- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2517

Undiscovered Gems With Strong Fundamentals To Explore This October 2024

Reviewed by Simply Wall St

As global markets experience fluctuations with notable highs in U.S. indices and economic shifts across Europe and China, the Hong Kong market presents a unique landscape for investors seeking opportunities amidst broader market sentiments. In this dynamic environment, identifying stocks with strong fundamentals becomes crucial, as these qualities can help navigate uncertainties and capitalize on potential growth within the region's small-cap sector.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Lvji Technology Holdings | 3.06% | 4.56% | -1.87% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Time Interconnect Technology | 151.14% | 24.74% | 19.78% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research and development, design, manufacture, and sale of mobile phones across China, India, Algeria, Bangladesh, and other international markets with a market cap of HK$4.90 billion.

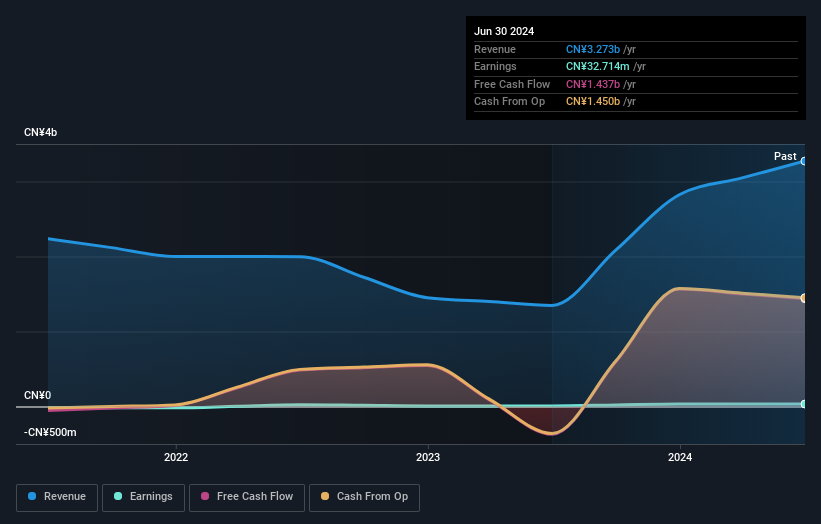

Operations: Sprocomm Intelligence generates revenue primarily from the sale of wireless communications equipment, amounting to CN¥3.27 billion. The company's financial performance is characterized by its focus on mobile phone markets in several countries, contributing to its overall market presence.

Sprocomm Intelligence, a small player in the tech industry, recently reported half-year sales of CNY 1.26 billion, up from CNY 807 million the previous year. Net income slightly rose to CNY 9.86 million despite a significant one-off gain of CN¥18.1 million impacting results. The company's debt-to-equity ratio improved significantly from 73.8% to 37.6% over five years, although interest coverage remains weak at 1.8x EBIT, suggesting financial constraints may persist despite trading well below estimated fair value.

- Navigate through the intricacies of Sprocomm Intelligence with our comprehensive health report here.

