- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2363

Shareholders Would Enjoy A Repeat Of Tongda Hong Tai Holdings' (HKG:2363) Recent Growth In Returns

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in Tongda Hong Tai Holdings' (HKG:2363) returns on capital, so let's have a look.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Tongda Hong Tai Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.21 = HK$21m ÷ (HK$158m - HK$59m) (Based on the trailing twelve months to June 2025).

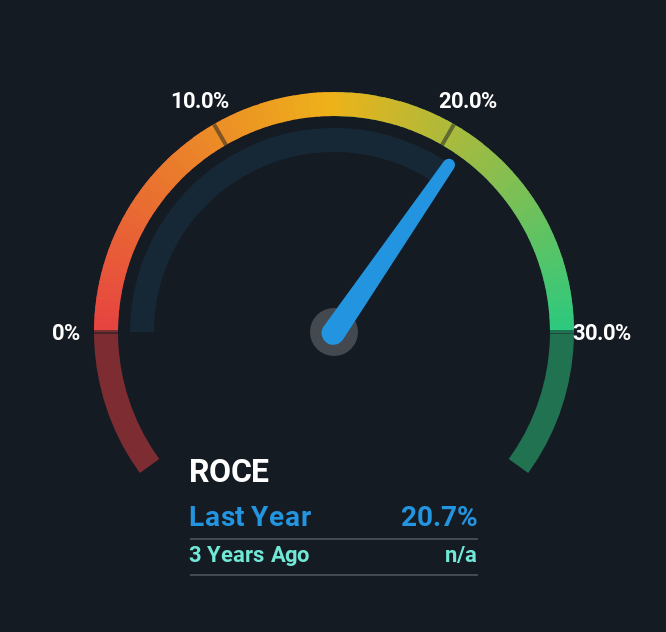

So, Tongda Hong Tai Holdings has an ROCE of 21%. In absolute terms that's a great return and it's even better than the Electronic industry average of 6.9%.

View our latest analysis for Tongda Hong Tai Holdings

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Tongda Hong Tai Holdings' past further, check out this free graph covering Tongda Hong Tai Holdings' past earnings, revenue and cash flow.

What Can We Tell From Tongda Hong Tai Holdings' ROCE Trend?

It's great to see that Tongda Hong Tai Holdings has started to generate some pre-tax earnings from prior investments. The company was generating losses five years ago, but now it's turned around, earning 21% which is no doubt a relief for some early shareholders. At first glance, it seems the business is getting more proficient at generating returns, because over the same period, the amount of capital employed has reduced by 64%. This could potentially mean that the company is selling some of its assets.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 37%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. This tells us that Tongda Hong Tai Holdings has grown its returns without a reliance on increasing their current liabilities, which we're very happy with.

The Key Takeaway

From what we've seen above, Tongda Hong Tai Holdings has managed to increase it's returns on capital all the while reducing it's capital base. Although the company may be facing some issues elsewhere since the stock has plunged 87% in the last five years. Still, it's worth doing some further research to see if the trends will continue into the future.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 5 warning signs for Tongda Hong Tai Holdings (of which 3 are significant!) that you should know about.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Tongda Hong Tai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2363

Tongda Hong Tai Holdings

An investment holding company, engages in the manufacture and sale of casings for laptops, notebooks, and tablets in Mainland China.

Moderate risk with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026