- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:9911

Investors Still Aren't Entirely Convinced By Newborn Town Inc.'s (HKG:9911) Revenues Despite 59% Price Jump

Newborn Town Inc. (HKG:9911) shares have had a really impressive month, gaining 59% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 56%.

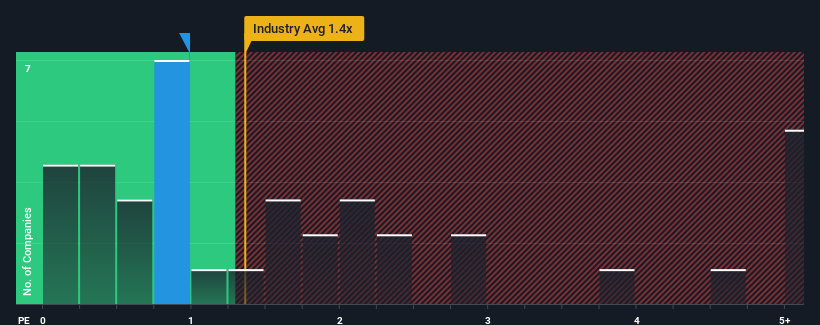

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Newborn Town's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Software industry in Hong Kong is also close to 1.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Newborn Town

How Newborn Town Has Been Performing

Recent times haven't been great for Newborn Town as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Newborn Town.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Newborn Town would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 3.9% gain to the company's revenues. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 39% as estimated by the four analysts watching the company. With the industry only predicted to deliver 22%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Newborn Town is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Newborn Town's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Newborn Town's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Newborn Town with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Newborn Town might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9911

Newborn Town

An investment holding company, engages in the social networking business worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives