- Japan

- /

- Hospitality

- /

- TSE:3563

3 Stocks Estimated To Be Up To 48.3% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate the complexities of trade tensions and fluctuating economic indicators, investors are keenly observing how these developments impact stock valuations. With major indices experiencing mixed performances amid tariff uncertainties and evolving monetary policies, the search for undervalued stocks becomes particularly relevant. In such a climate, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.71 | US$37.36 | 49.9% |

| KG Mobilians (KOSDAQ:A046440) | ₩4445.00 | ₩8850.75 | 49.8% |

| Alarum Technologies (TASE:ALAR) | ₪3.356 | ₪6.68 | 49.7% |

| Celsius Holdings (NasdaqCM:CELH) | US$21.28 | US$42.43 | 49.8% |

| Aoshikang Technology (SZSE:002913) | CN¥29.12 | CN¥57.92 | 49.7% |

| S&U (LSE:SUS) | £16.25 | £32.33 | 49.7% |

| Similarweb (NYSE:SMWB) | US$11.87 | US$23.62 | 49.7% |

| Neosperience (BIT:NSP) | €0.53 | €1.06 | 49.9% |

| Medy-Tox (KOSDAQ:A086900) | ₩119200.00 | ₩235487.26 | 49.4% |

| Kyndryl Holdings (NYSE:KD) | US$41.15 | US$81.37 | 49.4% |

We'll examine a selection from our screener results.

Airbus (ENXTPA:AIR)

Overview: Airbus SE, along with its subsidiaries, is involved in the design, manufacture, and delivery of aerospace products, services, and solutions globally, with a market cap of approximately €134.10 billion.

Operations: The company's revenue segments include Airbus Helicopters at €7.55 billion, Airbus Defence and Space at €11.97 billion, and Airbus (including Holding Function and Bank Activities) at €49.14 billion.

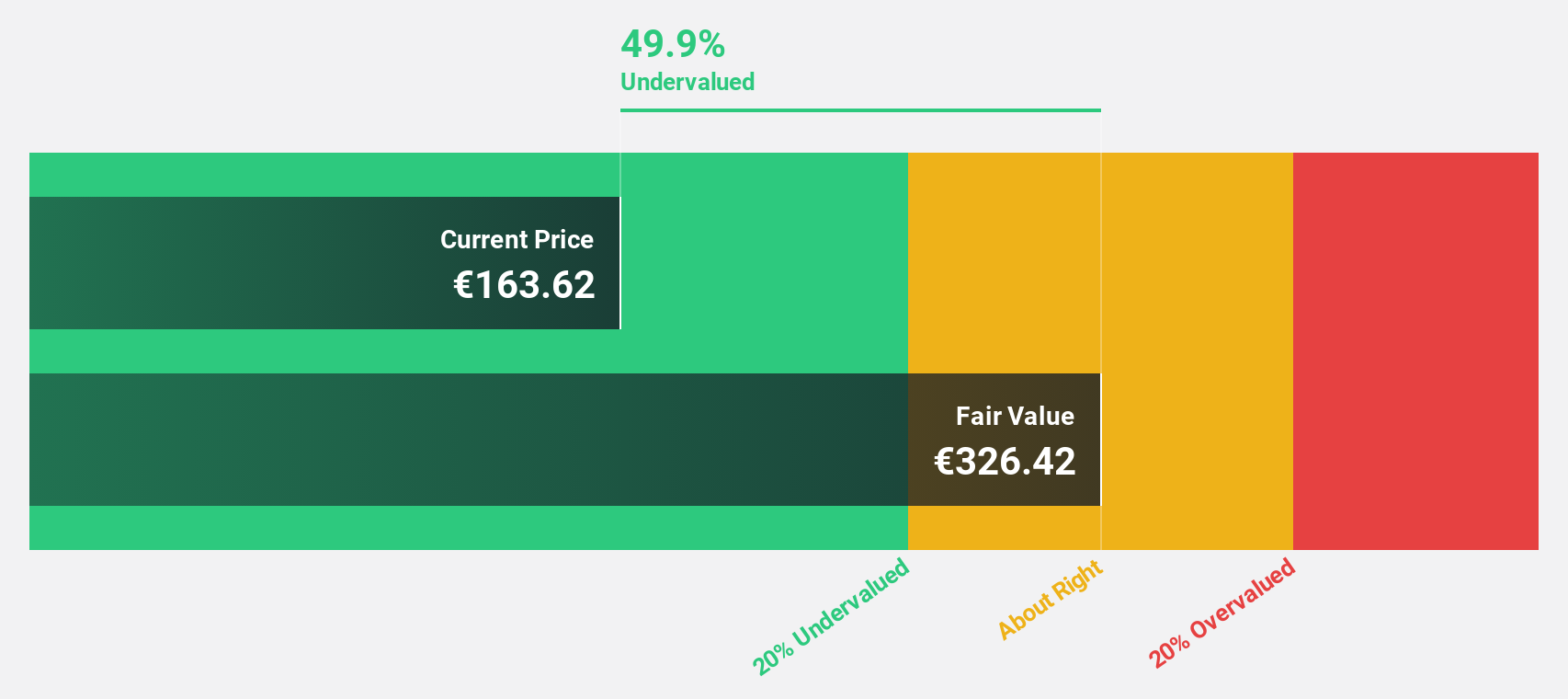

Estimated Discount To Fair Value: 47.9%

Airbus is trading at €169.88, significantly below its estimated fair value of €326.31, indicating potential undervaluation based on cash flows. The company anticipates annual earnings growth of 23.4%, outpacing the French market's 12.6% forecast, with a high return on equity projected at 25.1%. Recent contracts, like the Eutelsat satellite deal, bolster future revenue streams and align with Airbus's strategic growth initiatives in the aerospace sector.

- In light of our recent growth report, it seems possible that Airbus' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Airbus stock in this financial health report.

Cowell e Holdings (SEHK:1415)

Overview: Cowell e Holdings Inc. is an investment holding company that designs, develops, manufactures, and sells optical modules and systems integration products for smartphones and other mobile devices in various international markets, with a market cap of HK$25.62 billion.

Operations: The company's revenue segment includes Photographic Equipment & Supplies, generating $1.14 billion.

