- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1013

Why We're Not Concerned About Wai Chun Group Holdings Limited's (HKG:1013) Share Price

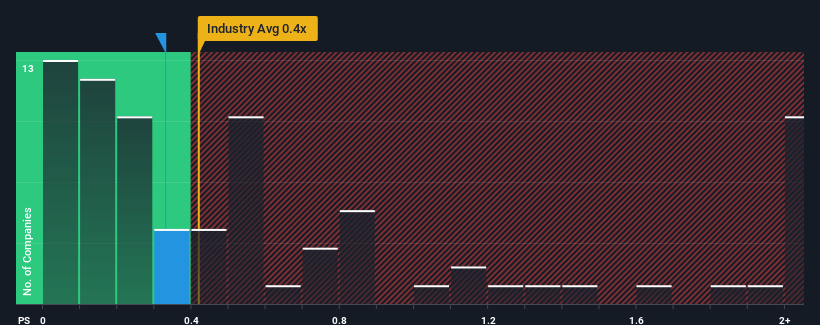

With a median price-to-sales (or "P/S") ratio of close to 0.4x in the Electronic industry in Hong Kong, you could be forgiven for feeling indifferent about Wai Chun Group Holdings Limited's (HKG:1013) P/S ratio of 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Wai Chun Group Holdings

How Wai Chun Group Holdings Has Been Performing

For instance, Wai Chun Group Holdings' receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Wai Chun Group Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Wai Chun Group Holdings?

Wai Chun Group Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.6%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 21% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 7.8% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, it's clear to see why Wai Chun Group Holdings' P/S matches up closely to its industry peers. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

What Does Wai Chun Group Holdings' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we've seen, Wai Chun Group Holdings' three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Wai Chun Group Holdings (3 shouldn't be ignored!) that you need to be mindful of.

If you're unsure about the strength of Wai Chun Group Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wai Chun Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1013

Wai Chun Group Holdings

An investment holding company, engages in the sale and service, and provision of integration services of computer and communication systems in the People’s Republic of China and Hong Kong.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)