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

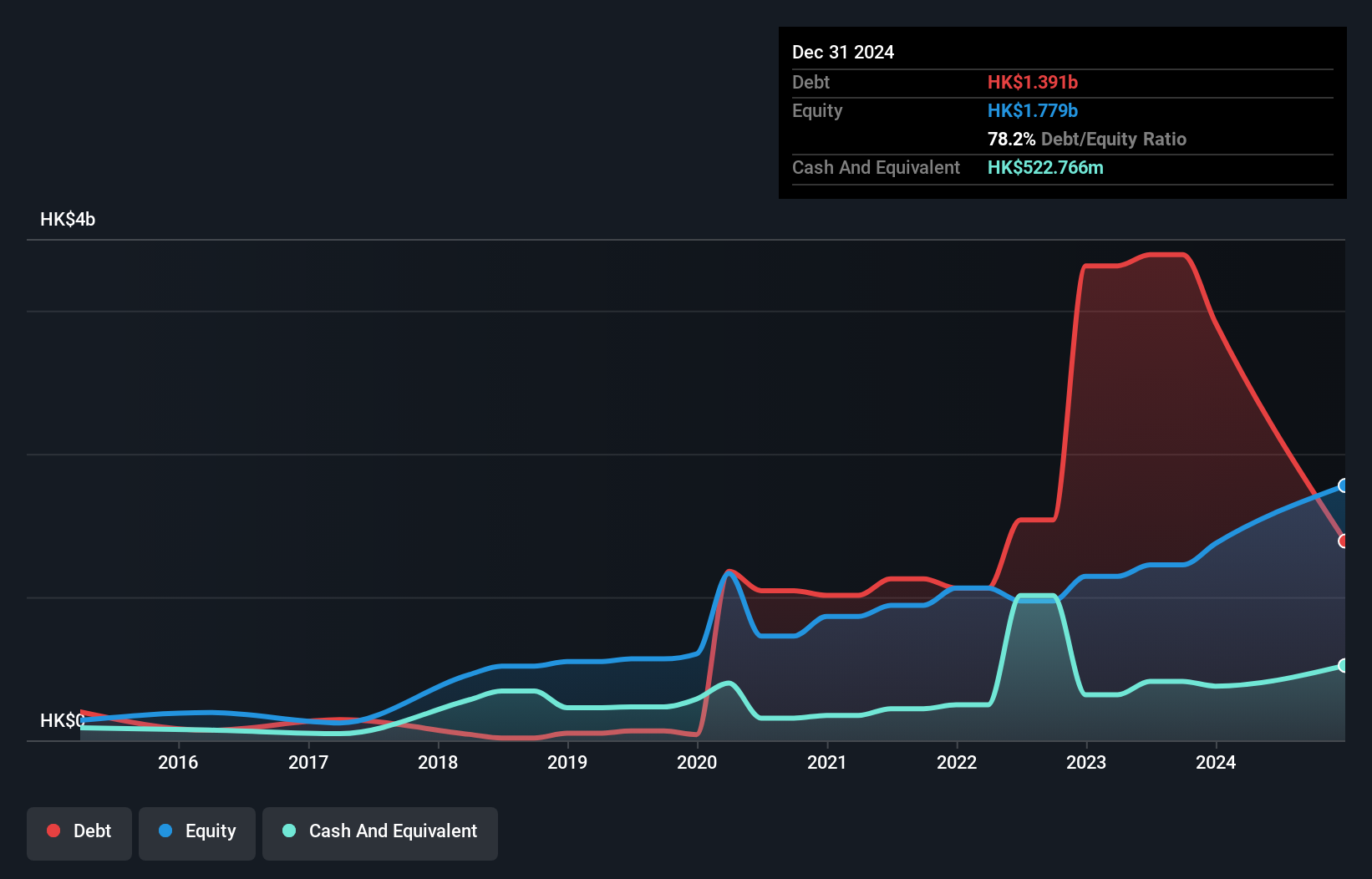

Overview: Time Interconnect Technology Limited is an investment holding company that manufactures and sells cable assembly and networking cable products across various international markets, with a market capitalization of HK$9.93 billion.

Operations: The company generates revenue primarily from its Cable Assembly and Server segments, with contributions of HK$2.57 billion and HK$2.57 billion, respectively. Digital Cable adds another HK$1.36 billion to the revenue stream.

Time Interconnect Technology has seen a notable rise in earnings, with a 71.6% increase over the past year, outpacing the Electrical industry average of 15.1%. Despite its high net debt to equity ratio of 83.3%, interest payments are well covered by EBIT at 10.4 times coverage. The company recently announced an interim dividend of HKD 0.01 per share, totaling HKD 19 million, reflecting solid financial health and growth potential in cable assembly and digital cable sectors.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

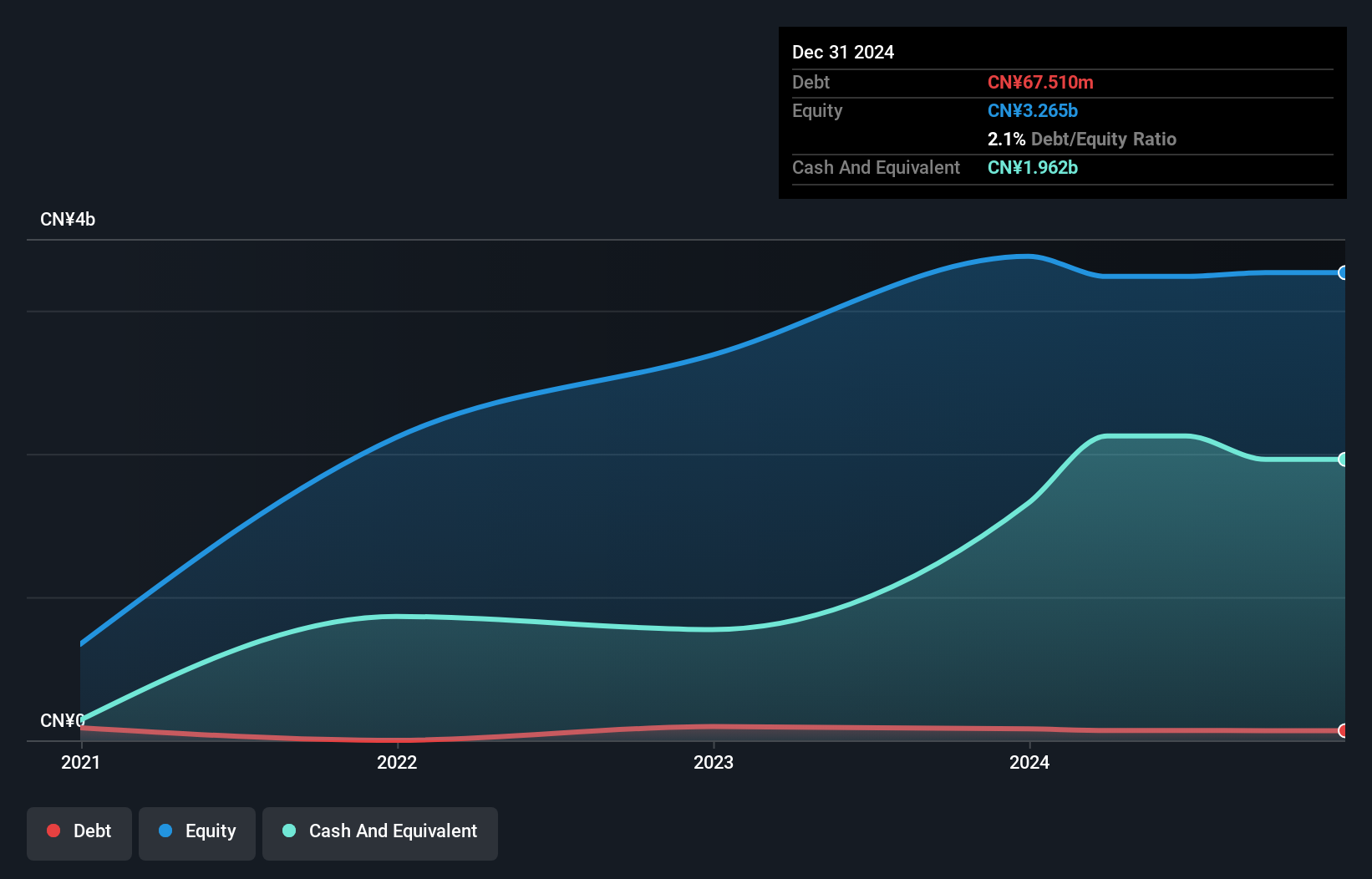

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$10.19 billion.

Operations: The company's primary revenue stream is from retail sales through grocery stores, amounting to CN¥5.99 billion.

Guoquan Food, a relatively small player in the market, reported earnings for the first half of 2024 with sales at CNY 2.67 billion, down from CNY 2.76 billion last year. Net income dropped to CNY 85.98 million from CNY 107.7 million previously, reflecting a challenging environment. Despite this, it trades at an attractive valuation—51% below estimated fair value—and boasts high-quality earnings with more cash than total debt and positive free cash flow of CNY 467.84 million as of October 2024.

Taking Advantage

- Delve into our full catalog of 169 SEHK Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2517

Guoquan Food (Shanghai)

Operates as a home meal products company in China.

Excellent balance sheet and fair value.