- China

- /

- Communications

- /

- SZSE:300394

High Growth Tech Stocks in Asia for March 2025

Reviewed by Simply Wall St

As global markets grapple with trade policy uncertainties and inflation concerns, the Asian tech sector continues to capture attention, particularly as China's stimulus hopes fuel optimism. In this environment, identifying high-growth tech stocks involves focusing on companies that demonstrate resilience and adaptability to shifting economic landscapes while capitalizing on technological advancements and consumer trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.74% | 33.49% | ★★★★★★ |

| Seojin SystemLtd | 31.08% | 34.32% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Bioneer | 26.13% | 104.84% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Kingboard Laminates Holdings (SEHK:1888)

Simply Wall St Growth Rating: ★★★★☆☆

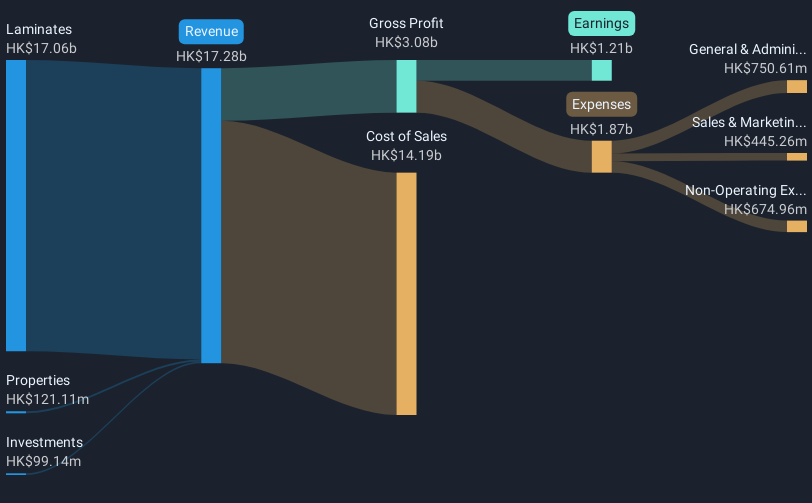

Overview: Kingboard Laminates Holdings Limited is an investment holding company that manufactures and sells laminates across the People's Republic of China, Europe, other Asian countries, and the United States, with a market capitalization of HK$28.95 billion.

Operations: The company primarily generates revenue from its laminates segment, which accounts for HK$17.06 billion, while its properties and investments segments contribute HK$121.11 million and HK$99.14 million, respectively.

Kingboard Laminates Holdings, a player in the electronic components sector, has demonstrated robust financial performance with earnings growth of 139.9% over the past year, significantly outpacing the industry average of 11.7%. This growth trajectory is supported by an aggressive R&D strategy, with substantial investment aimed at innovation and maintaining competitive edge in a rapidly evolving market. Looking ahead, both revenue and earnings are expected to continue their upward trend with forecasts at 12.2% and 33.67% per annum respectively, outperforming broader Hong Kong market projections. The firm's ability to generate high-quality earnings and maintain positive free cash flow positions it well for sustained future growth within Asia's high-tech landscape.

Shengyi Electronics (SHSE:688183)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shengyi Electronics Co., Ltd. focuses on the research, development, production, and sales of printed circuit boards in China with a market capitalization of CN¥24.62 billion.

Operations: The company specializes in the production and sales of printed circuit boards, leveraging its research and development capabilities to enhance product offerings. With a market capitalization of CN¥24.62 billion, it operates primarily within China, focusing on innovation in electronic components.

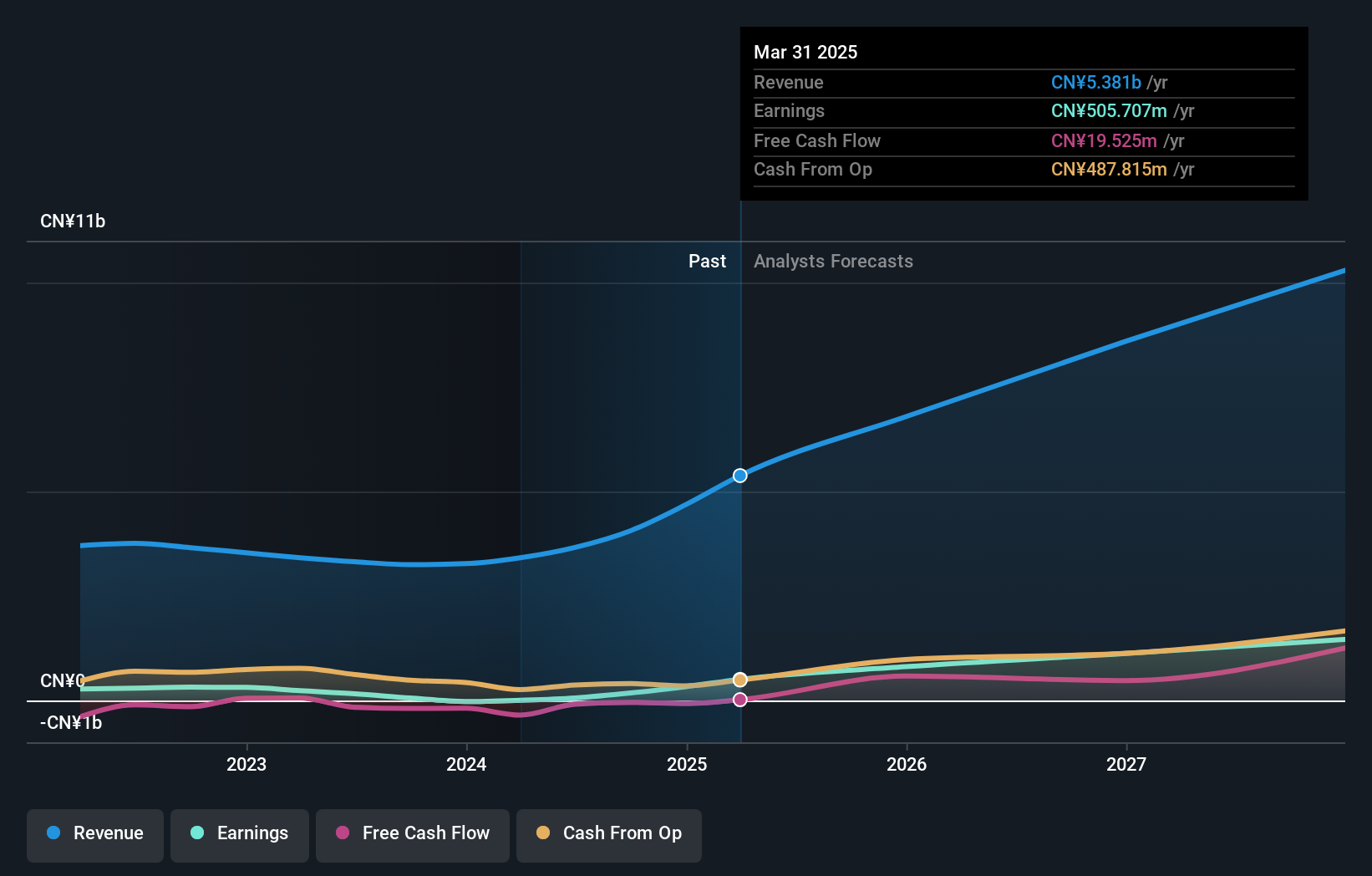

Shengyi Electronics, amidst a volatile share price in recent months, has charted a path to profitability this year. With earnings expected to surge by 46.3% annually, the company is outpacing the broader Chinese market's growth of 25.2%. This robust performance is underpinned by significant R&D investments, which have been crucial in maintaining its competitive edge within the tech sector. Despite challenges, Shengyi's strategic focus on innovation and its ability to adapt to market demands suggest promising prospects for sustained growth.

- Click here and access our complete health analysis report to understand the dynamics of Shengyi Electronics.

Evaluate Shengyi Electronics' historical performance by accessing our past performance report.

Suzhou TFC Optical Communication (SZSE:300394)

Simply Wall St Growth Rating: ★★★★★★

Overview: Suzhou TFC Optical Communication Co., Ltd. is engaged in the design, manufacture, and sale of optical communication devices with a market cap of CN¥52.70 billion.

