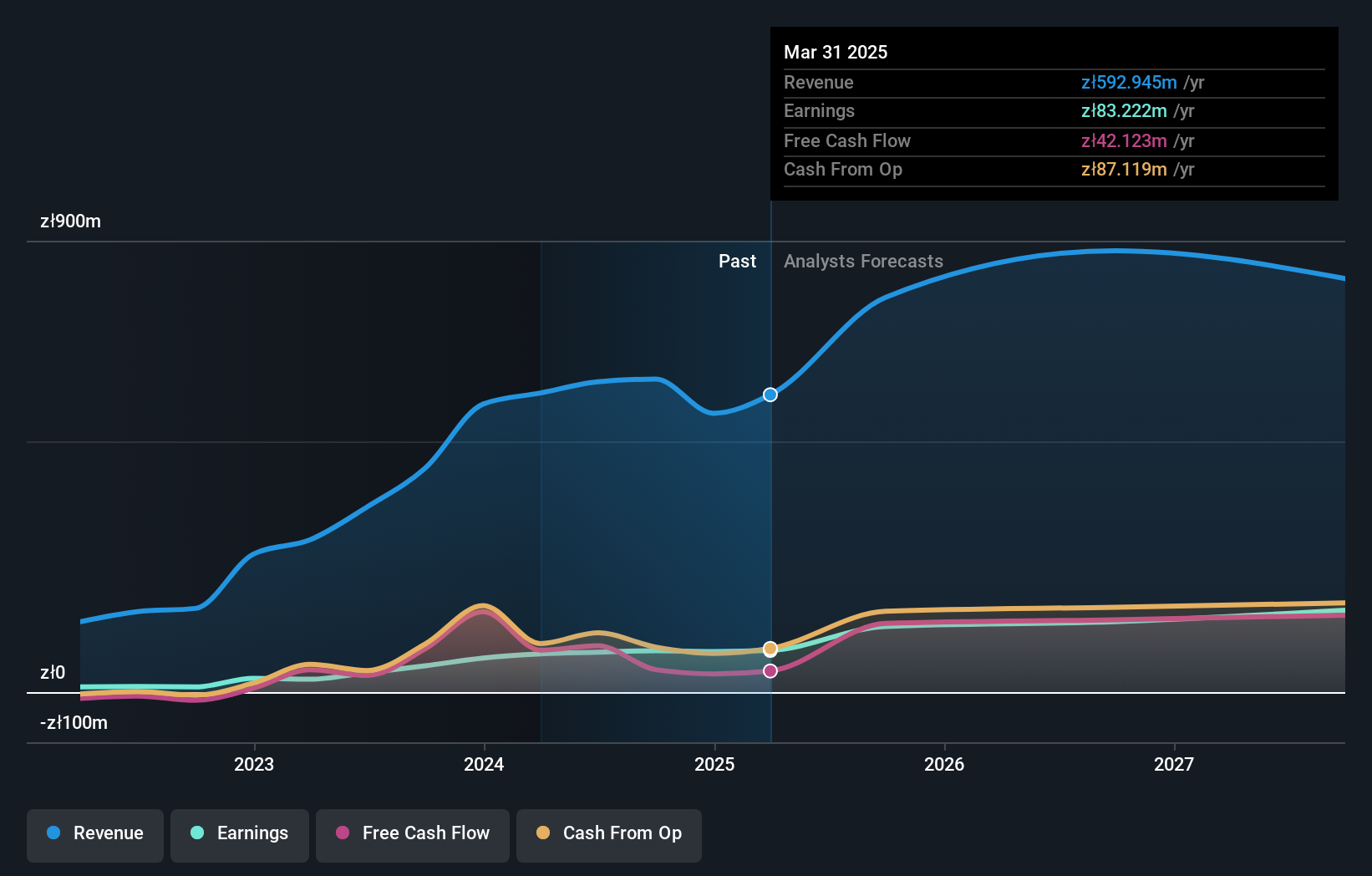

Synektik Spólka Akcyjna, navigating through a challenging market environment, has demonstrated resilience with a 22.1% earnings growth over the past year, outperforming the Healthcare Services industry's growth of 3.6%. This Polish tech firm is not just surviving but thriving, with revenue projections set to exceed the local market forecast at 9.1% annually compared to Poland's average of 4.8%. The company’s commitment to innovation is evident from its substantial R&D investments, which are crucial for maintaining its competitive edge in developing advanced medical technologies. Despite a slight dip in net income and EPS as reported in their latest earnings results, Synektik maintains a robust growth trajectory and high Return on Equity forecasted at an impressive 48.8% in three years’ time, signaling strong future prospects amidst evolving industry dynamics.

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: init innovation in traffic systems SE, along with its subsidiaries, offers intelligent transportation systems solutions for public transportation globally and has a market capitalization of approximately €357.52 million.

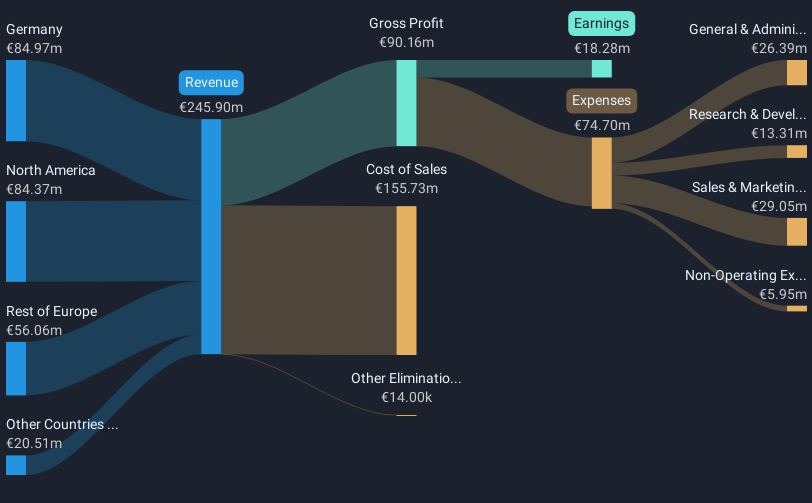

Operations: The company generates revenue primarily from its wireless communications equipment segment, totaling approximately €245.89 million.

Init innovation in traffic systems, thriving amidst rapid technological shifts in transportation, has shown a robust annual revenue growth of 12.3%, outpacing the industry average. This performance is bolstered by strategic R&D investments, accounting for a significant portion of revenue, which underscores its commitment to leading-edge solutions in traffic management. With earnings projected to surge by 27.8% annually, Init's focus on innovative software solutions positions it well within the high-growth tech sector. Moreover, its recent initiatives have led to an expansion in market reach and client base, enhancing future growth prospects and solidifying its role as a pivotal player in transforming urban mobility ecosystems.

Make It Happen

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1199 more companies for you to explore.Click here to unveil our expertly curated list of 1202 High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:992

Lenovo Group

An investment holding company, develops, manufactures, and markets technology products and services.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion