- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

Did Record Q3 2025 EV and Innovation Revenue Just Shift Xiaomi's (SEHK:1810) Investment Narrative?

Reviewed by Sasha Jovanovic

- In the third quarter of 2025, Xiaomi reported record-high results, with revenue from its smart electric cars and innovation business rising very large year over year.

- This surge in automotive and innovation revenue underlines how far Xiaomi’s efforts to diversify beyond smartphones and IoT have already reshaped its business mix.

- We’ll now examine how Xiaomi’s rapid smart electric car revenue growth may influence its investment narrative centered on ecosystem expansion.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Xiaomi Investment Narrative Recap

To own Xiaomi today, you need to believe it can turn its huge user base into a broader hardware plus services ecosystem, with EVs as a new anchor. The latest quarter’s record results and more than 199% year over year jump in smart electric car and innovation revenue reinforce that EV execution is the key short term catalyst, while heavy auto investment and intense competition remain the biggest near term risk to margins and returns.

Among recent updates, Xiaomi’s expanded partnership with BASF Coatings to co develop 100 car paint colors over three years ties directly into the fast growing Cars business. It highlights how the company is building out its EV offering in parallel with the revenue ramp, which matters for investors watching whether automotive growth can offset smartphone and IoT saturation risks and support the broader ecosystem story.

Yet beneath the record car revenue, investors also need to be aware of the growing risk that escalating R&D and EV investment could...

Read the full narrative on Xiaomi (it's free!)

Xiaomi's narrative projects CN¥765.2 billion revenue and CN¥69.6 billion earnings by 2028.

Uncover how Xiaomi's forecasts yield a HK$57.89 fair value, a 35% upside to its current price.

Exploring Other Perspectives

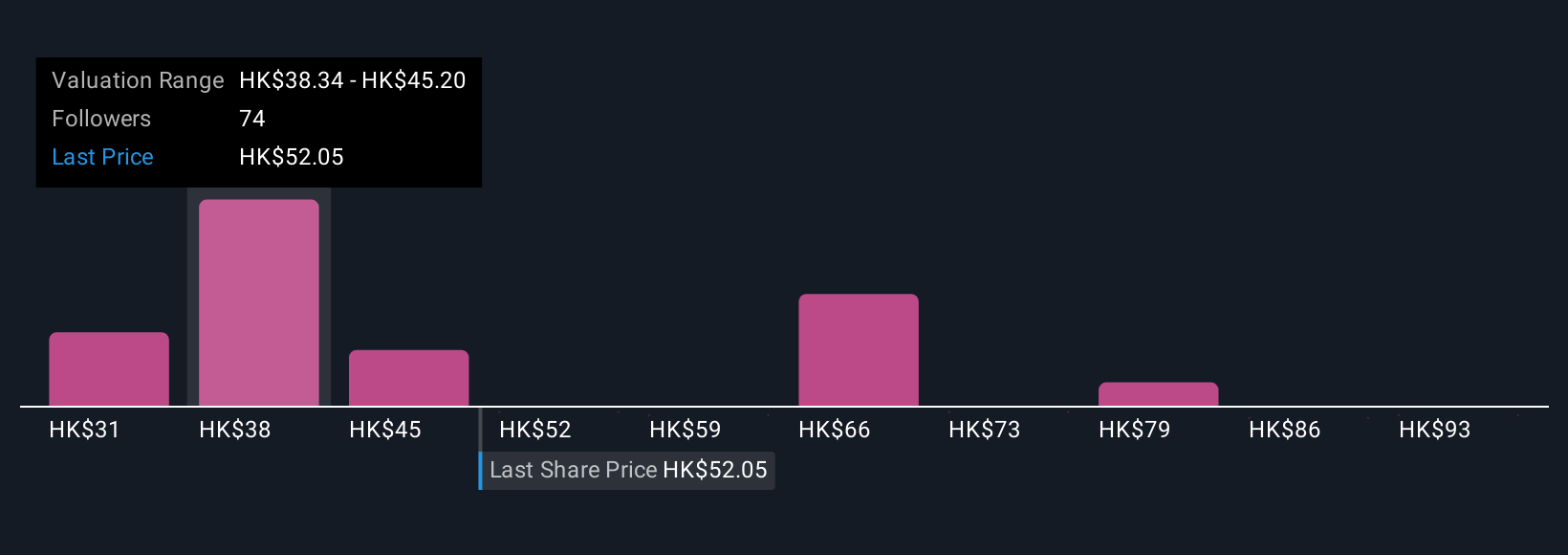

Seventeen fair value estimates from the Simply Wall St Community span roughly HK$31.49 to HK$80.26, showing how far apart individual views can be. As you weigh those opinions against Xiaomi’s surging EV revenue and heavy investment needs, it pays to compare several perspectives before deciding how this growth story might affect the business over time.

Explore 17 other fair value estimates on Xiaomi - why the stock might be worth as much as 88% more than the current price!

Build Your Own Xiaomi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xiaomi research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Xiaomi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xiaomi's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1810

Xiaomi

An investment holding company, engages in the development and sales of smartphones in Mainland China and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026