If You Had Bought Tianli Holdings Group's (HKG:117) Shares Five Years Ago You Would Be Down 81%

It's nice to see the Tianli Holdings Group Limited (HKG:117) share price up 20% in a week. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Indeed, the share price is down a whopping 81% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The fundamental business performance will ultimately determine if the turnaround can be sustained.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Tianli Holdings Group

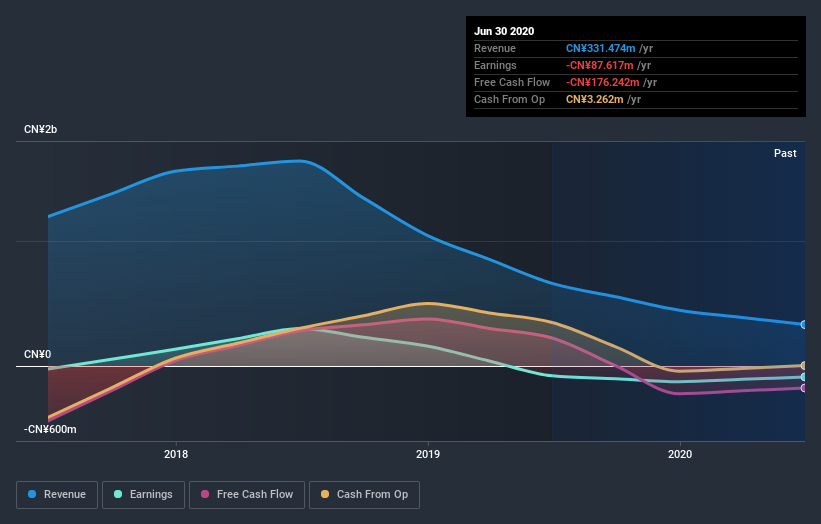

Because Tianli Holdings Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Tianli Holdings Group saw its revenue increase by 0.5% per year. That's far from impressive given all the money it is losing. It's not so sure that share price crash of 13% per year is completely deserved, but the market is doubtless disappointed. We'd be pretty cautious about this one, although the sell-off may be too severe. A company like this generally needs to produce profits before it can find favour with new investors.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Tianli Holdings Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Tianli Holdings Group shareholders have received a total shareholder return of 13% over one year. Notably the five-year annualised TSR loss of 13% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Tianli Holdings Group has 1 warning sign we think you should be aware of.

But note: Tianli Holdings Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Tianli Holdings Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tianli Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:117

Tianli Holdings Group

An investment holding company, manufactures and sells multi-layer ceramic capacitors (MLCC) in Mainland China, Hong Kong, and internationally.

Slight risk and overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Shopify: The Quiet Shift From Store Builder to Commerce Operating System

UnitedHealth Stock: Why Scale, Data, and Integration Still Matter in U.S. Healthcare

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)