- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2018

AAC Technologies Holdings (SEHK:2018): Valuation Insights Following Launch of Major Share Buyback Program

Reviewed by Simply Wall St

AAC Technologies Holdings (SEHK:2018) just kicked off a substantial share buyback program authorized by its shareholders. The company aims to repurchase up to 10% of its issued share capital, with the move intended to boost value for existing investors.

See our latest analysis for AAC Technologies Holdings.

Over the past year, AAC Technologies Holdings has not only launched this major buyback, but momentum has also been building. While the share price has been volatile in recent months, the total shareholder return stands at an impressive 31.7% for the last twelve months and a remarkable 220% over three years. This reflects long-term growth potential and shifts in investor confidence.

If AAC Technologies’ recent moves have you rethinking your approach, now is the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With the buyback underway and recent growth in both revenue and net income, is AAC Technologies Holdings genuinely undervalued at its current level, or has the market already accounted for expectations of future expansion?

Most Popular Narrative: 30% Undervalued

With the fair value estimate at HK$57.86, AAC Technologies Holdings’ recent close of HK$40.32 leaves substantial upside if the consensus narrative proves accurate. The most widely followed view suggests that key business shifts could soon unlock value beyond what the market currently prices in.

Diversification into non-smartphone growth verticals, including automotive acoustics, robotics motors, and XR/AI glasses, reduces reliance on cyclical smartphone demand and underpins long-term revenue stability and higher profitability as these markets mature.

What is fueling such a bullish price target? The current forecast combines momentum from new tech markets, leaner operations, and a nearly double-digit profit margin within just a few years. The real surprise is in the projected numbers and valuation multiple required to justify this view. Want to know what’s driving such a confident upside call? The answer is hidden in ambitious revenue and earnings growth estimates baked into the fair value.

Result: Fair Value of $57.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained pressure on core profit margins or slow adoption of new optical technology could quickly change the growth outlook for AAC Technologies Holdings.

Find out about the key risks to this AAC Technologies Holdings narrative.

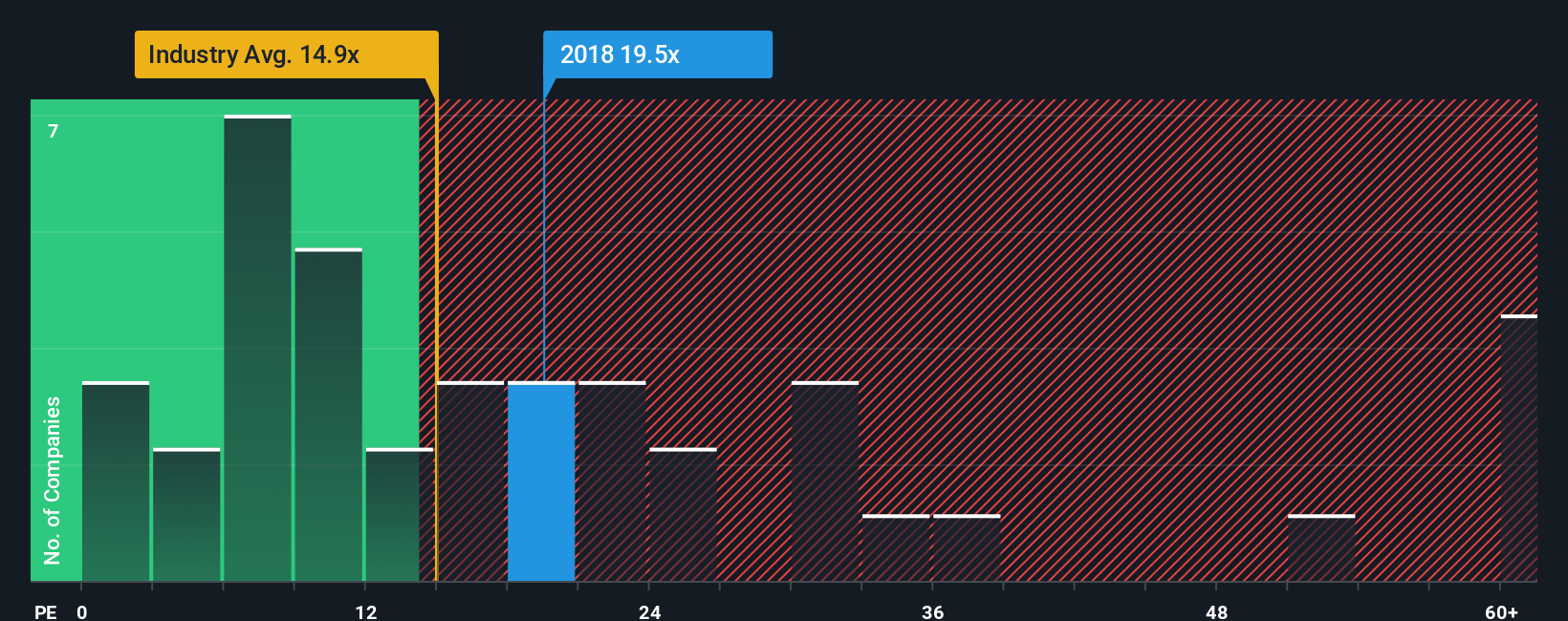

Another View: P/E Ratio Raises a Flag

While the consensus valuation points to substantial upside, a look at the price-to-earnings ratio offers a different perspective. AAC Technologies Holdings trades at 20.3x earnings, higher than the industry average of 15.3x and above its fair ratio of 19.4x. Compared to its peer group average of 45.4x, the stock appears cheaper. However, the premium over the industry and fair ratio suggests limited margin for error if growth stalls. Does this premium reflect justified optimism, or does it increase valuation risk for cautious investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AAC Technologies Holdings Narrative

If you would rather reach your own conclusion or want to put the numbers to the test yourself, crafting your own narrative is quick and straightforward. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding AAC Technologies Holdings.

Looking for More Investment Ideas?

Expand your investment horizon with opportunities you might have overlooked. Seize your advantage while others wait; these smart options could be the breakthrough your portfolio needs.

- Uncover top picks making waves in artificial intelligence by checking out these 27 AI penny stocks and stay a step ahead in this high-growth sector.

- Boost your income potential by reviewing these 17 dividend stocks with yields > 3% that consistently deliver attractive yields above 3% and reward shareholders steadily.

- Get ahead of the next tech revolution by exploring these 28 quantum computing stocks at the forefront of quantum computing innovation and industry disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2018

AAC Technologies Holdings

An investment holding company, provides sensory experience solutions in Greater China, the United States, Europe, Other Asian countries, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)