- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3969

Investor Optimism Abounds China Railway Signal & Communication Corporation Limited (HKG:3969) But Growth Is Lacking

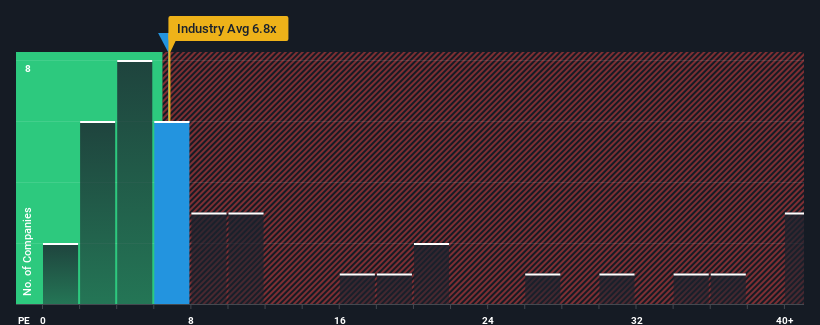

There wouldn't be many who think China Railway Signal & Communication Corporation Limited's (HKG:3969) price-to-earnings (or "P/E") ratio of 6.7x is worth a mention when the median P/E in Hong Kong is similar at about 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

The recently shrinking earnings for China Railway Signal & Communication have been in line with the market. It seems that few are expecting the company's earnings performance to deviate much from most other companies, which has held the P/E back. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's earnings continue tracking the market.

Check out our latest analysis for China Railway Signal & Communication

Does Growth Match The P/E?

In order to justify its P/E ratio, China Railway Signal & Communication would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 2.9% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 19% during the coming year according to the four analysts following the company. With the market predicted to deliver 22% growth , the company is positioned for a weaker earnings result.

In light of this, it's curious that China Railway Signal & Communication's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From China Railway Signal & Communication's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of China Railway Signal & Communication's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for China Railway Signal & Communication that you should be aware of.

If you're unsure about the strength of China Railway Signal & Communication's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3969

China Railway Signal & Communication

Provides rail transportation control system solutions in China and internationally.

Excellent balance sheet with moderate growth potential.