- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2239

Health Check: How Prudently Does SMIT Holdings (HKG:2239) Use Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that SMIT Holdings Limited (HKG:2239) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for SMIT Holdings

What Is SMIT Holdings's Debt?

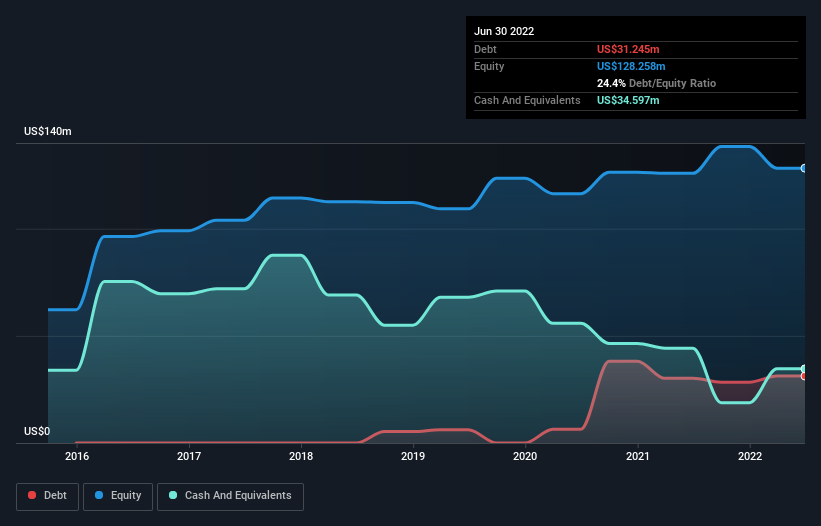

As you can see below, SMIT Holdings had US$31.2m of debt, at June 2022, which is about the same as the year before. You can click the chart for greater detail. But it also has US$34.6m in cash to offset that, meaning it has US$3.35m net cash.

How Strong Is SMIT Holdings' Balance Sheet?

According to the last reported balance sheet, SMIT Holdings had liabilities of US$51.6m due within 12 months, and liabilities of US$45.4m due beyond 12 months. Offsetting these obligations, it had cash of US$34.6m as well as receivables valued at US$15.2m due within 12 months. So its liabilities total US$47.2m more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of US$73.5m, so it does suggest shareholders should keep an eye on SMIT Holdings' use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. While it does have liabilities worth noting, SMIT Holdings also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since SMIT Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year SMIT Holdings wasn't profitable at an EBIT level, but managed to grow its revenue by 4.3%, to US$37m. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is SMIT Holdings?

While SMIT Holdings lost money on an earnings before interest and tax (EBIT) level, it actually booked a paper profit of US$7.0m. So when you consider it has net cash, along with the statutory profit, the stock probably isn't as risky as it might seem, at least in the short term. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that SMIT Holdings is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2239

SMIT Holdings

Designs, develops, and markets security devices primarily for pay TV broadcasting access worldwide.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026