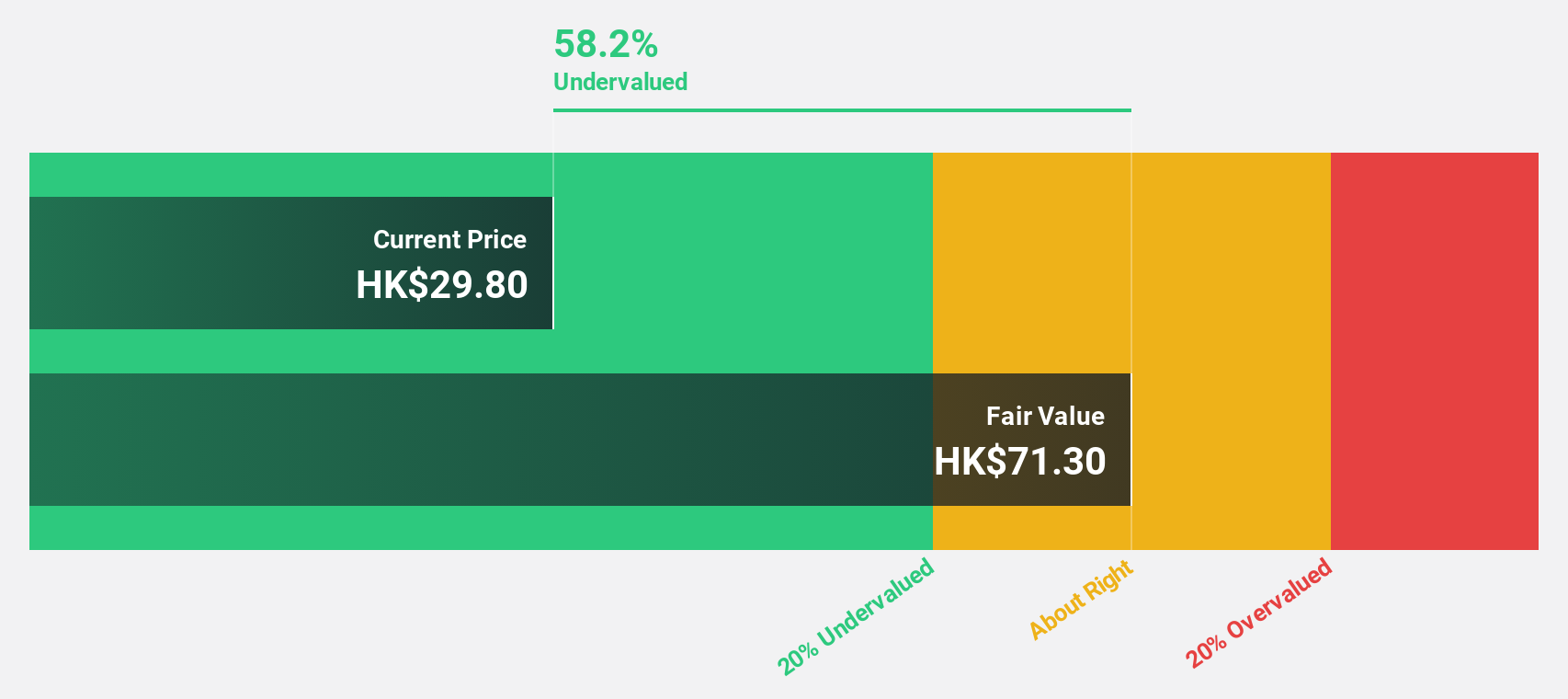

Estimated Discount To Fair Value: 29.1%

Cowell e Holdings, trading at HK$29.7, is valued below its estimated fair value of HK$41.88, presenting an opportunity based on cash flows. The company forecasts robust revenue growth of 27.4% annually, surpassing the Hong Kong market's 7.8%, and anticipates earnings to grow significantly by 30.5% per year over the next three years. However, profit margins have decreased from 6.6% to 3.9%, which may warrant attention despite high non-cash earnings quality.

- According our earnings growth report, there's an indication that Cowell e Holdings might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Cowell e Holdings.

Food & Life Companies (TSE:3563)

Overview: Food & Life Companies Ltd. operates a chain of sushi restaurants and has a market cap of ¥478.51 billion.

Operations: The company's revenue segments include its chain of sushi restaurants.

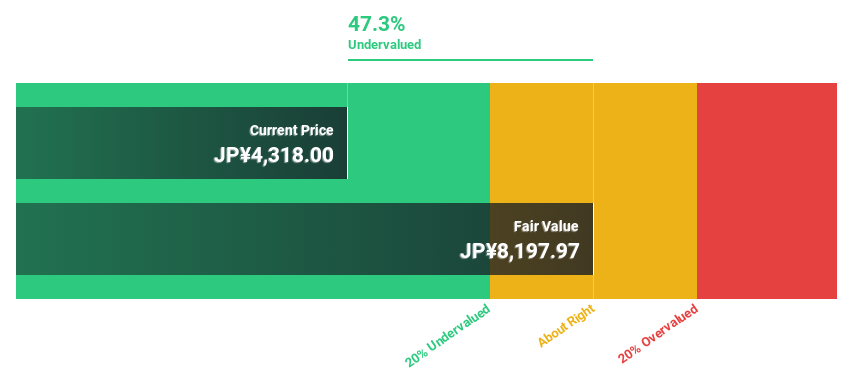

Estimated Discount To Fair Value: 48.3%

Food & Life Companies is trading at ¥4,230, significantly below its estimated fair value of ¥8,173.94. The company's earnings are expected to grow 9.7% annually, outpacing the JP market's 7.7%. However, it carries a high level of debt and has experienced share price volatility recently. For fiscal year 2025, guidance includes sales of ¥408 billion and operating profit of ¥26 billion, with a slight dividend decrease to ¥27.50 per share from last year's ¥30.00.

- Our growth report here indicates Food & Life Companies may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Food & Life Companies.

Taking Advantage

- Investigate our full lineup of 916 Undervalued Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3563

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives