- Hong Kong

- /

- Communications

- /

- SEHK:285

High Growth Tech In Hong Kong Featuring 3 Promising Stocks

Reviewed by Simply Wall St

The Hong Kong market has been buoyed by the recent Fed rate cut, which has injected optimism into global equities, including those in the tech sector. As investors look for high-growth opportunities amidst this positive sentiment, we explore three promising tech stocks in Hong Kong that stand out due to their innovative potential and market positioning.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.30% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 33.07% | 54.67% | ★★★★★★ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| Innovent Biologics | 22.35% | 59.39% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology, an investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China with a market cap of HK$187.55 billion.

Operations: Kuaishou Technology generates revenue primarily from domestic operations (CN¥117.32 billion) and a smaller portion from overseas markets (CN¥3.57 billion). The company focuses on live streaming and online marketing services in China.

Kuaishou Technology, a dynamic player in Hong Kong's tech scene, has demonstrated robust financial and operational growth. In the recent quarter, the company reported a significant increase in sales to CNY 30.98 billion and net income surged to CNY 3.98 billion, reflecting strong market adoption and effective monetization strategies. Notably, its R&D investment remains aggressive, underpinning its commitment to innovation; however, specific figures were not disclosed in the provided data. The firm's Kling AI platform is pivotal in this strategy—recent upgrades have enhanced video quality and expanded functionality, ensuring Kuaishou stays at the forefront of AI-driven content creation. With earnings forecasted to grow by 18.7% annually—outpacing the local market rate of 11.8%—and revenue expected to rise by 9% annually against a market growth rate of 7.3%, Kuaishou is well-positioned for sustained expansion amidst an increasingly competitive landscape.

BYD Electronic (International) (SEHK:285)

Simply Wall St Growth Rating: ★★★★☆☆

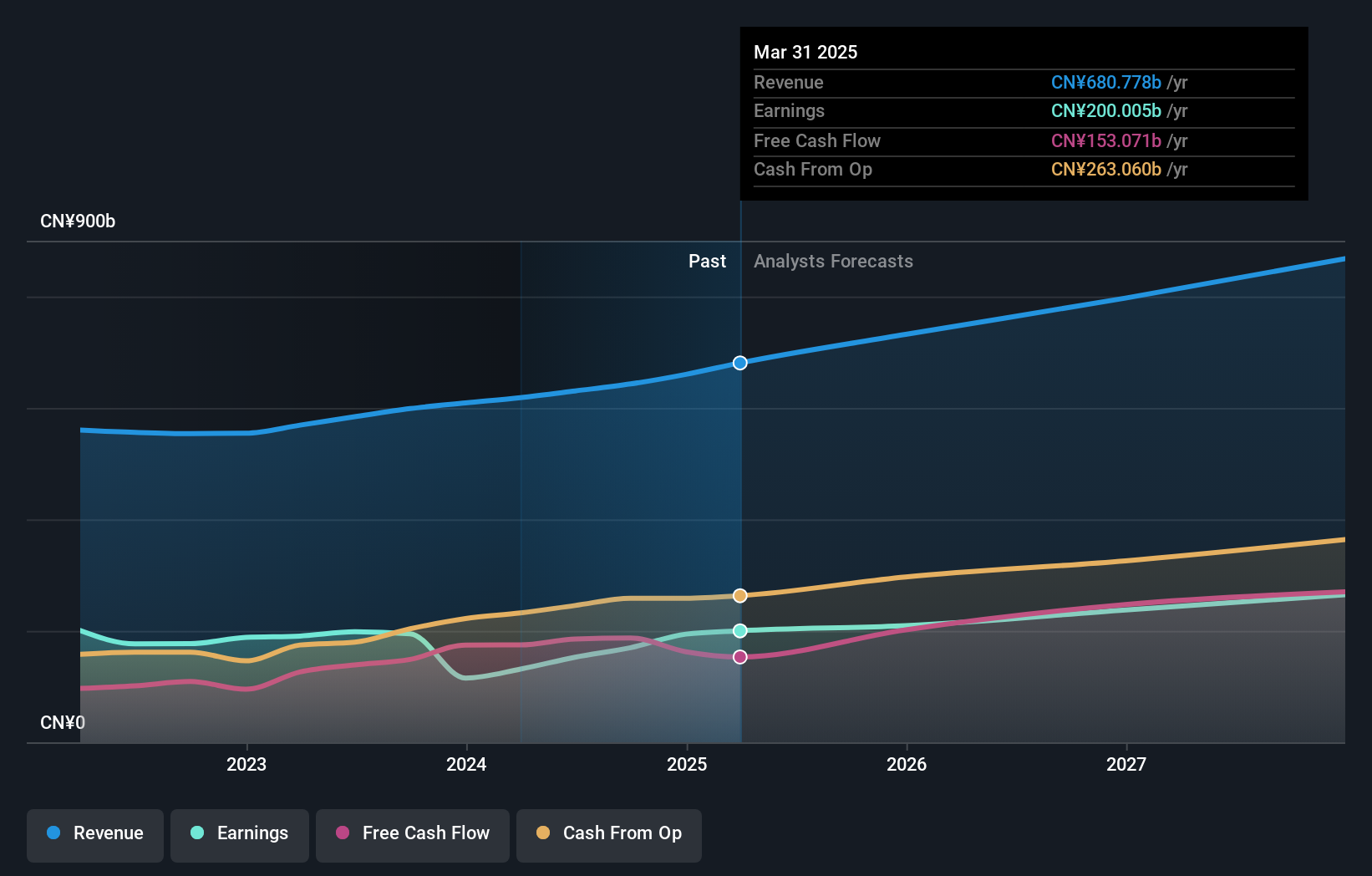

Overview: BYD Electronic (International) Company Limited, an investment holding company, primarily engages in the design, manufacture, assembly, and sale of mobile handset components, modules, and other products in the People’s Republic of China and internationally with a market cap of HK$64.78 billion.

Operations: The company generates revenue primarily from the manufacture, assembly, and sale of mobile handset components and modules, amounting to CN¥152.36 billion. The business focuses on both domestic and international markets.

BYD Electronic (International) has shown resilience and strategic foresight in Hong Kong's competitive tech landscape. With a reported 39.8% increase in sales reaching CNY 78.58 billion for the first half of 2024, the company underscores its robust market presence and operational efficiency. Notably, its commitment to innovation is evident with R&D expenses constituting 12% of revenue, aligning with industry demands for continuous technological advancement. Despite a marginal increase in net income to CNY 1.52 billion, BYD Electronic is poised for future growth, leveraging recent enhancements in product offerings and strategic market positioning discussed at the Macquarie Asia TMT Conference on September 19, 2024.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited is an investment holding company that provides value-added services, online advertising, fintech, and business services in China and internationally, with a market cap of HK$3.70 trillion.

Operations: Tencent generates revenue primarily from value-added services (CN¥302.28 billion), online advertising (CN¥111.89 billion), and fintech and business services (CN¥209.17 billion). The company's diversified revenue streams highlight its significant presence in various sectors, both domestically and internationally.

Tencent Holdings has demonstrated robust growth dynamics within Hong Kong's tech sector, with a notable revenue increase to CNY 320.62 billion in the first half of 2024, up from CNY 299.19 billion year-over-year. This performance is bolstered by an aggressive R&D strategy, where expenses have surged to represent 12.8% of their total revenue, underscoring a commitment to innovation and market leadership in software and AI technologies. Furthermore, the company's recent earnings reveal a substantial profit leap with net income almost doubling to CNY 89.52 billion, reflecting effective operational execution and strategic market adaptations discussed during their latest earnings call on August 14th. These financial indicators are promising as Tencent continues to outpace average market growth rates with forecasts showing an annual revenue increase of approximately 8.2%.

Seize The Opportunity

- Get an in-depth perspective on all 45 SEHK High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD Electronic (International) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:285

BYD Electronic (International)

An investment holding company, primarily engages in the design, manufacture, assembly, and sale of mobile handset components, modules, and other products in the People’s Republic of China and internationally.

Solid track record with excellent balance sheet.