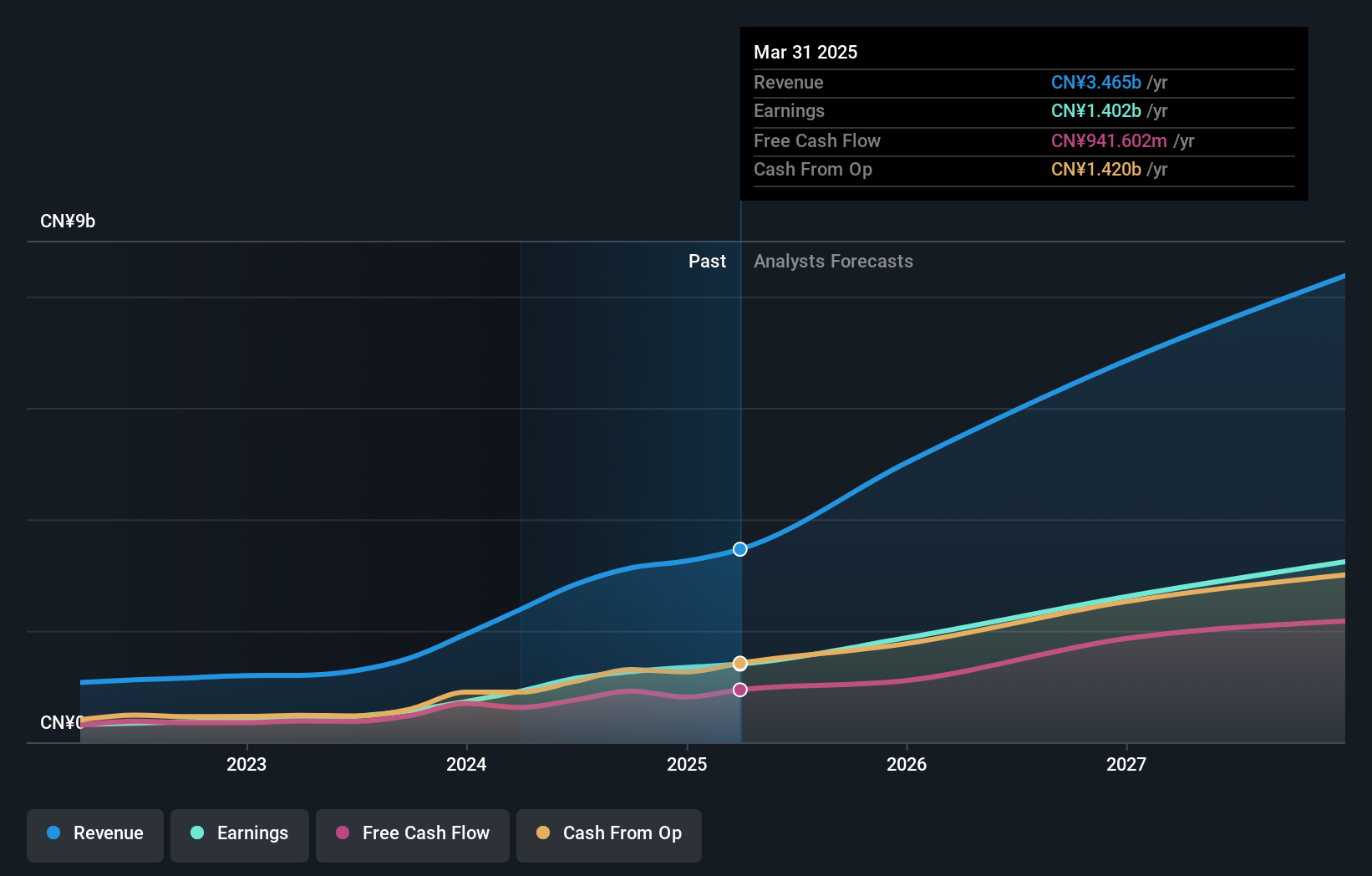

Operations: TFC Optical primarily generates revenue from its optical communication device segment, which accounts for CN¥3.12 billion. The company's market cap stands at CN¥52.70 billion, indicating its significant presence in the optical communication industry.

Suzhou TFC Optical Communication, amidst a highly volatile market, has demonstrated robust growth with a 34.7% increase in revenue and a 33.5% rise in earnings annually. This performance is bolstered by substantial R&D investments, accounting for significant portions of its revenue, reflecting the company's commitment to innovation and technological advancement in optical communications. With earnings having surged by 124.3% over the past year, Suzhou TFC stands out not just for its growth but also for its strategic focus on sectors poised for future expansion, such as high-speed data transmission technologies essential for next-generation networks and services.

Taking Advantage

- Reveal the 519 hidden gems among our Asian High Growth Tech and AI Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Suzhou TFC Optical Communication, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300394

Suzhou TFC Optical Communication

Suzhou TFC Optical Communication Co., Ltd.

Exceptional growth potential, undervalued and pays a dividend.

Market Insights

Community Narratives