- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

Asian Market Insights: Promising Penny Stocks For September 2025

Reviewed by Simply Wall St

As the Asian markets navigate a complex global landscape marked by economic uncertainties and shifting interest rate expectations, investors are increasingly seeking opportunities that offer both stability and growth potential. Penny stocks, despite their somewhat outdated moniker, remain an intriguing investment area for those looking to explore smaller or newer companies with promising financial health. In this article, we spotlight several penny stocks in Asia that stand out for their robust balance sheets and potential for long-term success.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.88 | THB3.83B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.94 | HK$2.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.67 | HK$1.03B | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.50 | HK$2.08B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.93 | SGD376.92M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.88 | THB2.93B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.18 | SGD12.52B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.97 | THB1.43B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.98 | THB10.06B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 981 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

FIT Hon Teng (SEHK:6088)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally, with a market cap of HK$31.10 billion.

Operations: The company's revenue is primarily derived from its Consumer Products segment, which generated $671.57 million, and its Intermediate Products segment, which contributed $4.13 billion.

Market Cap: HK$31.1B

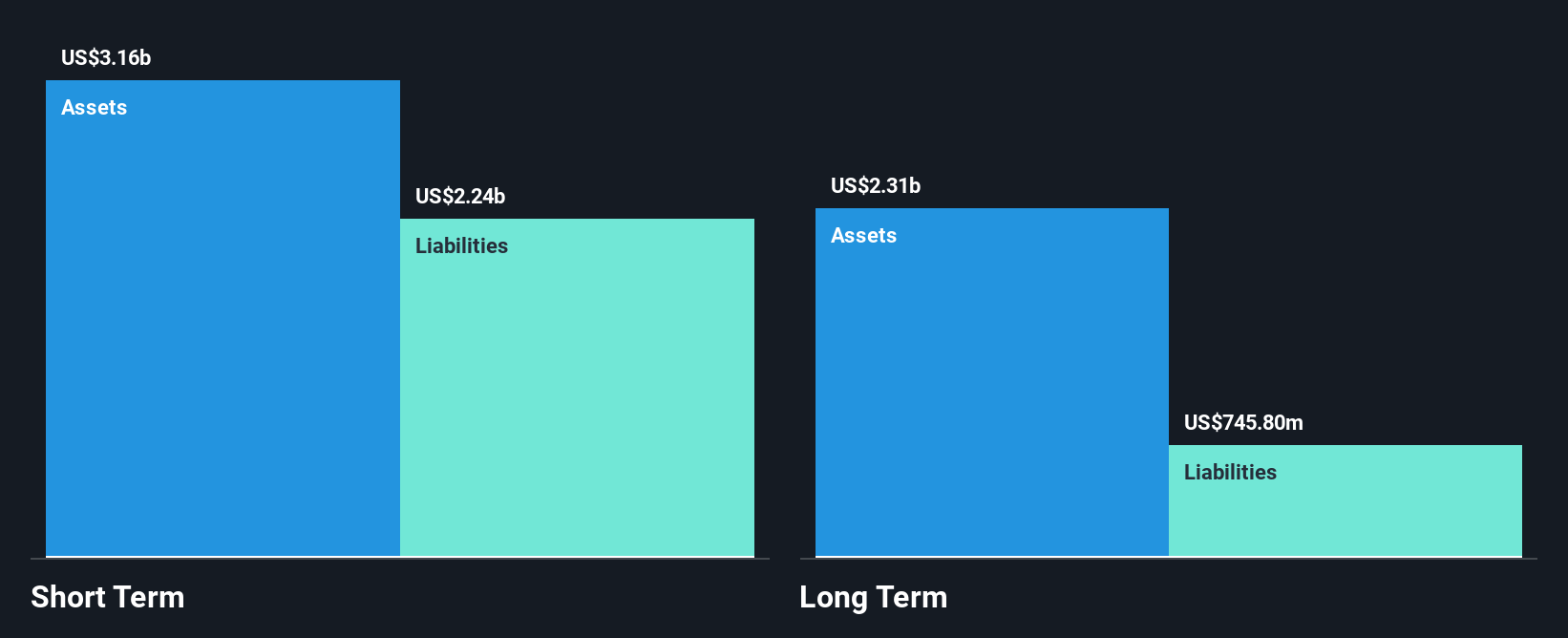

FIT Hon Teng Limited's recent earnings report shows a slight revenue increase to US$2.30 billion for the first half of 2025, though net income dipped marginally to US$31.51 million. The company's strategic alliance with Point2 Technology aims to enhance data center interconnectivity through innovative e-Tube technology, potentially driving future growth. Financially, FIT maintains a satisfactory net debt-to-equity ratio of 20.5% and covers its interest payments well with EBIT at 3.3 times coverage, but its profit margins have narrowed slightly year-on-year and earnings growth has been negative recently compared to industry trends.

- Navigate through the intricacies of FIT Hon Teng with our comprehensive balance sheet health report here.

- Evaluate FIT Hon Teng's prospects by accessing our earnings growth report.

Sansiri (SET:SIRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sansiri Public Company Limited, along with its subsidiaries, operates in the property development sector in Thailand with a market cap of THB25.79 billion.

Operations: The company's revenue is primarily derived from Real Estate at THB30.96 billion, supplemented by Building Management, Project Management and Real Estate Brokerage at THB2.78 billion, and Hotel Business contributing THB753 million.

Market Cap: THB25.79B

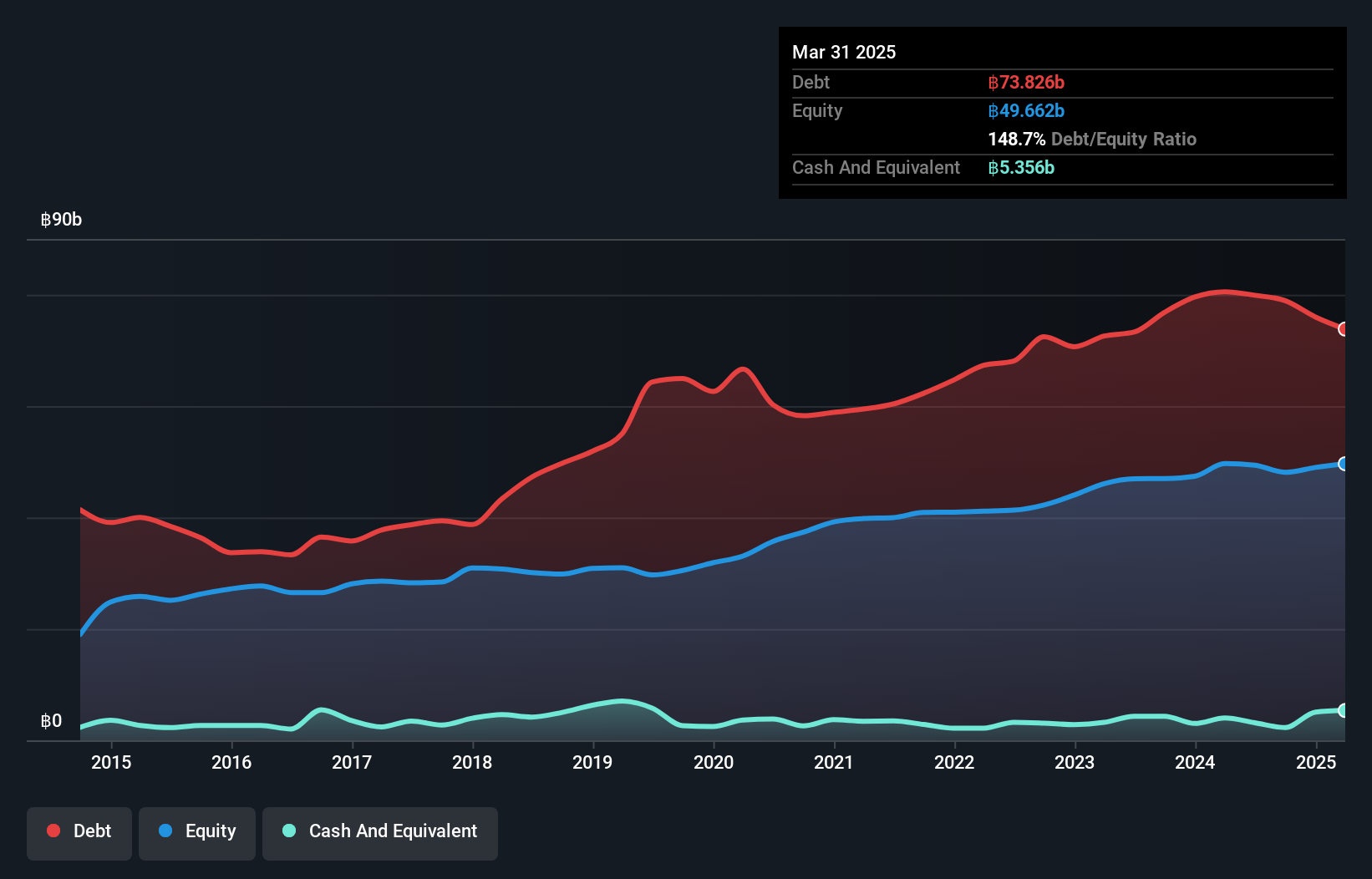

Sansiri Public Company Limited's recent financial performance reflects challenges with declining revenues and net income, reporting THB15.68 billion in revenue for the first half of 2025, down from THB19.46 billion a year ago. Despite this, the company maintains strong short-term asset coverage over liabilities and has reduced its debt-to-equity ratio to 145.3% over five years. However, interest payments are well-covered by EBIT at 21.3 times coverage despite operating cash flow inadequately covering debt levels. Recent strategic moves include forming new subsidiaries and joint ventures in property development, potentially enhancing future growth prospects amidst an unstable dividend track record.

- Click here to discover the nuances of Sansiri with our detailed analytical financial health report.

- Explore Sansiri's analyst forecasts in our growth report.

Zhanjiang Guolian Aquatic Products (SZSE:300094)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhanjiang Guolian Aquatic Products Co., Ltd. operates in the seafood industry, focusing on the processing and distribution of aquatic products, with a market cap of CN¥4.29 billion.

Operations: Zhanjiang Guolian Aquatic Products Co., Ltd. does not report distinct revenue segments.

Market Cap: CN¥4.29B

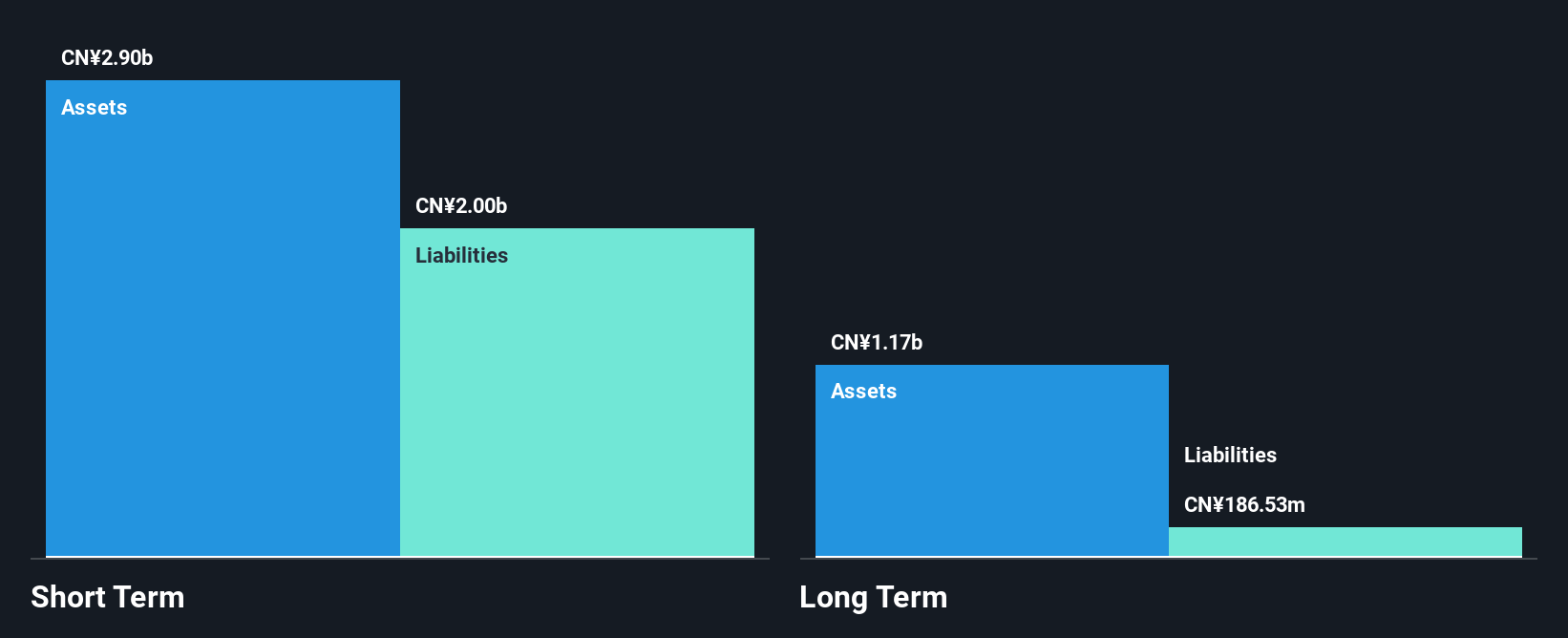

Zhanjiang Guolian Aquatic Products faces significant financial challenges, with recent half-year earnings showing a decline in revenue to CN¥1.65 billion from CN¥2.02 billion and a net loss of CN¥540.34 million compared to a profit last year. The company’s high debt-to-equity ratio of 79.6% signals financial strain, though short-term assets cover both short and long-term liabilities, indicating some liquidity strength. The management team is relatively inexperienced with an average tenure of 1.8 years, which could impact strategic direction amidst volatile share prices and negative return on equity at -98.11%. Despite these hurdles, the cash runway remains sufficient for over three years based on current free cash flow levels.

- Click to explore a detailed breakdown of our findings in Zhanjiang Guolian Aquatic Products' financial health report.

- Gain insights into Zhanjiang Guolian Aquatic Products' past trends and performance with our report on the company's historical track record.

Make It Happen

- Unlock our comprehensive list of 981 Asian Penny Stocks by clicking here.

- Ready For A Different Approach? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives