With EPS Growth And More, Future Data Group (HKG:8229) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Future Data Group (HKG:8229), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Future Data Group

Future Data Group's Improving Profits

In the last three years Future Data Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Future Data Group's EPS shot from HK$0.024 to HK$0.055, over the last year. Year on year growth of 134% is certainly a sight to behold.

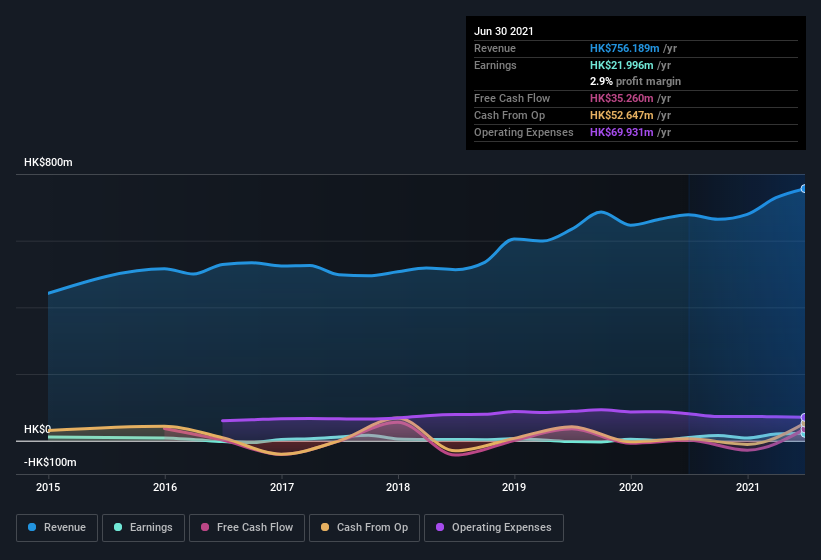

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Future Data Group maintained stable EBIT margins over the last year, all while growing revenue 12% to HK$756m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Future Data Group isn't a huge company, given its market capitalization of HK$88m. That makes it extra important to check on its balance sheet strength.

Are Future Data Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First things first; I didn't see insiders sell Future Data Group shares in the last year. But the really good news is that Executive Director Guolin Tao spent HK$5.0m buying stock stock, at an average price of around HK$0.22. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

Does Future Data Group Deserve A Spot On Your Watchlist?

Future Data Group's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put Future Data Group on your watchlist. However, before you get too excited we've discovered 1 warning sign for Future Data Group that you should be aware of.

The good news is that Future Data Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8229

Future Data Group

An investment holding company, provides system integration and maintenance services in South Korea and Hong Kong.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion